Treasury Yields Tick Lower While Awaiting Tier 1 Data Next Week

- Treasury yields are a touch lower this morning as a mixed read on durable goods orders for September clears the deck for next week’s higher profile reports. Durable goods numbers continue to be subject to the travails of Boeing as the strike is keeping buyers cautious. Orders ex transportation were better than expected, but then again, transportation does constitute a big chunk of overall orders. Currently, the 10yr Treasury is yielding 4.18%, down 2bps on the day, while the 2yr is yielding 4.05%, also down 2bps on the day.

- While this week was rather quiet on the data front that will change quickly next week as some first-tier reports arrive. The September Job Openings and Labor Turnover Survey(JOLTS) report will be released on Tuesday with eyes on both the Job Openings number and the Quits Rate. Both had been declining of late, except for a slight uptick in openings in August. In any event, openings are approaching the 1 to 1 ratio to unemployed vs. more than 3 to 1 at the height of the labor market tightness a couple years ago. Meanwhile, the Quits Rate (the percentage of total employed voluntarily leaving a job) has declined to 1.9% from 3.0% indicating less worker confidence in getting a new and/or better paying job. The Fed would like to see both measures stabilize and not weaken any further.

- Next, the first estimate of third quarter GDP will be released on Wednesday with a solid 3.0% expected per the Bloomberg consensus. The Atlanta Fed GDPNow model, however, is looking for an even stronger result at 3.4%. In any event, no hint of economic weakness is expected from the first estimate. That leads us to the October jobs report on Friday along with the Fed’s preferred PCE inflation measure. Payrolls are expected to come off the hot September print with 135 thousand new jobs vs. 254 thousand the prior month. The unemployment rate is expected to remain at 4.1%. Finally, the PCE inflation numbers could be a little hotter than preferred. Core PCE is expected to print 0.3% MoM compared to the docile 0.1% September reading. Despite that forecasted monthly increase, the core PCE YoY rate is expected to drop a tenth to 2.6%. That should keep a 25bps rate cut on track in November.

- The first round of October data arrived yesterday with the S&P Global PMI series. While not as famous as the ISM report, it does provide an earlier peek at October results. The manufacturing sector slightly beat expectations at 48.8 vs. 47.5 expected and.47.3 in September. S&P Global uses the same methodology as the more famous ISM series where 50 is the dividing line between an expanding sector and contracting one, so manufacturing, while slightly improved, continues to remain in contractionary territory. Meanwhile, the services-side of the economy continued to hum along with a 55.3 print vs. 55 expected and 55.2 in September. Until we see a more dramatic dip in the services side numbers it’s hard to see a recession developing anytime soon.

- Also, while expectations were that the multiple hurricanes would drive claims higher, that didn’t happen as weekly claims dipped from 241 thousand to 227 thousand. That was short of the 240 thousand and continues to show the reluctance on the part of employers to let go full-time employees. Just like with the services-side PMI, it’s hard to see a recession developing if claims continue to remain benign. That said, continuing claims continued to move higher (see graph below) and that speaks to some of the slowdown in hiring that was picked up in the Fed’s latest Beige Book of economic conditions.

