Weekend’s Events have Market in Risk-On Tone

Weekend’s Events have Market in Risk-On Tone

-

- Treasury yields are higher this morning as investors process the weekend’s violent events in a risk-on tone with the fallout pointing to increased odds of a Trump election, not to mention increasing odds for down ballot races as well. (more on that below). Currently, the 10yr note is yielding 4.21%, up 3bp on the day, and the 2yr is yielding 4.45%, down 1bp on the day.

- The violent political events of the weekend have provided another catalyst in the trading calculus with odds increasing of a Trump win, and improving odds down ballot, and what that may mean for the economy and rates ( market consensus: higher deficits and inflation). This morning, a risk-on trade has developed with equity futures rising and Treasury yields increasing on the longer-end, but the moves are tentative at this point, as one would expect.

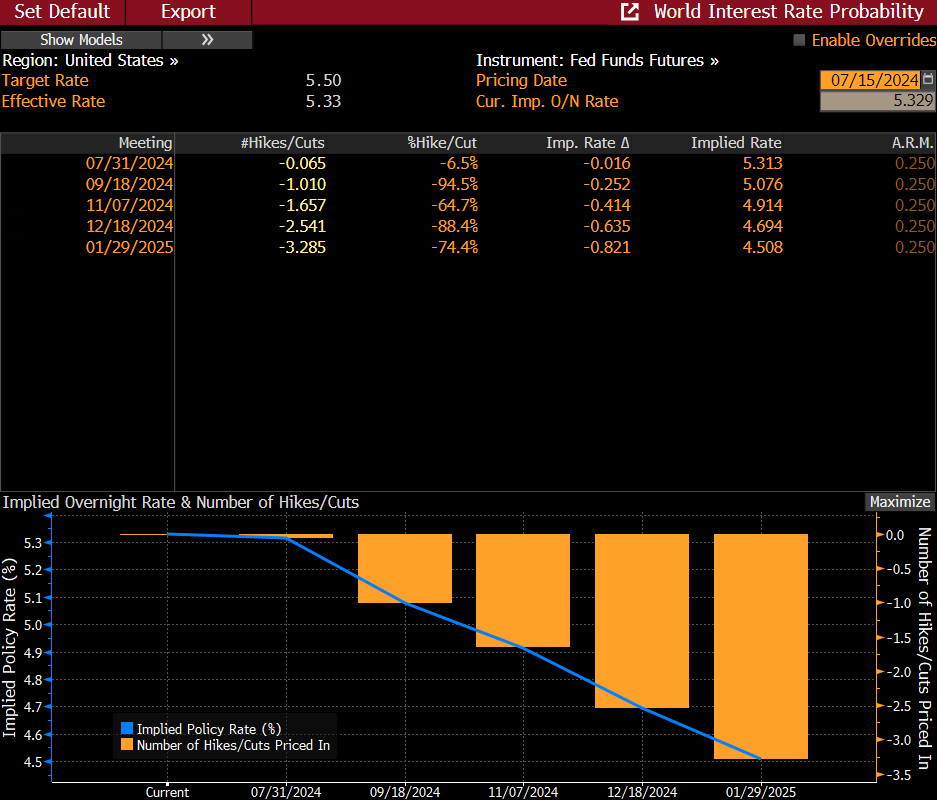

- On how the events may affect monetary policy we’ll hear more later from Chair Jerome Powell in a noon interview conducted by David Rubenstein. While we’re not expecting any turn in policy at this interview, we’ll be on the alert for any softening in the “need more convincing inflation data.” The cool June CPI read will provide the most fodder for economic questions, while Powell probably steer clear of any questions regarding the weekend’s events and how that may shape future policy.

- Away from Powell, other Fed speakers will be busy this week before going into radio silence prior to the July 31 FOMC meeting. We’ll have speakers sprinkled across every day this week along with the Fed’s Beige Book summarizing economic conditions across the twelve Fed districts on Wednesday. This will be part of the staff’s economic presentation at that meeting. Recall, the June Beige Book picked up signs of slowing by the consumer and a pushing back on higher prices. We’ll see if those observations become something of a trend in this report.

- From a data perspective, we can’t match last week’s first tier inflation releases, but the June Retail Sales report will highlight this week’s more meager data flow. Expectations are that overall sales decreased -0.3% vs. 0.1% in May. Sales ex-autos and gas are expected to be better at 0.3% vs. 0.1% the prior month while the GDP inclusion, Control Group, is expected to be up 0.2% vs. 0.4%. So, away from lower gas prices and slower auto sales driving the headline lower, core sales are expected to provide something of a rebound from May’s slowdown which goes against the slowing consumer theory. The Atlanta Fed’s GDPNow latest forecast for second quarter GDP is 2.0% but will be updated following the retail sales report.

- Also tomorrow, more inflation numbers will arrive with the June Import and Export Prices report. More deflation is expected from both with import prices expected to fall -0.2% vs. -0.4% in May while export prices are expected to fall -0.1% vs. -0.6%. While a smaller piece of the economy, if the expectations come to fruition, it provides another “good inflation read” that the Fed professes to be waiting on.

- We can report some anecdotal data from our week off that may play into the slowing consumer theme, with a couple caveats. We experienced full airplanes as usual. In fact, we left on Sunday, July 7, which had the highest passenger load this year. Coming at the end of the long July 4th weekend that wasn’t unexpected. The venues we attended, however, were not anywhere near full, a noticeable difference from our spring experience. Now, that could have been a consequence of outdoor activities in 95-degree heat, and following the long July 4th weekend, but it also may speak to a more discerning consumer when it comes to discretionary spending.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.