While Tariff Worries Abound, Will the Job Market Continue to Show Strength?

- Treasury yields are moving lower this morning as tariff uncertainty continues to weigh on investors and the risk-off tone is contributing to strong Treasury bids. With the so-called “Liberation Day” approaching on Wednesday, and details still being fleshed out, the better part of valor seems to be sitting it out in Treasuries, or cash. Despite a week filled with first-tier jobs data, the tariff uncertainty looks to be dominating the mood right now. Currently, the 10yr Treasury is yielding 4.20%, down 5bps on the day, while the 2yr is yielding 3.86%, also down 5bps on the day.

- We finally have a week in front of us filled with first-tier data that may or may not confirm the weakness in the so-called “soft data” that have been weakening for some time now. The full data calendar will not, however, distract from the ongoing tariff talk and “Liberation Day” set for this Wednesday with “reciprocal tariffs” scheduled to be rolled out. The moving target that is Liberation Day policy, and what it will exactly entail only adds to the uncertainty as the week opens.

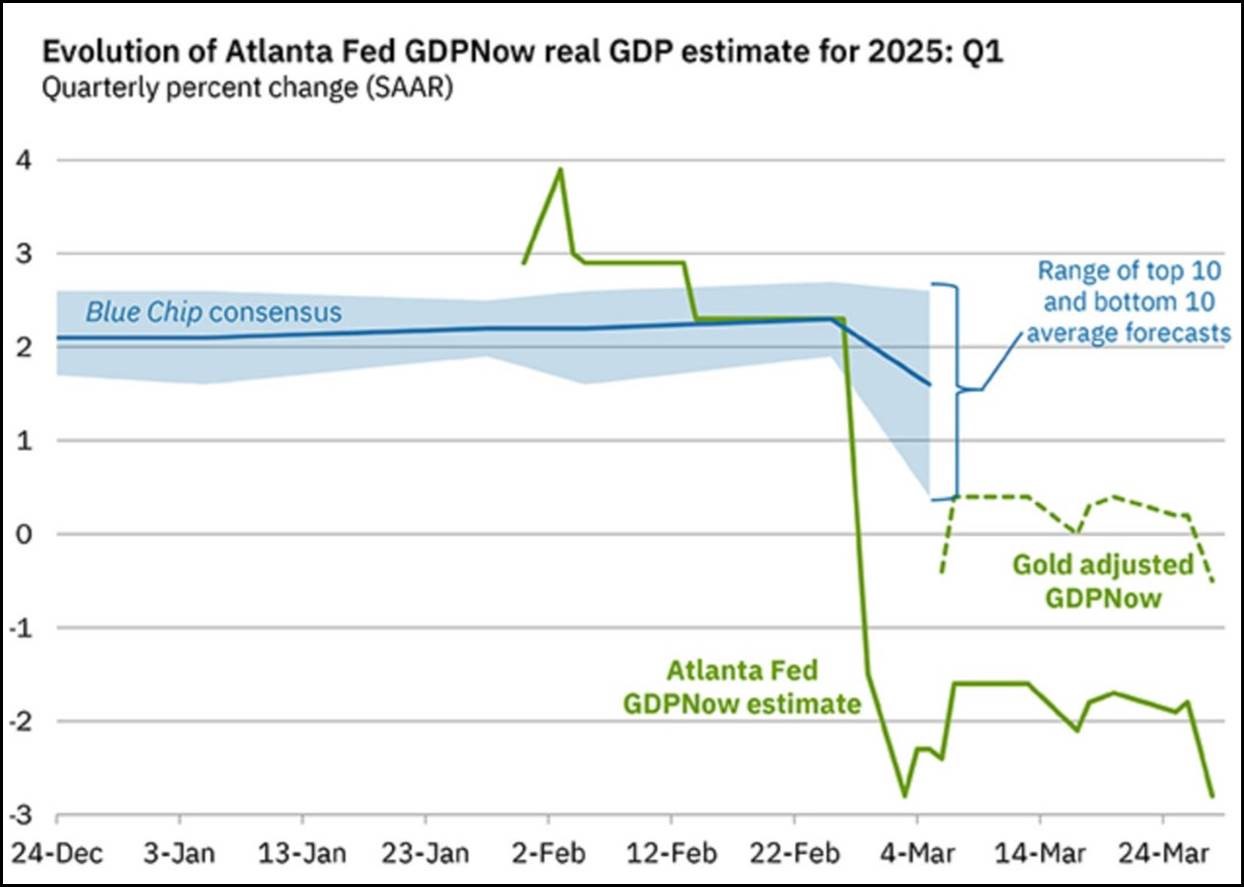

- As we await the data, the Atlanta Fed’s GDPNow model continues to replace estimates with hard numbers and it’s still reflecting a decidedly negative outlook for first quarter GDP. The latest update on Friday has it at -2.8%, tied with the March 4th reading, well before any of the February data started to hit. The big factors in the downward adjustment continue to be the lopsided trade deficit and tepid consumer spending that was weak in January and only slightly better in February. With a plethora of first-tier numbers set to populate the model this week we’ll check back with it on Friday. We doubt such a lopsided negative for the actual first quarter result, but time is running out to push it into the positive column.

