Whether January Strength Was A Fluke Will Start To Be Answered This Week

Whether January Strength Was A Fluke Will Start To Be Answered This Week

- With some pivotal economic releases pending this week Treasury yields are drifting higher this morning. The February jobs report looms on Friday while the ISM Services Index is due tomorrow (more on those below). Whether January strength was due to tricky seasonal adjustments or legitimate acceleration will begin to be revealed this week. Presently, the 10yr Treasury is yielding 4.21%, down 7/32nds in price while the 2yr Treasury is yielding 4.57%, down 2/32nd in price.

- While there’s no new data due today this week will be filled with early indicators of economic activity in February, with the headline being the jobs report on Friday. Last Friday’s ISM Manufacturing Index for February surprised to the downside both in activity (47.8 vs. 49.5 expected and 47.1 in January) and prices paid (52.5 vs. 53.0 expected and 52.9 in January). New orders also disappointed (49.2 vs. 52.7 expected and 52.5 in January). That softness plays into January’s strength being an anomaly, but we’ll test that thesis more thoroughly this week.

- The first of these tests will be tomorrow’s ISM Services Index for February with a slight decrease to 53.0 vs. 53.4 in January. That would signal a still expanding services sector, but slightly less than January. The sub-indices for prices paid (64.0 Jan.), employment (50.5 Jan.), and new orders (55.0 Jan.), will also be watched for any weakness that the ISM manufacturing sector revealed.

- The other big report will be Friday’s February payrolls numbers. Expectations are for job gains to dip to 200 thousand vs. 353 thousand in January with the unemployment rate sticking at 3.7%. Average hourly earnings are expected to slow after January’s pop to 0.2% MoM vs. 0.6% MoM. That would slow the YoY pace to 4.3% vs. 4.5% in January. The Fed wants that number closer to 3% to limit a potential wage-price spiral, and given the strength we saw in core services inflation in Friday’s PCE this will be a key metric for the Fed. As you can see, expectations are for a slightly cooler labor market but by no means is it expected to slow materially.

- Fed speak will be hot and heavy this week, but the headliner will be Chair Powell’s semi-annual address to Congress on Wednesday in front of the House Financial Services Committee and then again on Thursday before the Senate Banking Committee. Both are scheduled for 10am ET. While there’s no expectation of a shift from the recent patient pause refrain, we’re likely to get a bit more color on that stance, as well as possible thoughts on winding down QT.

- With that said, it’s unlikely that Powell will get too far ahead of the FOMC on suggesting a path for slowing the pace of balance sheet runoff. It’s expected that the March FOMC meeting will include discussions regarding the runoff process with a start date at the May or June meetings. Dallas Fed President Lorie Logan spoke late last week about the need to begin the process of slowing runoff, while Fed Governor Christopher Waller made clear in a recent speech that rate decisions and QT decisions are on separate paths and should be viewed that way. Logan’s views also carry weight as she used to head the Fed’s Open Market Operations Desk for the Fed and is familiar with the ins and outs of adequate reserve levels and other details that are key for setting the “right” balance sheet size.

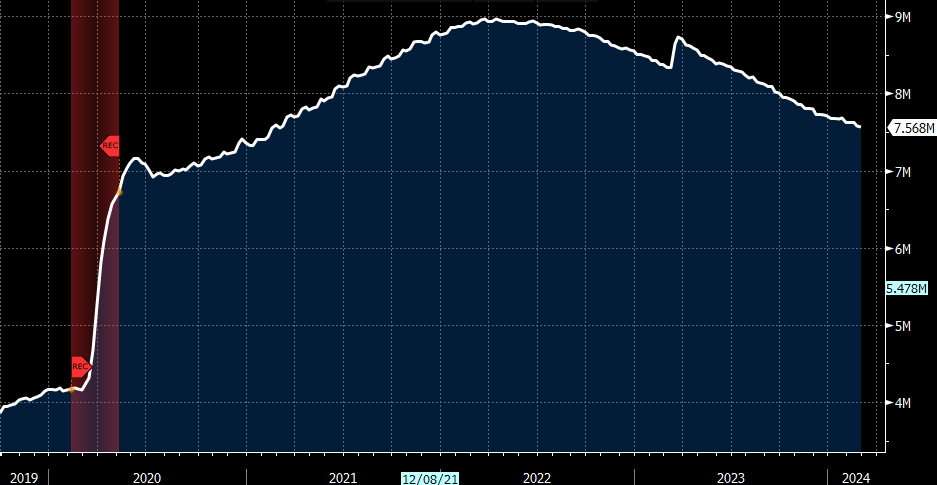

- As the graph below shows, while the balance sheet has shrunk from a $9 trillion high, it’s still well above pre-pandemic levels around $4 trillion. The question is what is the target now? That’s part of what we hope to learn in the upcoming FOMC meeting. With $95 billion being runoff monthly, there is still plenty of time to adjust but the Fed is seeking to slow the glide path to the desired level. There are differing opinions on what the new desired level is, but most cluster around $5 to $6 trillion. As the Fed reduces and eventually ends QT it will ease one pressure point on Treasuries as the Fed turns from actively reducing the balance sheet to maintaining the size of the balance sheet.

Fed’s Balance Sheet – Declining But Still Above Pre-Pandemic Levels

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.