While PPI Heads Higher, PCE Could Move Lower

- Treasury yields are moving slightly higher this morning as the inflation data this week, and the Import/Export prices this morning, are sketching out a challenging environment to get to the Fed’s 2% target anytime soon. Thus, some hesitation is the mood as investors also await the FOMC rate cut next week, and perhaps more importantly the updated dot plot and most likely reduced rate-cutting expectations for next year. Currently, the 10yr Treasury is yielding 4.35%, up 2bps on the day, while the 2yr is yielding 4.20%, up 2bps on the day.

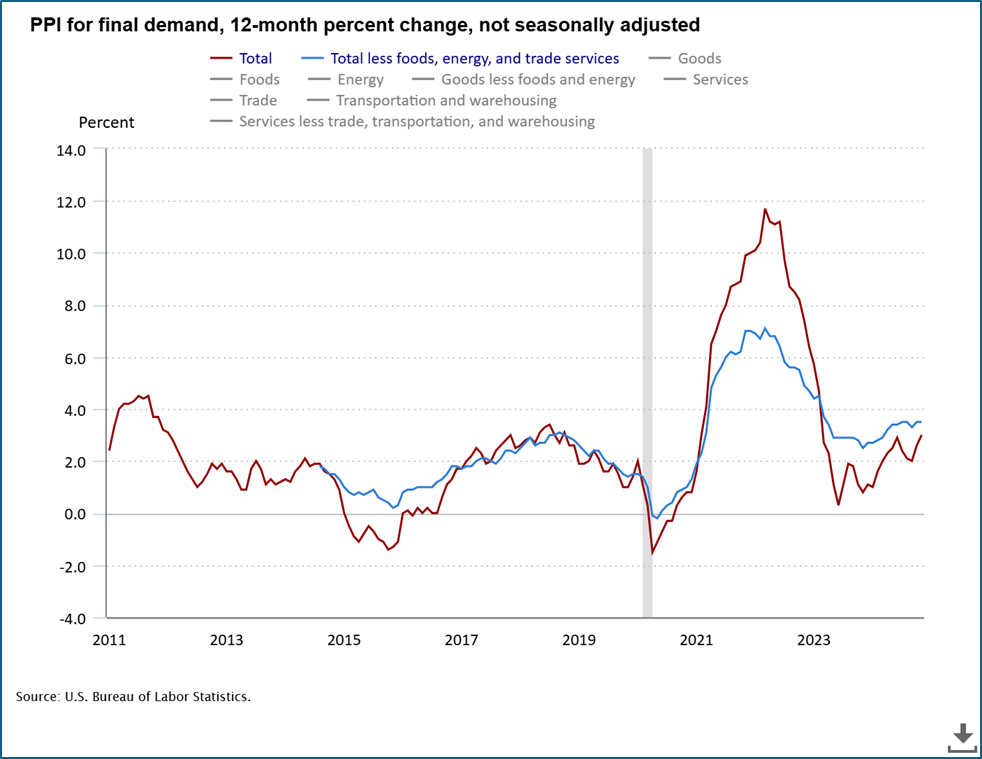

- November PPI came in a bit hotter than expected, driven by higher food prices, and the YoY rate on Final Demand moved six-tenths higher from 2.4% to 3.0% beating the 2.6% expectation, and the highest since April 2023 when it was trending lower off its 2022 high. Much like the CPI from Wednesday, food prices soared above recent trends and that led to most of the uptick in PPI. Eggs alone increased an eye-popping 54.6%. So, don’t expect those egg prices to get any cheaper in the grocery store anytime soon.

- While food can be a volatile category, the issue we see developing is that PPI had been deflating as late as December 2023 since peaking in 2022. That downtrend is over (see graph below). Some of that cheaper wholesale pricing found its way to the retail level and was, in effect, a contributor to the downtrend in CPI inflation over the last two years. It now looks like wholesale prices are on the uptick and that will create another challenge for the Fed to get retail-level inflation back to its 2% target.

