Waller Roots for July Rate Cut, Again

- Fed Governor Waller was at it again in a Thursday evening address outlining his views for a rate cut at the upcoming July FOMC meeting. That has markets modestly bull-steepening in response, and while the “cut now” remarks are nothing new from Waller, he did add more meat to the bone for his thinking and perhaps boosted his standing in the Fed Chair sweepstakes at the same time. As we open another summer Friday trading session, the 10yr is yielding 4.44%, down 3bps on the day, while the 2yr is yielding 3.89%, also down 3bps on the day.

- In a New York address last night entitled, The Case for Cutting Now, Fed Governor Chris Waller reiterated his call for a cut at the July FOMC meeting. Waller reiterated his stance that tariff costs will be one-off and thus the Fed should look through the impact. He estimates tariff costs are being split in some fashion between exporter, importer, and consumer, and thus the impact will be more limited than some had feared. He cites a Fed study that excluding tariff costs headline inflation is running close to the 2.00% target. Meanwhile, he is concerned the labor market is masking weakness that will be revealed as monthly revisions to payrolls are made, which lately have been to reduce the original estimates. If you’re interested, and it’s a quick read, the full speech can be found here.

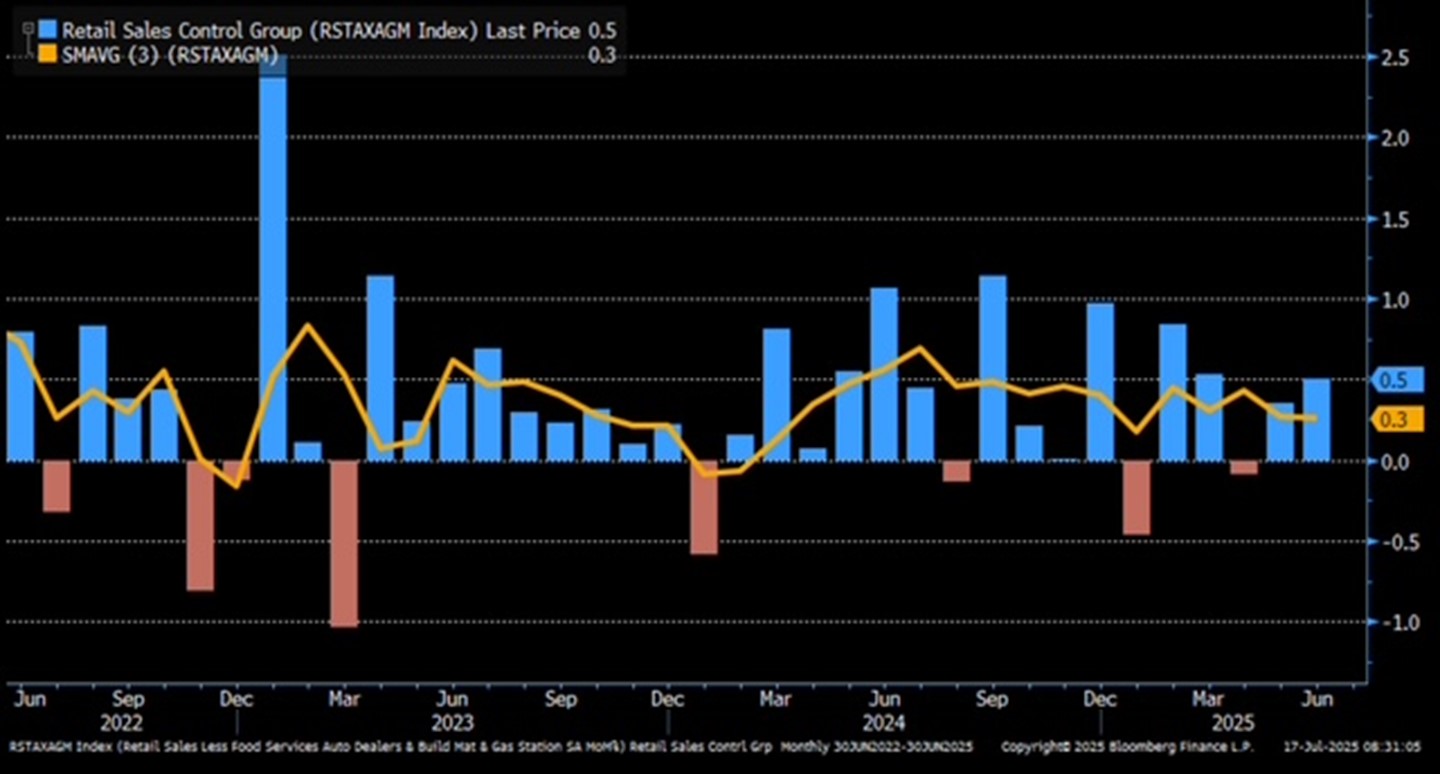

