Trump’s Tone Shift on Powell’s Future and China Tariffs Rekindles Animal Spirits

- With President Trump shifting his comments and tone to a more market-friendly stance regarding Fed Chair Jay Powell’s future and China tariffs, markets are feeling frisky, both Treasuries and equities. We’ll see if that positive tone remains throughout the day. Currently, the 10yr is yielding 4.28%, down 10 bps on the day, while the 2yr is yielding 3.80%, up 1bp.

- A moderation in tone from the Trump administration has put financial markets back in a more positive mood. President Trump revisited the Fed independence issue in noting he never had any intention of firing Fed Chair Powell, only that he wants him to move faster in lowering interest rates. Trump also said that China tariffs would come way down (but not to zero), and that seemingly opens the door for China to engage more enthusiastically in negotiations. We’ll see how long the new tone shift remains, but for today the markets are greeting it with major relief.

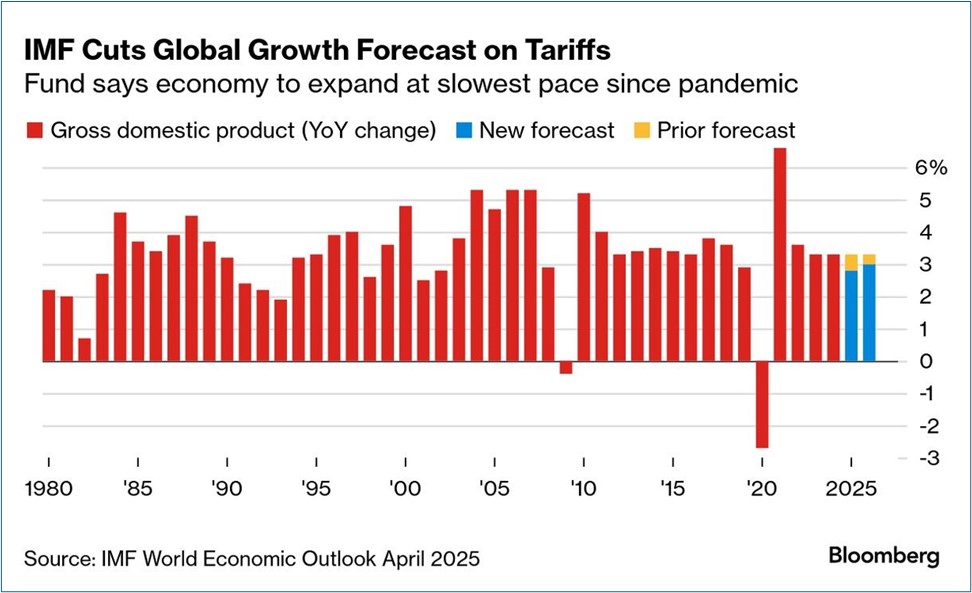

- While new economic data is few and far between this week, we do get perhaps the highlight release later this morning in the preliminary S&P Global PMI series. The release of European PMIs earlier was a downbeat affair, which serves to highlight the precarious nature of global growth at present. The US PMI series is expected to soften some from the March numbers but with the composite index (both services and manufacturing) remaining above the 50-dividing line (52.2 expected vs 53.5 in March).

- New home sales for March are expected a bit later in the morning with 685 thousand annualized units expected to have sold vs. 676 thousand in February. With market yields backing up since March, it’s likely that sales will stay challenging given affordability issues and poor consumer sentiment.

- We will get a decent amount of Fed news today, and hopefully none of it will be about Powell’s job status. In addition to the Fed Beige Book on the economic outlook due this afternoon, Chicago Fed President Austan Goolsbee and Fed Governor Christopher Waller are the highlights with five Fed speakers in total. Goolsbee has staked out the most dovish position of the vocal FOMC membership while Waller has recently thrown his hat into the “tariffs are transitory” lot, so we’ll see if both stick to their recent comments today.