- We did get one more inflation series this morning in the form of Import/Export Prices for November. Import prices rose 0.1%, above the -0.2% expectation and matching the prior month, while the YoY rate ticked up from 0.8% to 1.3%. Import prices ex-petroleum were unchanged, as expected, vs. 0.2% in October. Export prices were unchanged which was hotter than the -0.3% expectation but off the stout 1.0% increase in October. The YoY rate for export prices moved higher from -0.1% to 0.8% as deflating prices from last year roll off the calculation. So, while the monthly numbers were somewhat friendly, the YoY rates continue to edge higher as deflating prices from a year ago roll off. This too doesn’t bode well for store-level inflation, especially when we consider the potential for increased tariffs under the Trump Administration.

- With CPI, PPI, and Import/Export prices in hand the estimate for core PCE has come down from 0.2% MoM to 0.16% with the YoY rate holding at 2.8%. You may ask how the PCE estimate was lowered off the hottish PPI. Well, recall the real driver of the higher PPI was food which does not flow into PCE. The categories that directly feed into PCE, like airline fares and health insurance, decreased in November and that resulted in the lowered PCE estimate. If the 0.16% estimate (rounded to a low 0.2%) comes to pass it will compare favorably to the 0.3% print in October.

- Keep in mind, the PCE inflation series will be released on the 20th, after the FOMC meeting on the 18th, but Fed officials will no doubt see these estimates which will be another impetus for the expected 25bps rate cut. After that, we expect a pause in the first quarter of 2025 as the Fed assesses the labor market and inflation picture, not to mention the new administration rolling back into DC.