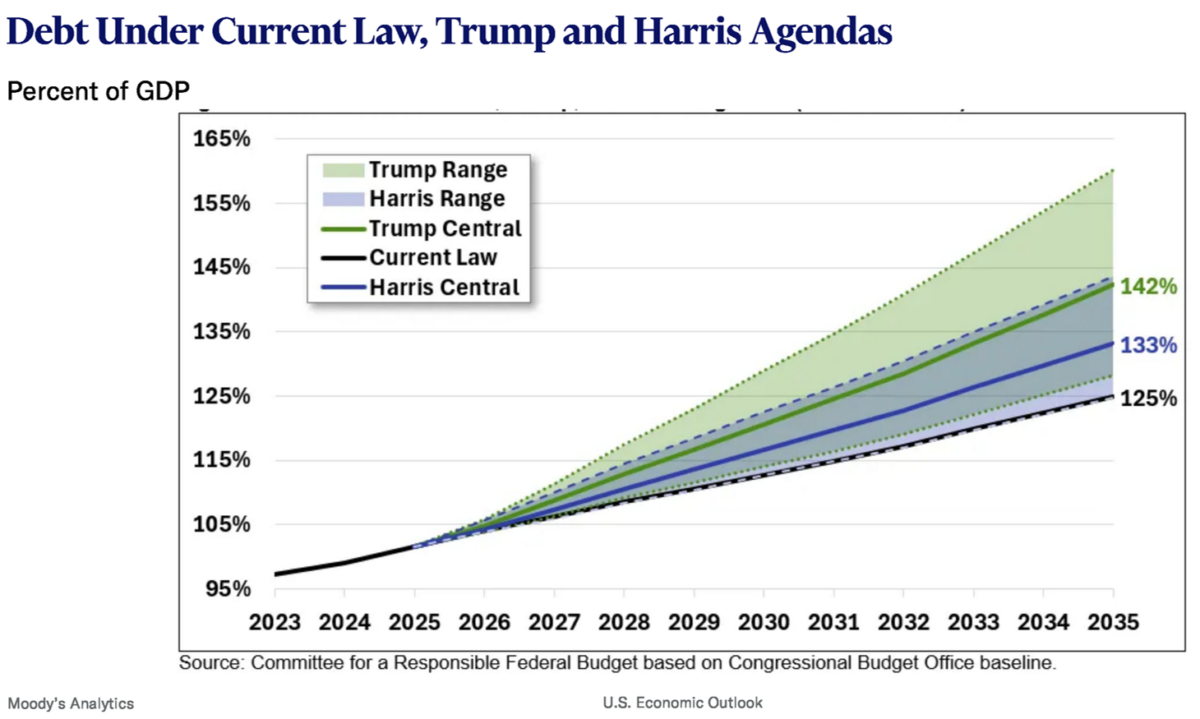

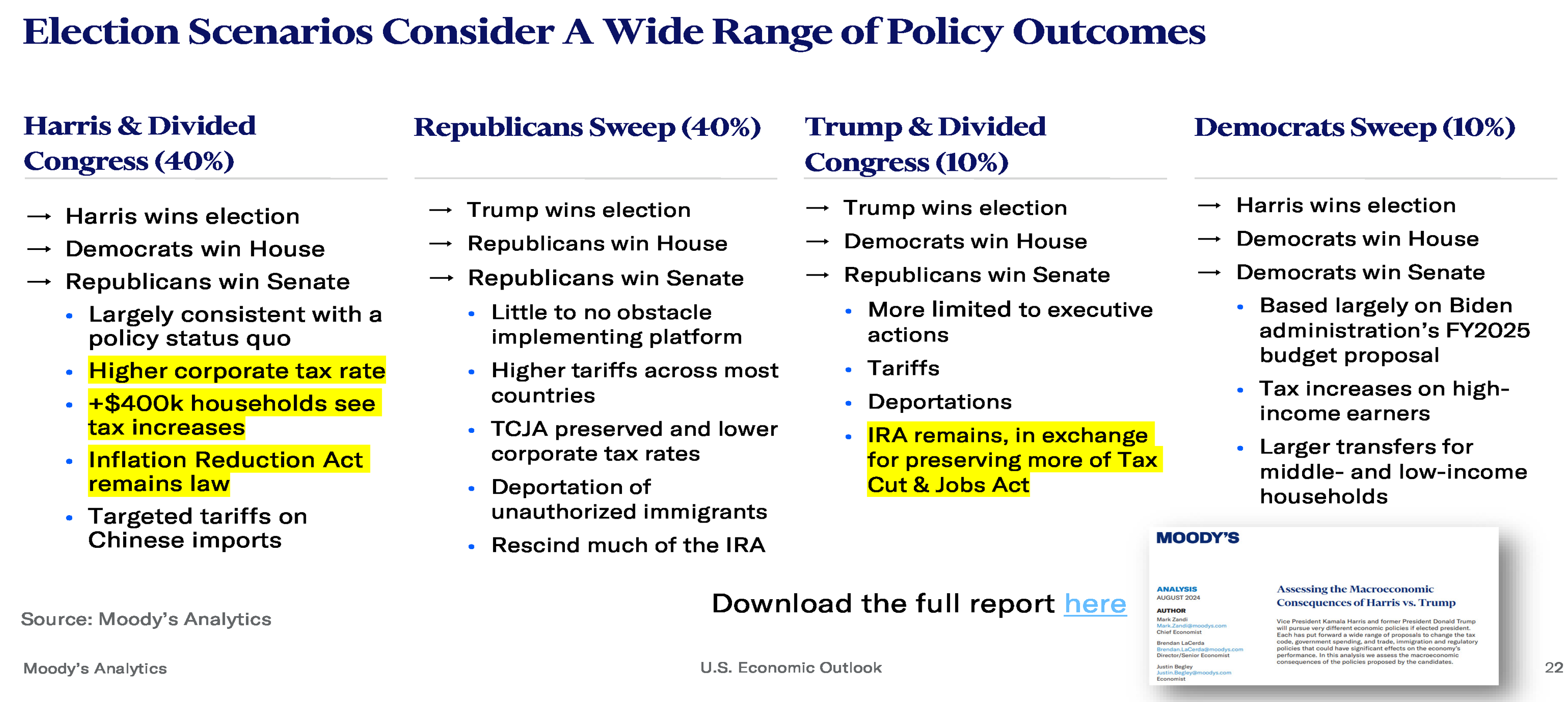

- We just returned from a couple group meetings with clients and reviewed our latest economic outlook, but while the clients appreciated the economic views, they were mostly interested in the coming election and what that might mean to the economy and rates. We relied on the recent Moody’s outlook in that regard We’ll gladly forward our updated economic outlook and the Moody’s view of the different election outcomes and what that could mean for both inflation and the deficit. So, just let us know.

Continuing Jobless Claims Moving Higher Indicating Slowdown in New Hiring

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.