Will it be 25 Basis Points or 50?

Will it be 25 Basis Points or 50?

- Treasury yields are backing up this morning as the market awaits the FOMC’s rate decision and updated forecasts this afternoon. The debate over 25 or 50 continues so the Fed’s decision will generate volatility but which way? Who knows, but the levels we see this morning aren’t likely to be what we close the day with. Currently, the 10yr is yielding 3.68% up 3bp on the day, while the 2yr is yielding 3.63%, up 2bp on the day.

- Finally, we have arrived at Decision Day for the Fed and the markets with the raging debate over 25 or 50 still undecided. After that we’ll have to cast about for the next flashy thing to amuse us. Of course, that may wait until next week as there will be plenty to chew on with today’s decision, updated dot plots and economic projections.

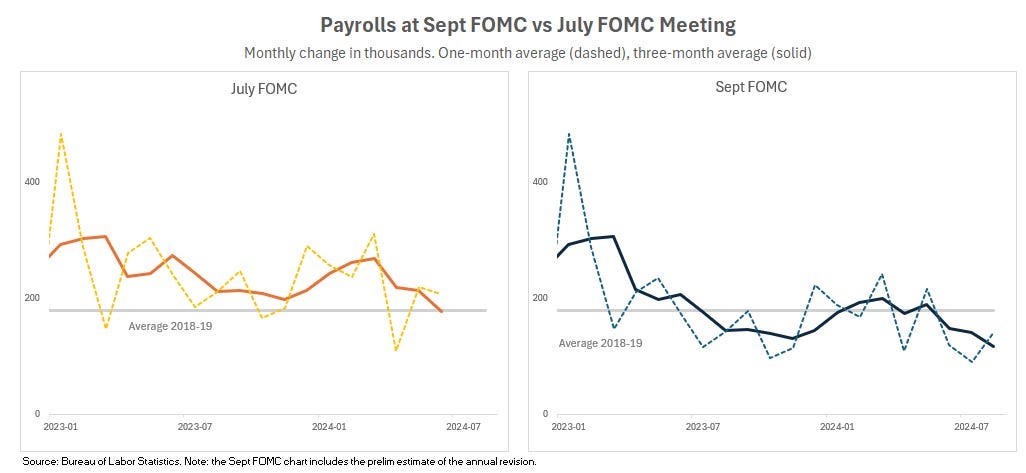

- With Powell’s Jackson Hole comment still ringing in our ears that the Fed, “does not seek nor welcome further cooling in the labor market,” a disappointing July employment report was followed by a tepid one in August that pushed back on the 50bp crowd, but just a little. With the tendency of initial reports to be revised lower the slowing in headline job growth is unmistakable (see first graph below). Secondary indicators like job openings to unemployed, jobs plentiful vs. hard-to-get, and the Quits Rate all dropping to, or below, pre-pandemic levels there is no doubt the labor market is cooling, the question is how fast? Fast enough to warrant a larger cut is the argument for a 50bp cut today vs. the more reflexive 25bp cut.

