Updated Dot Plot on Deck

- Treasuries are marking time until the 2pm ET FOMC rate decision announcement, and while no rate cut is expected the Fed will deliver an updated dot plot of rate expectations along with an updated economic outlook on GDP, inflation, and unemployment. Meanwhile, geo-political events continue to influence trading with the Israel/Iran war dominating at present, and implications the US may get directly involved obviously has the potential to raise trading volatility. With all these dynamics at work, equities are surprisingly set to open minimally higher (Dow indicated up 40 points), and that muted response also has Treasuries treading water. Currently, the 10yr Treasury is yielding 4.38%, down 2bps on the day, while the 2yr is yielding 3.94%, down 1bp on the day.

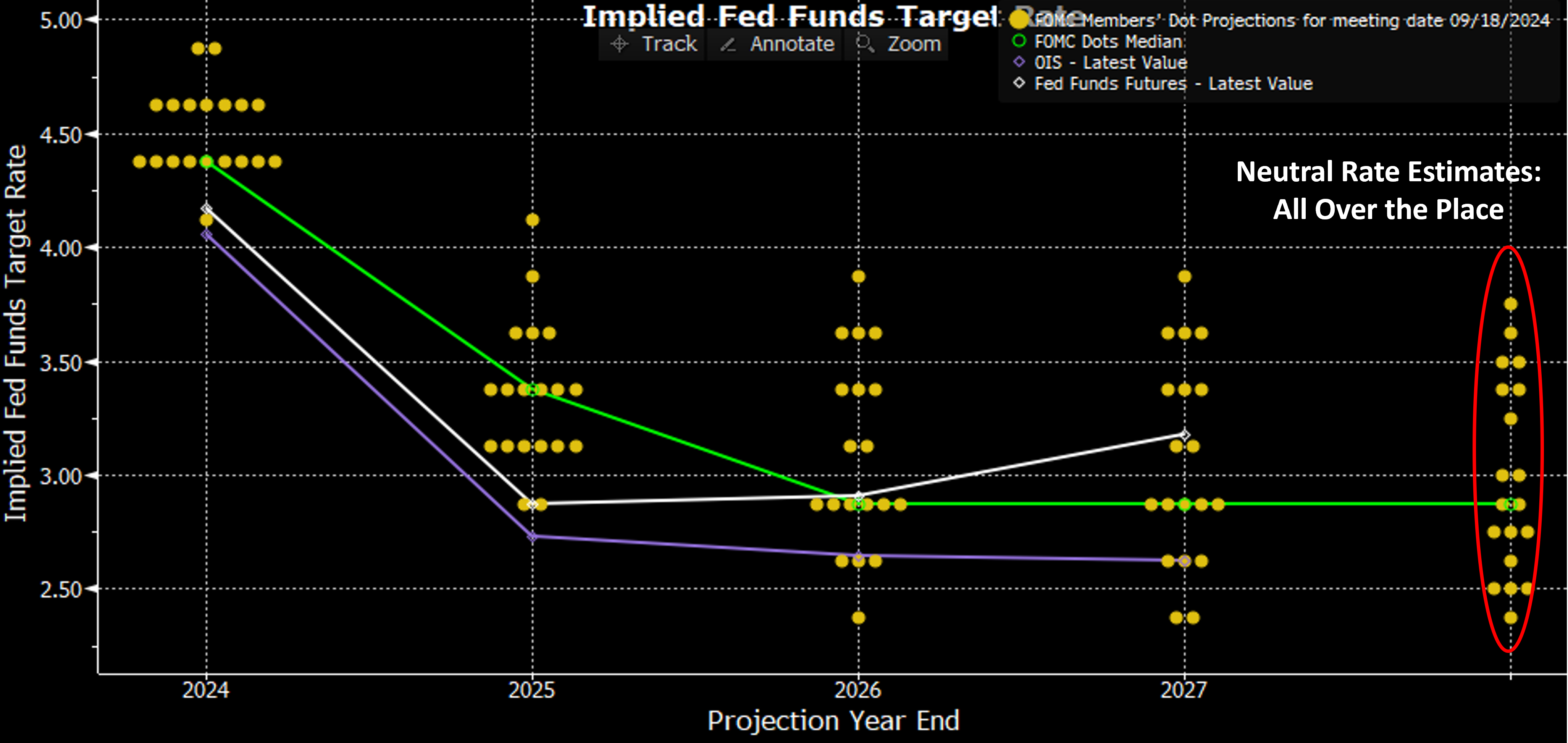

- As we mentioned Monday, the biggest question the market will be looking to have answered today is whether the Fed still projects two 25bps cuts this year as it had in the March dot plot. After this week, four meetings remain in 2025 (July 29-30, Sept. 16-17, Oct. 28-29, and Dec. 9-10). So, there remains plenty of time to get to rate cuts, but quarter-end meetings are always the favorites for that as they come with updated rate and economic information that provide a more fulsome defense of the Fed’s actions.

- That leaves September and December to get the dual rate-cutting job done. We don’t expect, however, that Powell will be that declarative today. Expect to hear that they remain data dependent, which means if the inflation data stays tame, and economic momentum continues to slip, a cut will happen. If one or the other refuses to cooperate a cut could be pushed to year-end, or worse case in 2026. That will no doubt prompt an outburst from the White House that Powell is “late, as usual.” At this point in his career, we think Powell will not be intimidated by such broadsides, and, in fact, probably relishes the criticism as an indicator of Fed independence.

