US-China Trade Talk News Stirs Risk-on Sentiment Ahead of FOMC

- News that the US and China are indeed in trade negotiations has put a risk-on mood into early trading, even with the FOMC rate decision on tap for this afternoon (2pm ET). With no expectation of a change in monetary policy, traders are taking full advantage of the trade talk news to push equities, but Treasuries are holding their own as well, in a holding pattern of sorts, until the Fed. Currently, the 10yr is yielding 4.33%, unchanged on the day, while the 2yr is yielding 3.81%, up 3bps on the day.

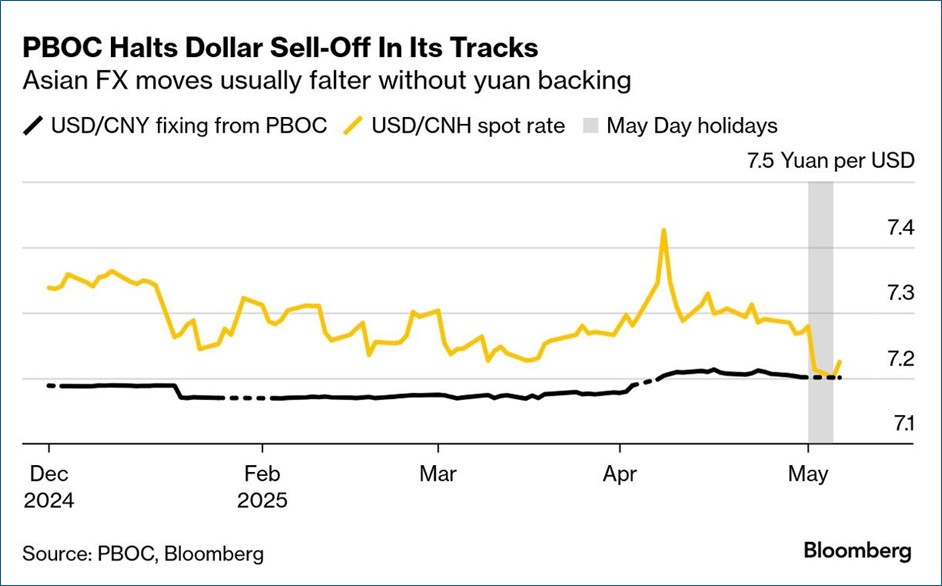

- Overnight, the US and China officially announced trade negotiations with China’s Press Official stating that Vice Premier He Lifeng will meet with Treasury Secretary Bessent and US Trade Representative Jay Greer in Switzerland between May 9 – 12th. Trade analysts see opportunities in the form of Fentanyl-related tariffs (20%) and some trimming potential around retaliatory / escalated tariffs (~91%), though the timeline and narrow path to economically viable de-escalation will be fraught with landmines, least of which from the White House itself. In a Fox News interview, Bessent said, “My sense is that this will be about de-escalation, not about the big trade deal, but we’ve got to de-escalate before we can move forward.”

- Another view is that US-China talks could hinge on the progress of other US trade deals, which might delay a meaningful rollback of escalatory tariffs until the end of the year when Bessent expects ‘the other 17’ deals might be concluded. Well, at least we can all agree that talking about negotiating is better than not talking at all.

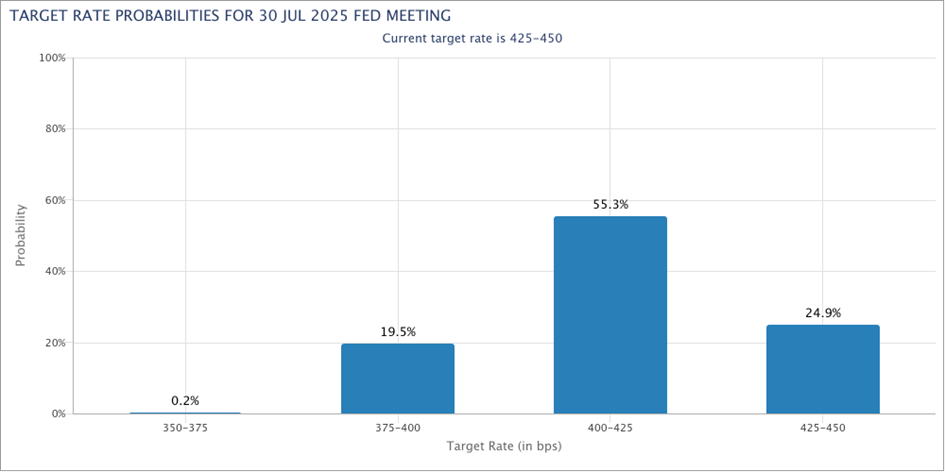

- Despite the US-China trade talk news, the FOMC will conclude their two-day meeting today with expectations far and wide calling for no rate cut. In addition, with no update to the dot plots and economic forecast, the drama around the meeting will center on the post-meeting Powell press conference.

- We think Powell will keep to the patient pause line what with a decent jobs report in his pocket, work still remaining on inflation, and financial conditions having reversed the tightening that followed the Liberation Day announcement. With hard data still reflecting a resilient economy, Powell likely feels he has time to see if the economic downturn manifests before the June/July FOMC meetings. We tend to think now, the economy will continue to remain solid enough to push the next cut into September’s meeting.

- Away from the Fed, Thursday brings a likely Bank of England rate cut. It’s also expected they could be in for a series of cuts which, if so, will only amp up the pressure on Powell as President Trump will certainly notice and probably comment. We don’t think it will force Powell’s hand to cut earlier than he believes is prudent but just expect another round of “Trump Wants Powell to Cut.”

- Also tomorrow, the weekly jobless claims will be updated. That series has become the go-to canary-in-the-coalmine when looking for early indications of economic slowing hitting the labor force. So far, the changes have been benign, as companies tend to see the layoff route as a last resort type of action. Add in the lagging nature of the labor market in general and it could be the case of more weekly reports with nothing much to see. However, with cargo shipping from China headed to the US advertised as being down 30% or more, the impact of the Chinese tariffs will unequivocally start to be felt in the ports (namely LA and Long Beach) that handle the majority of China’s shipments over the next couple weeks.

- We also understand, after hearing the head at the Port of Long Beach that if a deal is agreed to today it would take two weeks to reposition and load ships, then another two weeks to make the China-US sailing. Then add another week or two for shipping from ports to store shelves. So, best case, shortages that develop in the next few weeks will take another six weeks to be relieved. It could make for an unsettling early summer period for the US consumer.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.