- With that backdrop, the data calendar begins tomorrow morning with the ISM Manufacturing Index for March with it expected to slip back into contractionary territory, albeit barely (49.8 vs. 50.3). The various sub-indices will get plenty of attention as well such as Prices Paid, New Orders, and Employment to fill out the picture on the manufacturing side of the economy. The bigger story will come on Thursday when the ISM Services Index is expected to show a still solid services sector (53.0 expected vs. 53.5 in February). The services side has carried the economy for more than a year so any backsliding here will spark additional concerns about near-term growth.

- Tomorrow also brings the Job Openings and Labor Turnover Survey (JOLTS) for February and while it is another soft data/survey the dip in job openings has been a consistent theme for the past year as the openings to unemployment ratio approaches 1 to 1 vs. the 2 or 3 to openings to every unemployed when the labor market was struggling to find enough able bodies to fill positions. The Quits Rate will get some attention too for indications of worker confidence in finding a new job. Given the other weak confidence measures we suspect it will offer a similar message tomorrow.

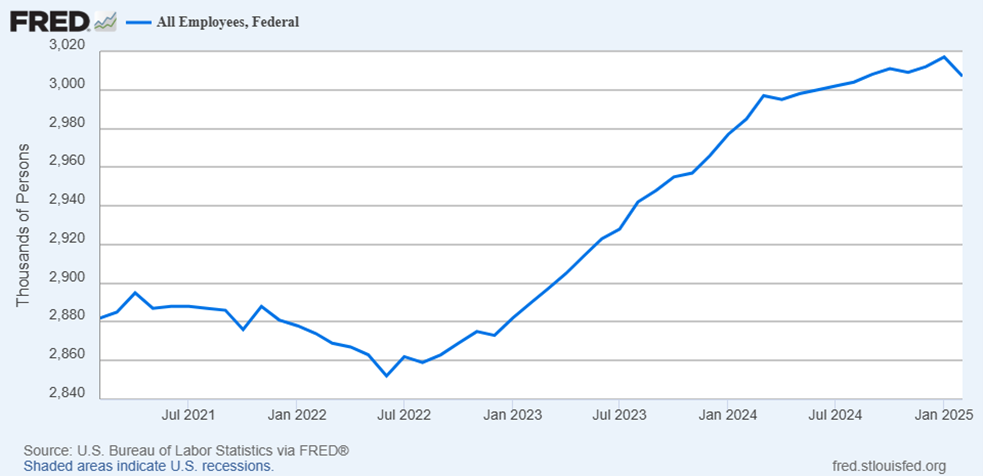

- Of course, the star of the week will be Friday’s payroll report with 120 thousand jobs expected vs. 151 thousand in February. Given the DOGE federal job cost cutting effort in DC, it’s not surprising to see the bulk of job growth is expected from the private sector at 118 thousand which implies only 2 thousand in net new government sector jobs. Now that includes state and local government jobs in addition to federal positions, but the trend lately had been 30 to 40 thousand new government jobs per month, so the estimates are reflecting a near halt in new government jobs.

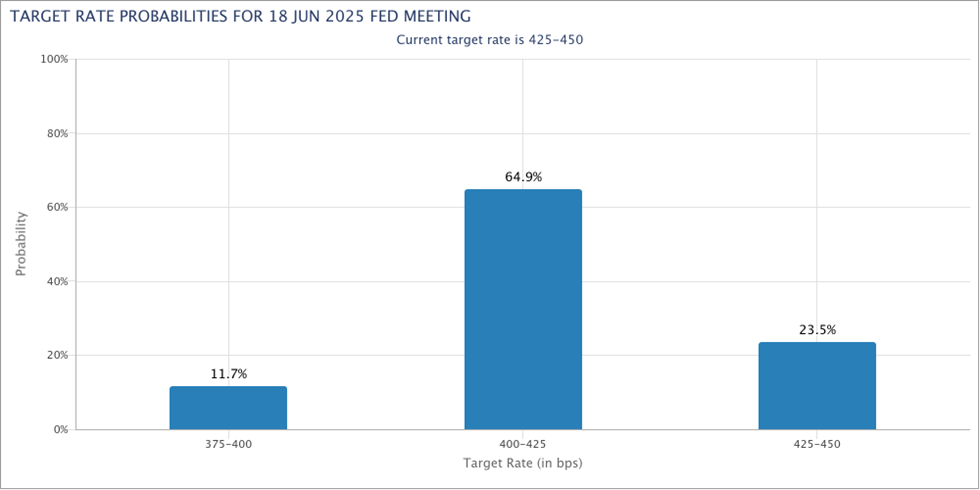

- The unemployment rate is expected to increase a tenth from 4.1% to 4.2%. Recall, the Fed has the year-end estimate at 4.3%, so a little more weakening in the labor market and we’ll be there with three-quarters of the year to spare. A lot can happen between now and December so we’re not putting much on that latest Fed estimate. When the unemployment rate starts to move higher, it usually does it in increments larger than expectations. In any event, the job report for March, on the whole, is expected to show some weakening, but nothing rising to concern at the Fed that they have to consider rate cuts, at least not until mid-year.

Futures Increase Odds of a June Rate Cut

Source: CME

Watch This Chart in the Months Ahead

Note: The alternative model forecast, which began on March 6th, which adjusts for imports and exports of gold is -0.5 percent.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.