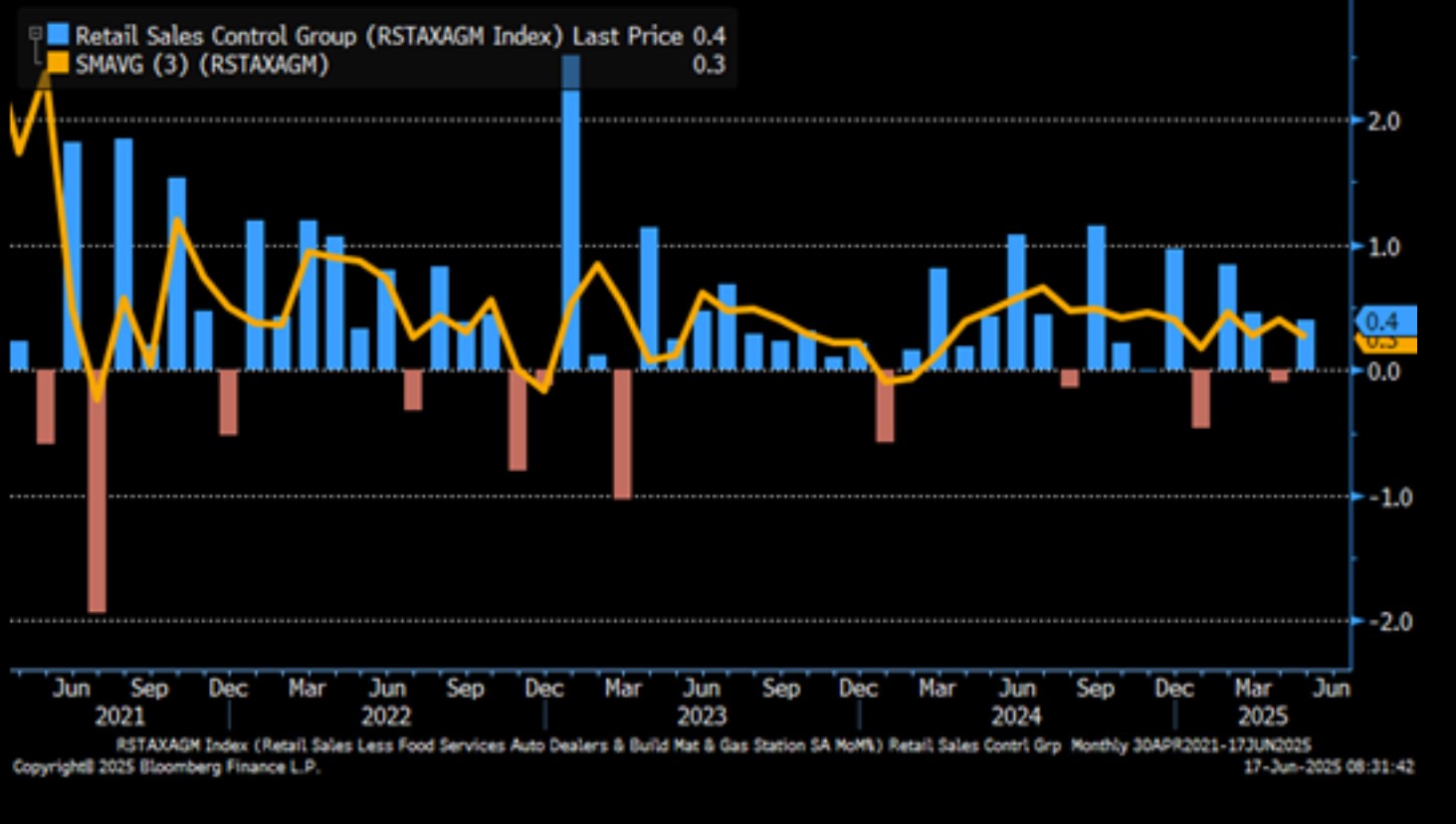

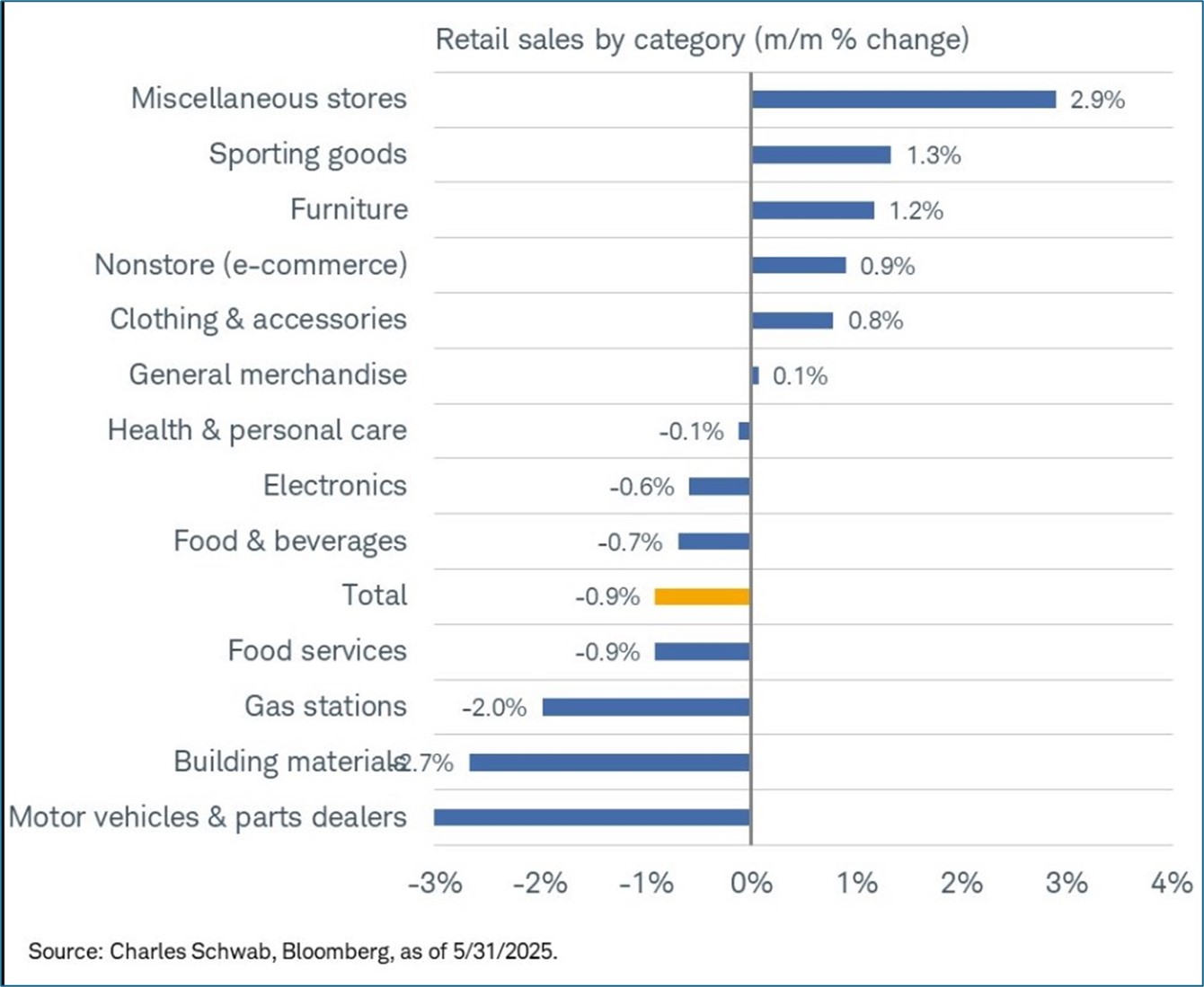

- Shifting gears from the Fed, but related to their task at hand, the May Retail Sales Report yesterday was a mixed bag, but it did show, through some of the smoke, that the consumer is hanging tough, despite economic uncertainty and the earlier spending splurge of front-running tariffs. Overall sales were down -0.9% vs. a 0.1% gain in April and -0.6% expected. The drop was mostly soft car and gas sales, along with weakness in building materials. Ex the volatile auto and gas segment, sales were slightly down -0.1% vs. 0.2% in April and expectations of 0.4%. The saving grace in the report was the direct feed into GDP, known as the Control Group, posted an impressive 0.4% gain compared to -0.1% the prior month, and just shy of the 0.5% expectation. Think of the Control Group as core consumer spending, net of volatile categories like autos, gas, building materials, etc.

- The slippage in auto sales is explained by the front-running of March purchases, while the gas drop-off was more about the decrease in gas prices during the month vs. a drop in miles driven as the report is not price/inflation adjusted. Also, building materials were off -2.7% which is another indication of the construction sector struggling with