Treasury Yields Lower on Cooler UK Inflation

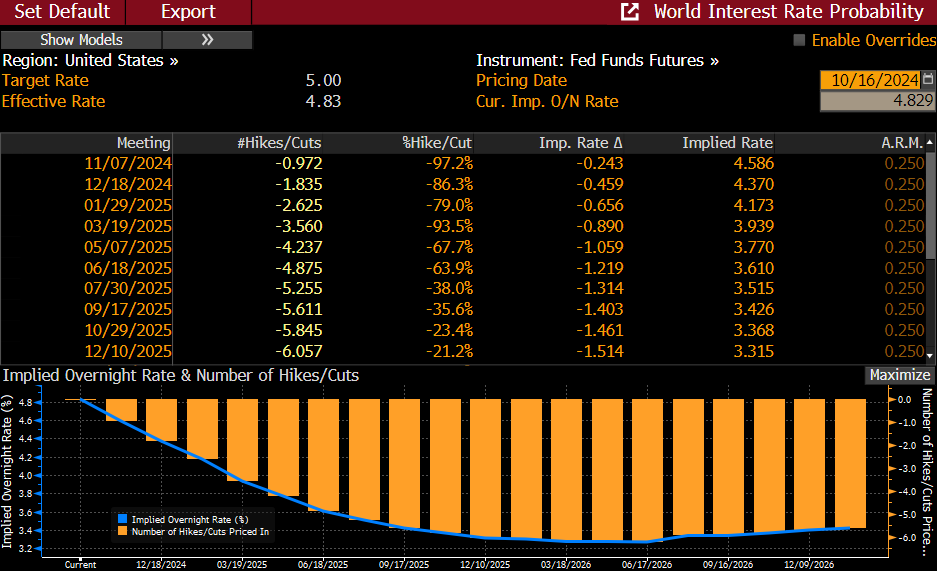

- Treasury yields are lower this morning as cooler inflation readings from the UK are prompting calls for a rate cut from the Bank of England. In addition, the ECB is expected to cut 25bps tomorrow, so the rate-cutting theme is top of mind, and the US is no exception. The question on this side of the pond is whether the Fed skips November or stays in cutting mode. Futures are leaning giving a 25bps cut 97% odds of happening and we agree with that sentiment (see futures table below). Currently, the 10yr Treasury is yielding 4.01%, down 2bps on the day, while the 2yr is yielding 3.93%, also down 2bps on the day.

- The last piece of data for assessing PCE inflation is in today with Import/Export prices for September. The price index for imports decreased 0.4% in September, the largest 1-month drop since a 0.7% decline in December 2023. The September decrease followed a 0.2% decline in August and 0.1% advances in July and June. U.S. import prices edged down 0.1% over the past year, the first 12-month drop since February 2024. Nonfuel import prices ticked up 0.1% for the third consecutive month in September. Higher prices in September for nonfuel industrial supplies and materials, consumer goods, and automotive vehicles more than offset lower foods, feeds, and beverages prices.

- Prices for exports fell 0.7% in September following a decline of 0.9% in August. Export prices decreased 1.1% for the third quarter of 2024, the largest 3-month drop since December 2023. Lower prices for nonagricultural exports in September more than offset higher agricultural export prices. The price index for U.S. exports declined 2.1% over the past year, the largest 12-month decrease since January 2024. So, the deflationary impulse from both exports and imports should be helpful for a cool PCE print, but only at the edges.

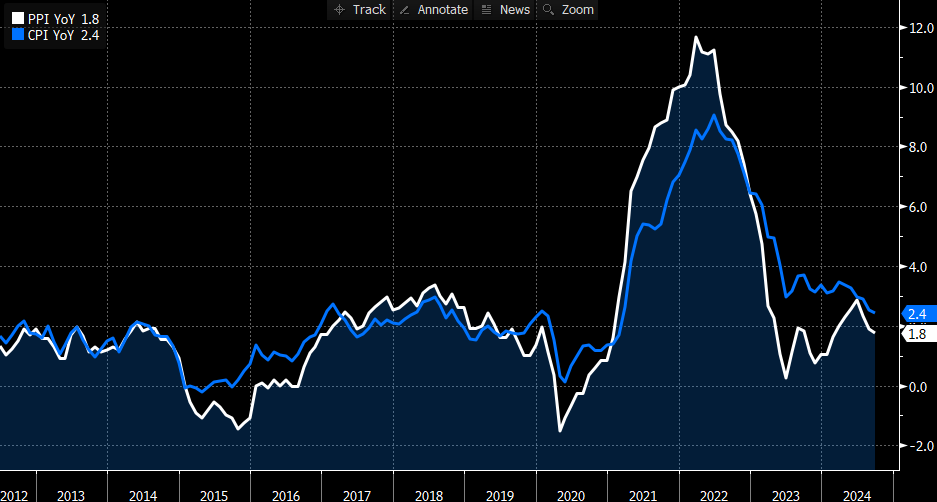

- With the data already in hand, and now import/export prices, estimates for core PCE will be refined a bit more, but current expectations are coming in around a “high” 0.2%, or 0.25%, which could easily slip to 0.3%, which would be disappointing, but probably not enough to forestall a November rate cut.

- Fed Governor Waller, in a speech on Monday, had this to say, “core PCE prices are expected to have risen around 0.25% last month. While not a welcome development, if the monthly core PCE inflation number comes in around this level, over the last 5 months it is still running very close to 25% on an annualized basis.” Sounds like he’s still on board for a November cut while Atlanta Fed President Rafael Bostic would be ok skipping the November meeting if inflation disappointed. But when weighing the importance of the two voices, we lean towards Waller as a governor and probably the most influential on the Committee next to Chair Powell.

- Tomorrow brings us the two most consequential reports for the week with Initial Jobless Claims expected to lift from 258 thousand to 260 thousand. This is well above the recent 230 thousand trend and the highest since August 2023. The caveat here is how much of the lift was attributable to the dual hurricane impacts, not to mention the Boeing strike. So, it will likely be a noisy report which will be an ongoing theme as we work through October reports. Meanwhile, September Retail Sales are forecasted to lift vs. August as the consumer is expected to rebound after a brief spending slowdown in August.

Futures Market Betting Strongly There will be a November Rate Cut

Source: Bloomberg

Fed’s Waller Likes the Trend in Inflation

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.