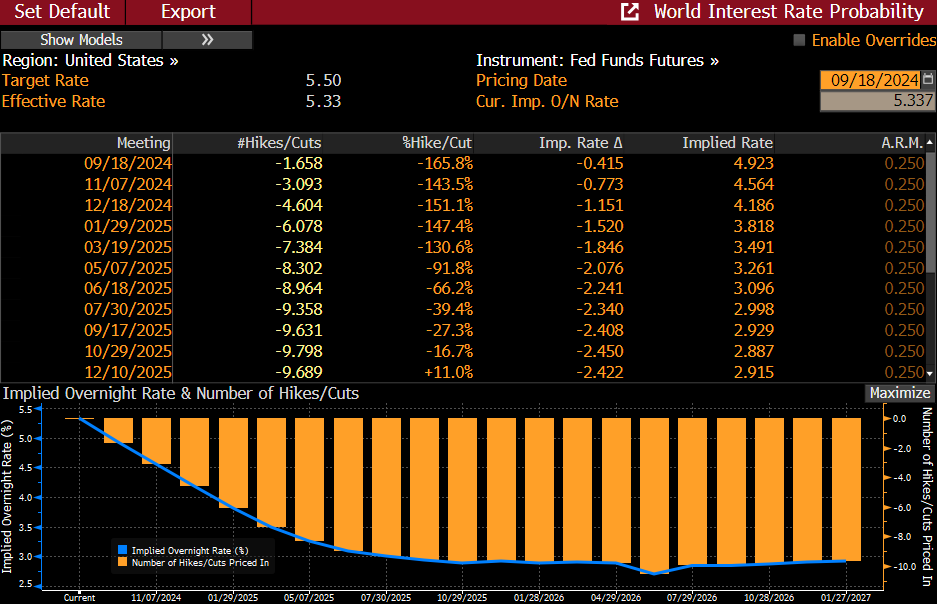

- We are amused too that in the so-called quiet period before the FOMC meeting there certainly wasn’t any shortage of ex-Fed officials willing to go on the record in favor of the larger cut. Also, Wall Street reporter, and noted Fed whisperer, Nick Timiraos stirred the pot with articles that the decision within the current FOMC members is a close one with nothing decided. Were these trial balloons by the Fed to gauge market reaction to a possible larger cut? Perhaps. It certainly did boost market expectations with 68% odds that it will be a 50bp cut (see second graph below).

- Also adding to the 50bp case is with CPI and PPI in hand analysts are estimating core PCE to come next week somewhere around 0.14% – 0.18% MoM. That rounds to either a “high” 0.1% or “low” 0.2%. In either case it would be cooler than core CPI, perhaps alleviating some concerns from the inflation hawks at the Fed.

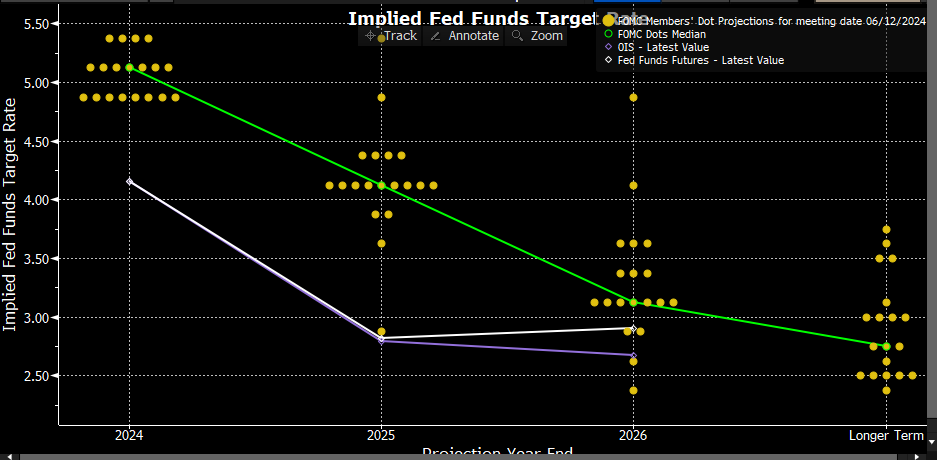

- The Fed is not likely, however, to provide one side a clear victory. A 25bp cut will disappoint the 50 crowd but it may be followed by an updated dot plot that shows a more aggressive rate-cutting schedule through 2025 vs. the June forecast when they had the funds rate declining to 4.00% (see June dot plot below). Meanwhile, a 50bp cut may be offset with an updated dot plot that remains well above the market’s 2.92% 2025 year-end expectation. It’s not likely that all the new data: rate cuts, dot plots, summary of economic projections, and Powell’s press conference will all line up neatly providing a consistent message on the Fed’s pace and magnitude of easing. More likely, there will be some head-scratching inconsistencies that muddles Treasury reaction, but make no mistake, the close nature of the call will create volatility this afternoon.

- Away from the Fed meeting, yesterday’s August Retail Sales report posted a solid 0.3% Control Group print which directly feeds into GDP and as that number was incorporated into the latest Atlanta Fed GDPNow forecast it bumped the third quarter projection from 2.5% to 3.0%. Some may argue how can the Fed cut 50 when we’re close to a 3% GDP? Well, we like to remind readers the Fed’s dual mandates are full employment and price stability, not GDP. We’ll also note that of the 13 categories within the report, seven saw declining sales in August while the July report had only three. We’re not implying the imminent demise of the consumer with that observation as this report is more goods-based. The Personal Income and Spending report due at month-end will provide a more comprehensive look at consumption, so it will give us something more to consider from that report besides the PCE inflation numbers.

- We’ll be back in the afternoon to provide a brief synopsis of the FOMC rate decision along with the updated rate and economic forecasts.

Fed Funds Futures See 68% Odds of a 50bp Cut Today

June Dot Plot – How Will it Change Today? Most Likely More Cuts, but Still Shy of Futures Market Expectations

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.