- After a soft performance in May, the consumer stepped back to the plate and laced a sharp double off the wall to dispel notions they were fading in the summer heat. Retail sales rose 0.6% for the month which was well clear of the 0.1% expectation and easily better than the disappointing -0.9% contraction in May. The pick-up in sales was broad-based as 10 of 13 categories were up month-over-month. In fact, the only two categories that saw sales slow were electronics and furniture, two categories that are predominately imported goods. Perhaps increased costs from tariffs impacted their sales. The Control Group – a direct feed into GDP – rose a solid 0.5%. After the report, the Atlanta Fed’s GDPNow model was left at 2.6% QoQ annualized.

- The report is another reminder to not be quick in writing off the American consumer, although the more comprehensive look at spending will come on the 31st with the Personal Income and Spending Report for June, so we’ll reserve judgment until then. In the meantime, evidence of stagflation – slowing economy and higher inflation – will have to wait a bit longer.

- Back at the White House, on Tuesday the President reportedly brandished a letter purportedly asking Fed Chair Powell for his resignation. Trump made this disclosure to a room of Republican lawmakers and staff. Reports are the room concurred that he should follow through. Later Trump disavowed any immediate intention to fire Powell but did add, “I don’t rule out anything, but I think it’s highly unlikely, unless he has to leave for fraud,” a reference to the over-budget renovations to the Fed’s headquarters. The markets reacted to the rumors and subsequent retraction in what may be a preview of coming attractions should the President follow through with the demand (see graph below).

