Treasury Yields Tick Higher While Awaiting Tier 1 Data This Week

- Treasury yields are a touch higher this morning, but off earlier levels as election anxiety increases, and as investors brace for a busy week of data. Currently, the 10yr Treasury is yielding 4.24%, up 1bp on the day, but it did reach 4.29% in overnight trading. Meanwhile, the 2yr is yielding 4.10%, also up 1bp on the day, but it did reach 4.14% in overnight action.

- This week has something for everyone. Economic releases? Oh, we have plenty. New Treasury auctions? Check. How about an updated announcement from the Treasury on future auction sizes? We have that too! Oh, and there is the little matter of a U.S. Presidential election in just over a week to keep everyone’s anxiety and suspense levels on high. It all adds up to what should be an exhausting last week of October.

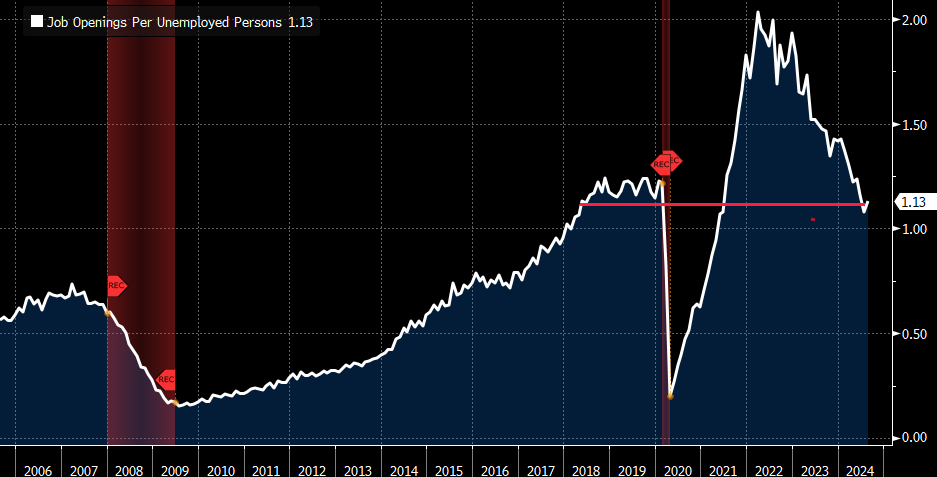

- Last week was devoid of much on the data front but that will change quickly beginning tomorrow. The September Job Openings and Labor Turnover Survey(JOLTS) report will be released with investors, and the Fed, focused on both the Job Openings number and the Quits Rate. Both had been declining of late, except for a slight uptick in openings in August. In any event, openings are approaching the 1 to 1 ratio to unemployed vs. more than 3 to 1 at the height of the labor market tightness a couple years ago. Meanwhile, the Quits Rate (the percentage of total employed voluntarily leaving a job) has declined to 1.9% from 3.0% indicating less worker confidence in getting a new and/or better paying job. The Fed would like to see both measures stabilize and not weaken any further.

- On Wednesday, the first estimate of third quarter GDP will be released with a solid 3.0% expected. The Atlanta Fed GDPNow model, however, is looking for an even stronger result at 3.3%. Also, the quarterly inflation numbers in the release will have analysts trying to spy any signs of what it may mean for Thursday’s September PCE numbers.

- Expectations are for core PCE to be on the hot side at 0.3% MoM vs. 0.1% the prior month, but even with that expected uptick it probably keeps a November rate cut in play. The Fed has plenty of room at this point to “recalibrate” policy, so better to move now rather than face possibly higher seasonal inflation numbers in the first quarter which will make rate cuts more difficult for the hawks on the committee.

- On Friday, non-farm jobs are expected to come off the hot September print with 135 thousand new jobs vs. 254 thousand the prior month. The unemployment rate is expected to remain at 4.1%. The question is with the hurricanes and strikes, how much signal can be gleaned from what could be a rather noisy report.

- Finally, the Treasury will be busy today with auctions of $69 billion in 2-year notes and $70 billion in 5-yr notes. Also, this afternoon they will be releasing their quarterly financing estimates. Expectations are in the $565 billion range, but just as important as the overall amount is whether they anticipate any changes to coupon auction sizes. The expectation is they won’t, but if not, it will put more pressure on yields.

Job Openings Per Unemployed Persons Back to Pre-Pandemic Levels

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.