Treasury Yields Mark Time Before Tomorrow’s CPI and Today’s 10yr Auction

- Treasury yields are mostly unchanged this morning as investors mark time before tomorrow’s CPI report, and 10yr supply later today. Also, as we mention below, the twin hurricanes of Helene and Milton are likely to make a mess of the October jobs report which could make it harder to tell if September’s strength was a one-off, or a genuine regrouping of labor market momentum. That answer may have to wait until November’s report. Currently, the 10yr Treasury is yielding 4.04%, up 1bp on the day, while the 2yr is yielding 3.97%, down 1bp on the day.

- The major events today aren’t all that major with FOMC minutes, a variety of Fed Speak, and new 10yr Treasury supply. The minutes aren’t likely to garner too much attention as they came after the September payrolls report that was surprisingly strong and has dominated the trading since its release last Friday. Still, the main takeaway may be how widespread the feeling was in starting off with a 50bps cut. While we know only Fed Governor Bowman voted against the move, the dispersion of dots in the updated dot plot offers a more diverse view.

- Fed speakers today include Raphael Bostic, Lorie Logan, Austan Goolsbee, Philip Jefferson, Susan Collins, and Mary Daly. Yesterday’s speakers talked mostly about a balanced approach to setting policy and we’re likely to get the same today. However, today’s speakers span the spectrum between dovish (Goolsbee, Daly), to neutral (Bostic, Jefferson, Collins) and hawkish (Logan) so it will be interesting to see how unified, or not, the messaging is today.

- We still believe the current funds rate is still far enough above neutral (call it 3.00%) that 25bps cuts in November and December should not be a tough call. Then the calendar turns to 2025 and if this year’s hotter-than-expected first quarter inflation numbers are repeated next year, the Fed may be forced to pause for a few months into 2025, until cooler inflation prints allow the rate-cutting to continue.

- That said, the November and December cuts will have to be buttressed by continued inflation improvement and tomorrow’s September CPI report is expected to show just that with the overall expected up 0.1% MoM and core up 0.2% MoM. Recall, however, last month’s core CPI surprised with a 0.3% MoM print vs. 0.2% expected. Core PCE, however, surprised to the downside with a 0.1% print vs. 0.2% expected. PCE weights housing a bit less than CPI and the surprising increase in Owner’s Equivalent Rent (OER) in CPI led to the upside surprise there. Fed Chair Powell in recent comments remains confident that OER will eventually dip into pre-pandemic levels as more current reads on rental rates have been softening for many months. So, no matter what we see in CPI this week, the Fed will wait on PCE on October 31st, before deciding on a November rate cut.

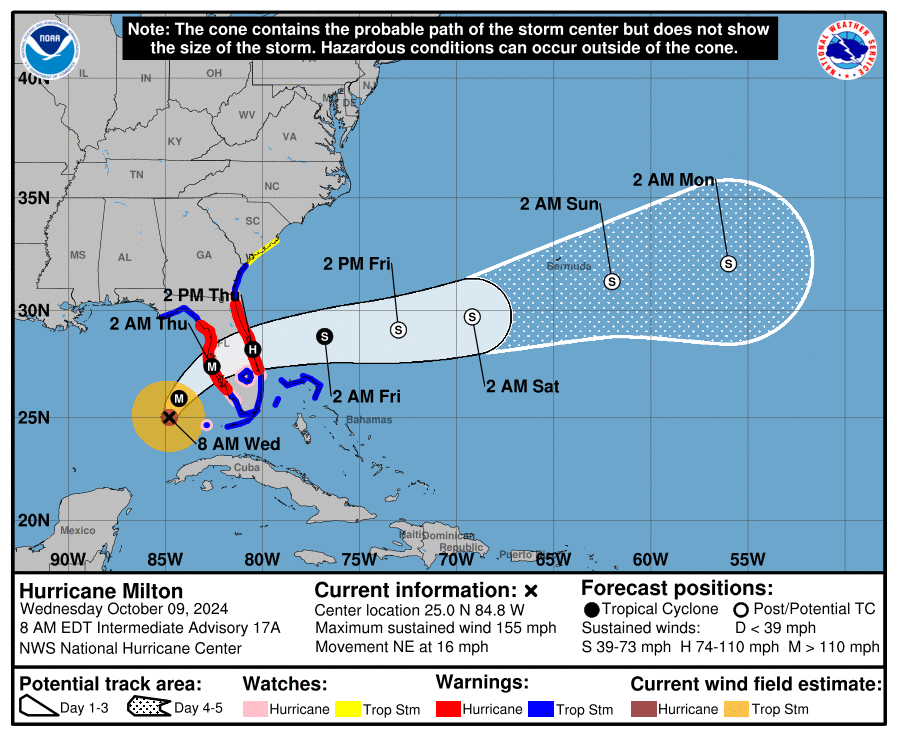

- Another thing to consider is that while the September employment report surprised everyone with its strength, the October report may have more noise than signal to offer either a conformation that the labor market has regained its momentum, or September was just a one-off. This is survey week for the October employment report and with Hurricane Milton about to make landfall in central Florida, and the lingering impact of Hurricane Helene, it could make for a noisy report. Initial jobless claims are expected to spike due to Helene’s damage and Milton will probably bring the same in the following week’s print. So, getting a good read on the labor market may be a bit more troublesome as we navigate storm fallout.

Disruptions from the Hurricanes Will Likely Rock the Docile Picture in Coming Jobless Claims Reports

The Twin Hurricanes of Helene and Milton Will Probably Make for a Noisy October Employment Report

Source: National Hurricane Center

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.