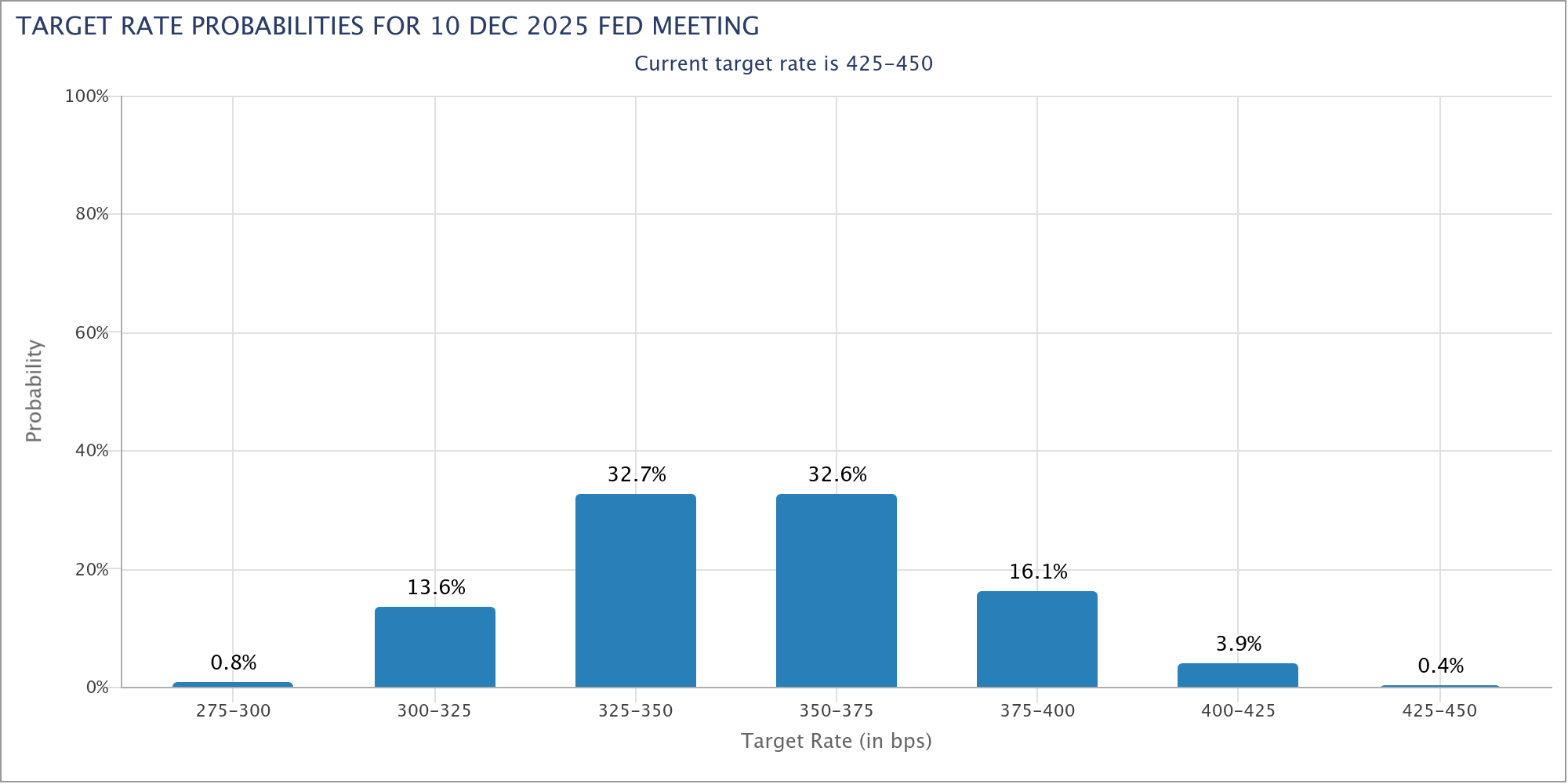

- The futures market remains pessimistic about the economy in that it’s predicting nearly 100bps in rate cuts this year. If we assume the resumption of rate-cutting begins in June, that will require cuts at consecutive meetings, not just quarter-end, or cuts coming in larger slices than 25bps.

Futures Predicting 75 – 100bps in Rate Cuts by Year-End

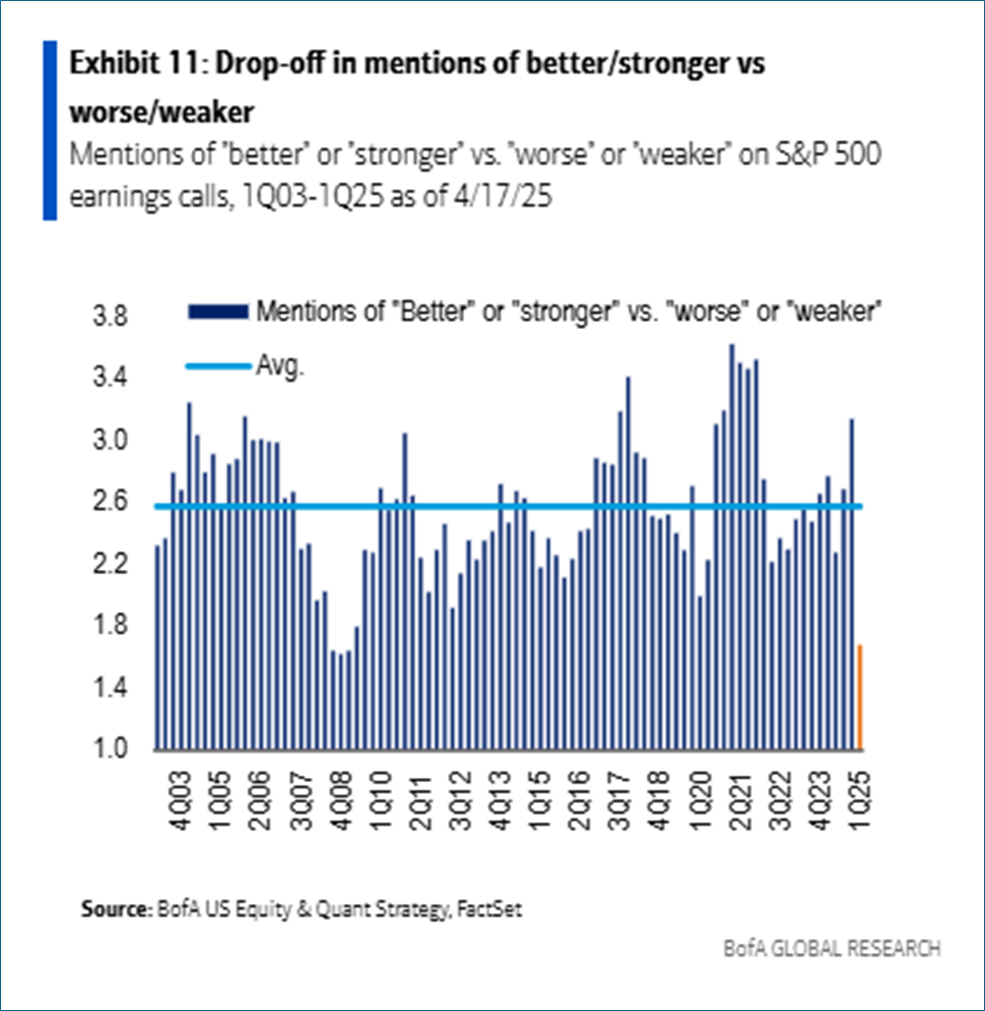

Earnings Call Mentions of Outlook Turn Down

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.