US Inks Trade Deal with UK, China Meet-Up Awaits

- While plenty of details of the US-UK trade “deal” remain to be hammered out, and despite talking points that highlight a more limited agreement than comprehensive, the market sees an opening for more deals and that is the operative theme this morning. The attention will quickly turn to this weekend’s China meeting. With Inflation Week looming, here’s hoping the weekend tariff news has the market on the front foot come Monday morning. Currently, the 10yr is yielding 4.39%, up 2bps on the day, while the 2yr is yielding 3.87%, down 2bps on the day.

- Yesterday, the US and UK signed the first of what are expected to be numerous trade deals. However, with trade between the two countries fairly close in size, and the UK being a long-time ally, it would seem this was one of the easier deals to accomplish versus some of the upcoming negotiations, read: China. The 10% blanket tariff level remained in place while modestly expanding agricultural access for both countries and lowering U.S. duties on British car exports. Some are calling the deal “limited” while others are harsher calling it “a nothingburger”. Regardless how one chooses to characterize it, it could set something of a template for other deals the administration is eager to sign. President Trump tried to push back on that notion saying the new tariff level is low compared to what other countries should expect given the “special relationship” with the UK. So, we’ll see if it will be the template for other deals that some had hoped for.

- This weekend, representatives from the US and China officially announced an agreement to meet in Switzerland this weekend. China’s press office stated that Vice Premier He Lifeng will meet with Treasury Secretary Bessent and US Trade Representative Jermaine Greer in Switzerland between May 9 – 12th. This is the first meeting between the principals so it’s unclear what can reasonably be expected.

- In a Fox News interview, US Treasury Secretary Bessent said, “My sense is that this will be about de-escalation, not about the big trade deal, but we’ve got to de-escalate before we can move forward.” President Trump said yesterday that he expects the talks to be substantive which puts some pressure on the US side to make it more than a meet-and-greet photo op. He has already mentioned this morning that “a 80% tariff seems right”, which will certainly temper some of the more optimistic expectations.

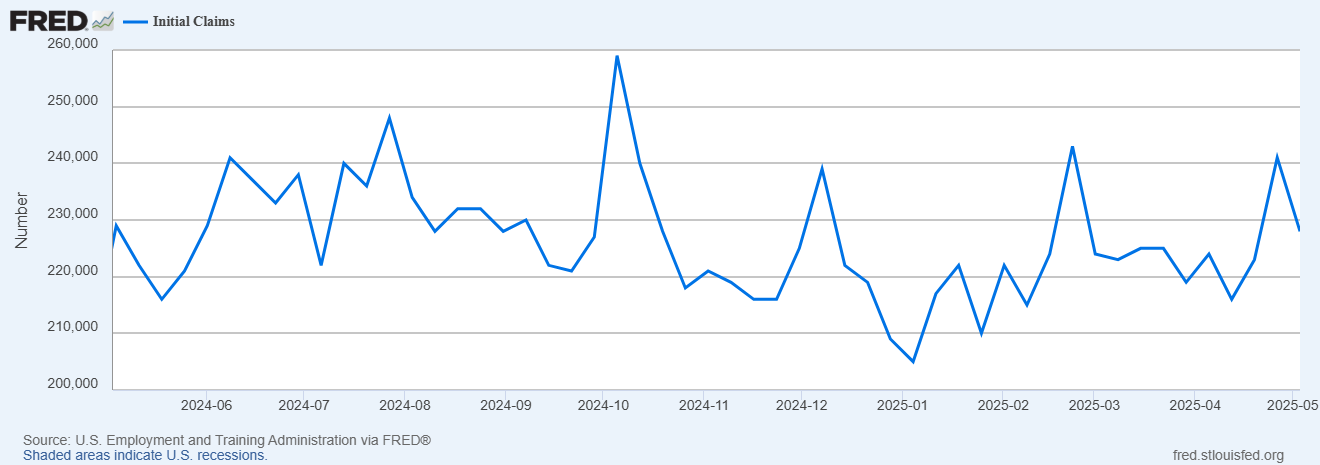

- The favorite labor market canary-in-the-coalmine, weekly jobless claims, continues to blissfully signal nothing much is happening to the layoff story. In the week ending May 3, the advance figure for seasonally adjusted initial jobless claims was 228,000, a decrease of 13,000 from the previous week’s unrevised level of 241,000. The 4-week moving average was 227,000, an increase of 1,000 from the previous week’s unrevised average of 226,000. The advance number for seasonally adjusted continuing claims during the week ending April 26 was 1,879,000, a decrease of 29,000 from the previous week’s revised level. The previous week’s level was revised down by 8,000 from 1,916,000 to 1,908,000. The 4-week moving average was 1,874,500, an increase of 8,750 from the previous week’s revised average. The previous week’s average was revised down by 2,000 from 1,867,750 to 1,865,750. Thus, this plays well with Powell’s patient pause comments that we heard yet again at Wednesday’s FOMC press conference.

- On to a more troubling report as the initial estimate of first quarter productivity was disappointing. The BLS reported yesterday that nonfarm business sector labor productivity decreased 0.8% in the first quarter of 2025 as output decreased 0.3% and hours worked increased 0.6%. (All quarterly percent changes are seasonally adjusted annualized rates). This is the first decline in nonfarm business sector labor productivity since the second quarter of 2022. From the same quarter a year ago, nonfarm business sector labor productivity increased 1.4%. Unit labor costs in the nonfarm business sector increased 5.7% in the first quarter of 2025, reflecting a 4.8% increase in hourly compensation and a 0.8% decrease in productivity. Unit labor costs increased 1.3% over the last four quarters. As noted in these figures, lower productivity leads to higher unit labor costs which leads to less profitability and/or higher goods/services prices. If productivity continues to struggle it will only add to the pricing pressure that increased tariffs will cause. Given all the turmoil over tariffs and supply chain concerns during the quarter it could be this poor showing is just a blip on the radar and not a longer-term issue, that is the hope anyway.