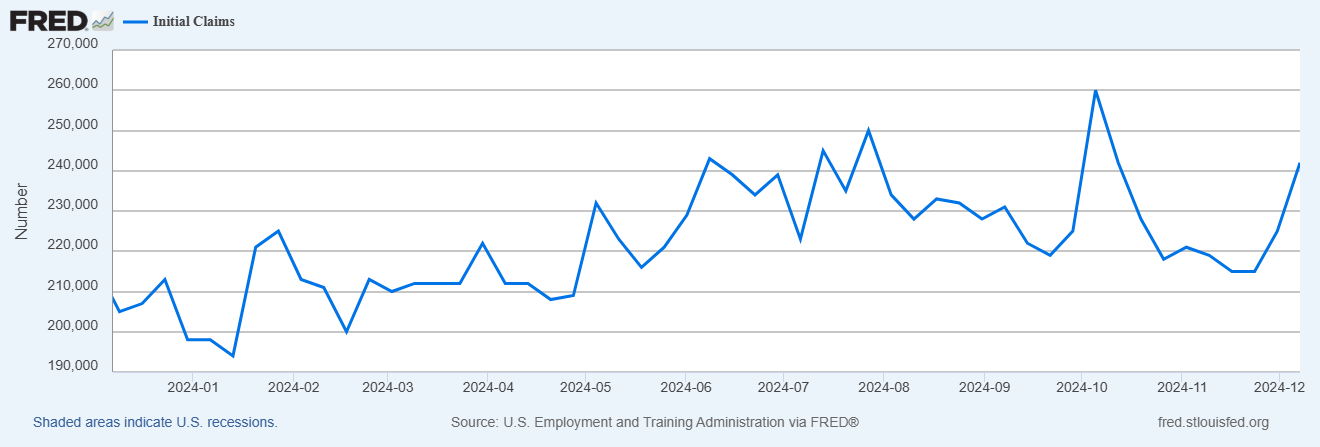

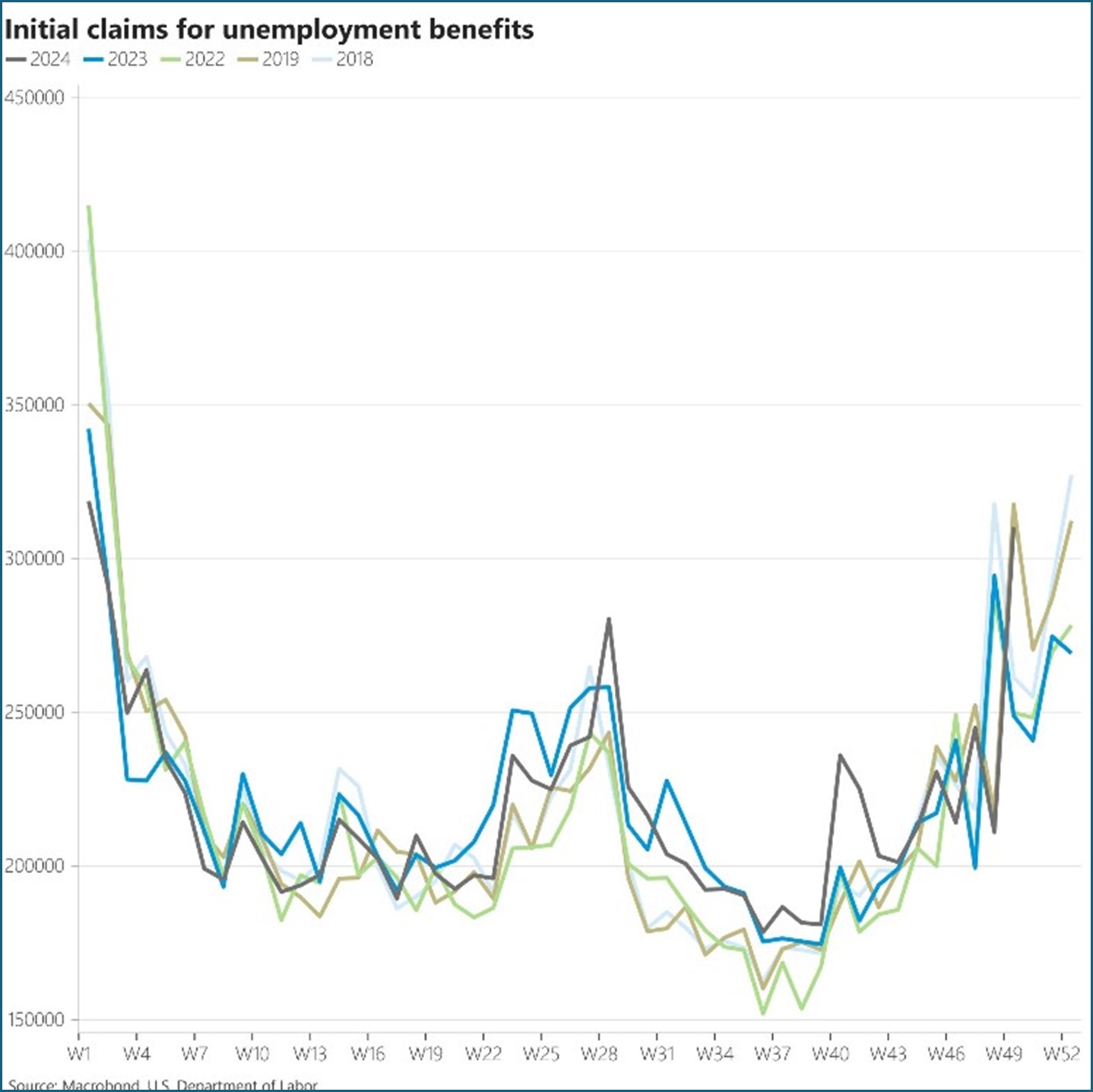

- Finally, most analysts have been wearily eyeing initial jobless claims, looking for any sign of increasing layoffs. Well, the latest claims figure did increase from 225 thousand to 242 thousand, easily above the 220 expectations. Now before you run off thinking the downturn is here, we were at that level back in October, so it’s not exactly groundbreaking. It does, however, merit watching, but we suspect it will be more of a blip than a shift in trend. The good news is the release comes every week, so we won’t have long to wait. Also, when comparing to prior years, last week’s number fits into the yearly trend (see last graph).

Note: Data Not Seasonally Adjusted

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.