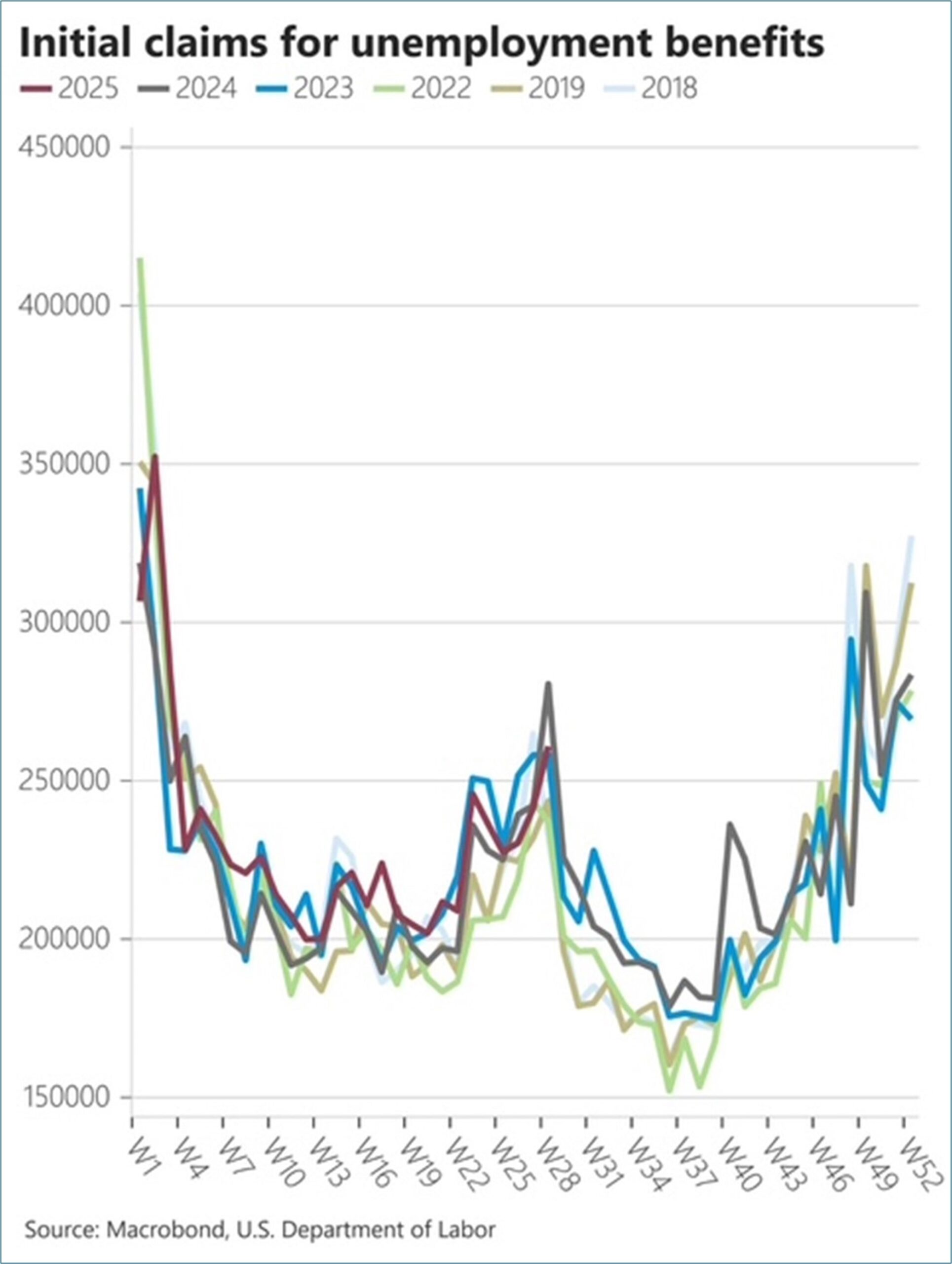

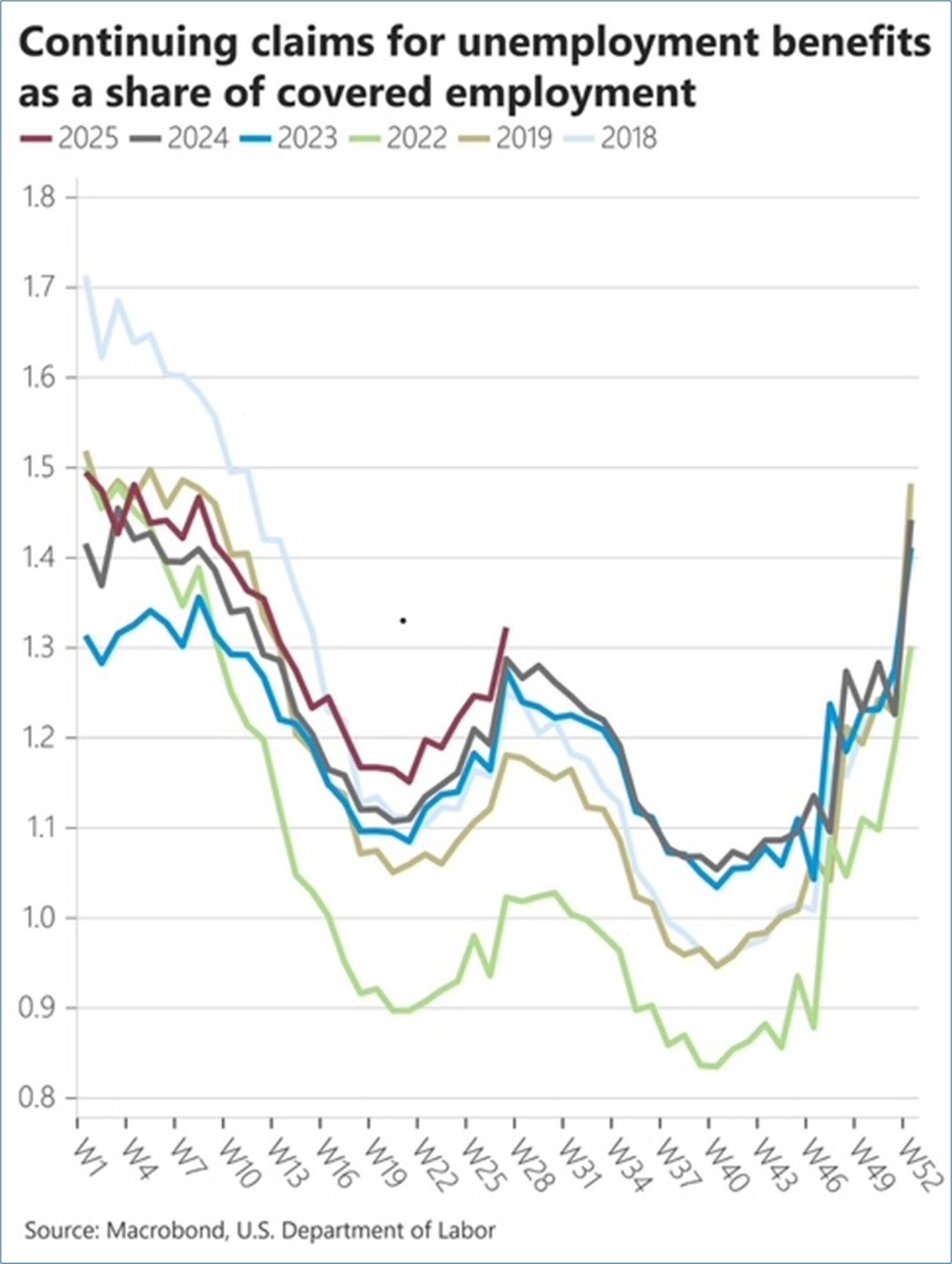

- On to more banal matters, initial jobless claims posted a nothing-to-see-here report. For the week ending July 12, initial jobless claims decreased by 7,000 to 221,000. The previous week’s level was revised up by 1,000 to 228,000. The 4-week moving average was 229,500, a decrease of 6,250 from the previous week’s average. Seasonally adjusted continuing unemployment claims during the week ending July 5 were 1,956,000, an increase of 2,000 from the previous week’s revised level. The previous week was revised down by 11,000 from 1,965,000 to 1,954,000. The 4-week moving average was 1,957,500, an increase of 4,750 from the previous week’s revised average. This remains the highest level for this average since November 20, 2021, and reflects the low-hire, low-fire labor market that has persisted for more than a year.

- Later this morning the University of Michigan’s preliminary July Sentiment Report will be released. While some improvement in the headline sentiment measure is expected (61.5 expected vs. 60.7 in June), the inflation expectations will garner most of the attention, as they spiked in recent months over fears of tariff-induced price increases. The Fed wants long-term inflation expectations to be stable so seeing them retreat a bit from recent levels would sooth some of their inflation-angst and help grease the skids for a possible September rate cut. The 1Yr inflation expectation is 5.0% which would be unchanged from June, while the 5-10Yr inflation expectation is 3.9% vs. 4.0% the prior month.

- Finally, June Housing Starts and Permits finished off the data for the week as starts rose 4.6% to 1.321 million annualized vs. 1.263 million in May. Meanwhile, permits rose 0.2% to 1.397 million annualized vs. 1.394 million the prior month. While the MoM numbers improved, they still trailed 2024 June results. You’d be hard-pressed to find another segment of the economy wishing more for rate cuts than the housing sector. Unfortunately, with the combination of solid retail sales, decent jobless claims numbers, and evidence of higher prices leaking into the inflation reports, unlike Waller, we think rate cuts will wait until September, at the earliest.

- Last chance to register! Kevin Smith and I will co-host a webinar next Tuesday at 2pm ET to review our midyear economic outlook, 2nd quarter investment portfolio performance, and strategies that will prosper in 2026. Please consider attending to what we are sure will be an informative 30-minute discussion. Registration is free at this link. We would love to see you there, at least virtually!

Retail Sales Control Group – Having a Decent 2nd Quarter

Equity Market Impact of Powell’s Possible Firing and Subsequent Retraction

Source: MarketWatch

Initial Claims Well Within Prior Years Levels

Continuing Claims, However, Trending Modestly Above Prior Years Levels

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.