- The New York Fed’s latest Survey of Consumer Expectations was released yesterday, and to the relief of the Fed median inflation expectations were unchanged at the one-year-ahead horizon at 3.6%. They did, however, increase by 0.2 percentage point at the three-year-ahead horizon to 3.2%, the highest reading since July 2022. In contrast, median inflation expectations decreased by 0.2 percentage point at the five-year-ahead horizon to 2.7%. The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) increased at the one- and three-year horizons and decreased slightly at the five-year horizon. Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—increased at all three horizons. Given the Fed’s preoccupation with wanting long-term inflation expectations to remain “well anchored” this report will ease some concerns that may have arisen after higher numbers were reported from the more volatile University of Michigan Sentiment Survey.

- With the FOMC meeting in the rearview mirror, Fed officials return to the microphones today to express their views, which we tend to think they will not stray too far from what we heard from Powell on Wednesday. We at least get a diversity of speakers across the dovish-hawkish spectrum so it will be interesting to see how diverse their views are coming on the heels of Powell’s somewhat hawkish-“policy is in a good place” stance. New York Fed President John Williams as well as Fed Governors Adriana Kugler and Michael Barr speak in Reykjavik. Governors Lisa Cook and Christopher Waller, St. Louis Fed President Alberto Musalem, Cleveland Fed President Beth Hammack and Chicago Fed President Austan Goolsbee speak elsewhere.

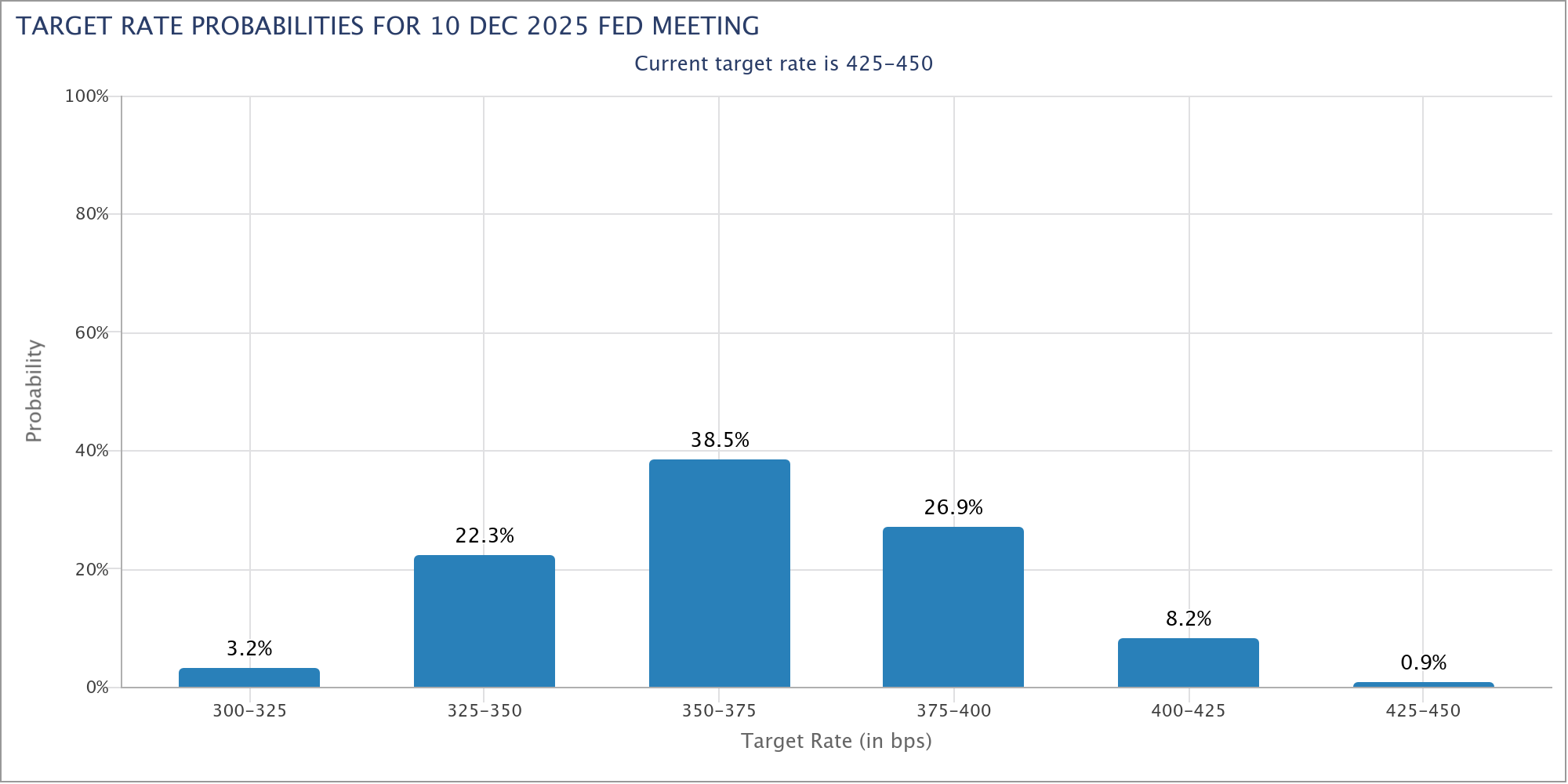

Futures Market Still Sees Three 25bps Rate Cuts this Year

Source: Bloomberg

Initial Jobless Claims Still Signal No Upward Shift in Layoffs

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.