mortgage rates remaining stubbornly above 7%, and we saw evidence of that again this morning in weaker than expected housing starts. Seven of the thirteen retail categories were negative on the month, but the six that were positive, like apparel, online sales, furniture, sporting goods all netted decent gains which contributed to the positive Control Group result.

- In fact, the Census Bureau provided a three-month look back (March through May) and overall sales were up 0.9% vs. the prior three-month period (Dec. 24 to Feb. 25) and up 4.5% from the same three months (March through May) in 2024. So, while some may pick at the headline decline, or the mixed results across the 13 categories (6 up, 7 down), taking a slight step back and capturing a wider time series reveals the consumer is still hanging tough and not ready to fold up the spending tent just yet. Bottom line, there is nothing in this report that will have the Fed nervous about continuing the expected pause.

- Yesterday, we also received the May Import/Export Price Index, and while import prices were unchanged ex-petroleum import prices rose 0.3% vs. 0.4% in April. In fact, if one goes back to January, prior to the tariff changes, non-fuel import prices were 0.0%, 0.2%, and -0.1% during the first quarter. Year-over-year, net of fuel, import prices have risen 1.7%. So, import prices are posting solid month over month gains since the tariff issue and that will be an increasing headwind for inflation, albeit on the margins given the limited impact of imports on the entire US economy.

- What could be a fly in the ointment much sooner is that foreign airline fares rose a solid 7.5% vs. a -3.0% drop in April. That line item feeds into PCE calculations so it may tilt estimates of a docile 0.1% monthly core PCE a tad higher. Some estimates have core PCE at 0.14%, so a nudge higher from the airline fare spike could see it rounding up to 0.2% MoM. It’s not enough to upset the cooler inflation story, but not as cool as hoped. Again, it won’t keep the Fed from cutting, say in September, but it opens the door for a lengthier discussion around the issue.

- We’ll be back this afternoon with a quick analysis of what we learned at the FOMC meeting, and perhaps what remains unanswered. Expect that email before 3pm ET.

March Dot Plot – Question is will the 2 Rate-Cut Projection for 2025 Live on?

Source: Bloomberg

Retail Sales Control Group in May – Still Solid Consumption but the Trend is Slowing

Weaker Autos, Gas, and Building Materials Spending Obscures Decent Core Retail Sales

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.