Treasury Yields Lean Higher as Traders Await Nvidia’s Earnings

- Treasury yields are slightly higher this morning as equities try to mount a rebound with Nvidia earnings looming after the bell with hopes they “save” the Mag 7 big tech group, after what has been a tough few weeks of selling. Currently, the 10yr Treasury is yielding 4.30%, unchanged on the day, while the 2yr is yielding 4.12%, up 2bps on the day.

- The Trump Administration has been vocal in wanting 10yr yields lower, given the obvious economic/housing implications of lower rates, and Treasury Secretary Bessent has been doing his part as well. Talking down any thoughts of increased longer duration issuance has helped at the margins, not to mention the spate of softer survey data of late.

- Maybe flying under the radar, it’s been interesting to see the recent move in 2-year yields drifting farther away from the effective fed funds rate at 4.33%. On Monday, 2-year yields dropped as low as 4.07%, 26 bps below the Fed’s effective policy rate. Before yesterday, 2-year yields hadn’t strayed below the funds rate by more than 17 bps since the Fed set its policy rate at 4.33% last year. This seems to align with the market’s increasing rate cut odds moving back to mid-year, and perhaps an increasing feel that the ending spot for funds will be lower than maybe presumed when the year began. We can only think of the Tom Hank’s movie Cast Away where his beloved Wilson, the soccer ball, drifts away from him while escaping the island on a raft. Perhaps the funds rate is also looking heartbroken at the 2yr yield drifting farther away?

- Back on terra firma, the latest survey data yesterday was another blow to the economic outlook as the Conference Board’s Consumer Confidence Index declined by 7.0 points in February to 98.3. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell 3.4 points to 136.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions— dropped 9.3 points to 72.9. For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead. The Confidence measure was the lowest since August 2021. Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.

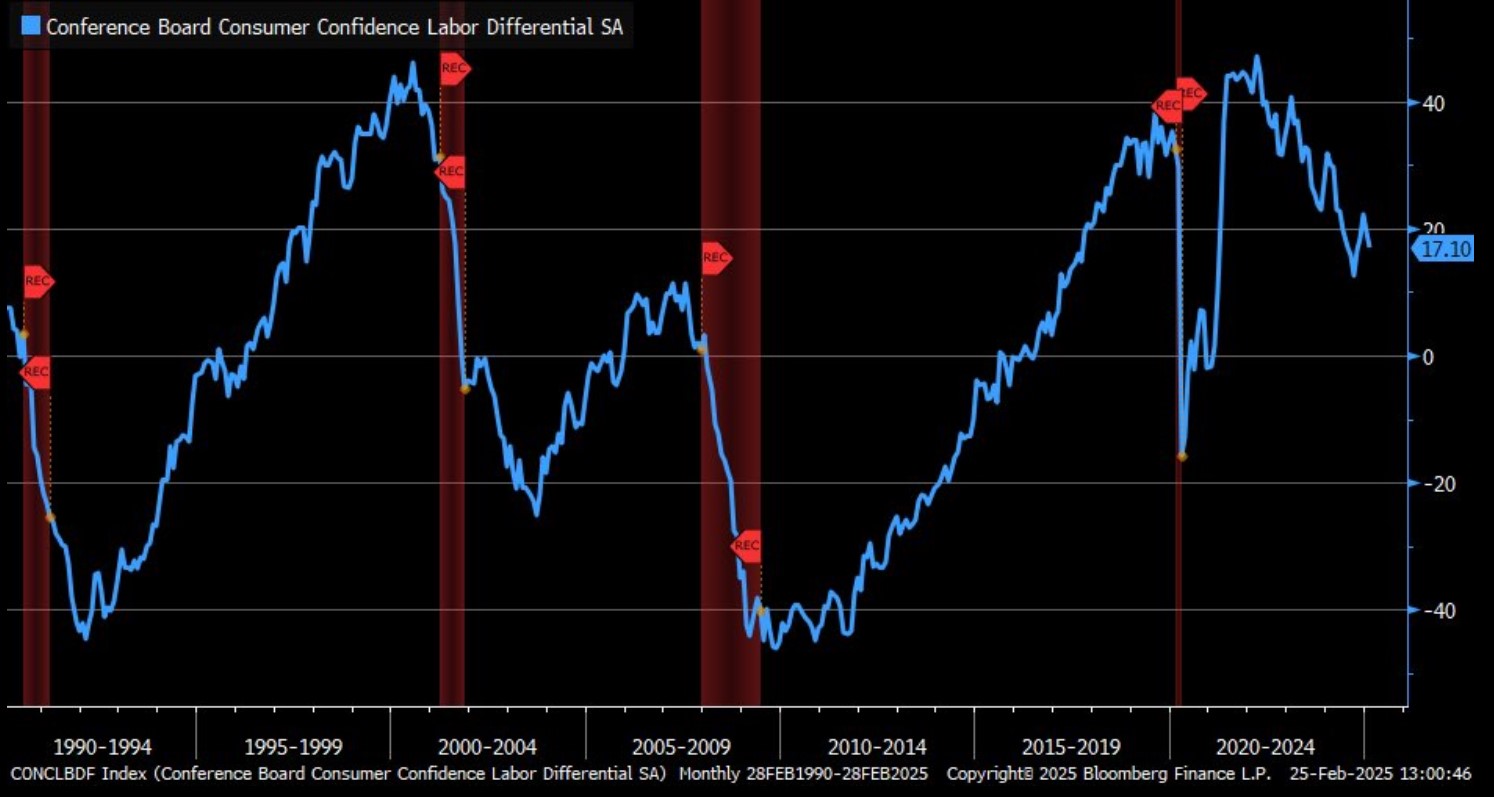

- In addition, consumers’ pessimism about the labor market outlook worsened. 18.4% of consumers expected more jobs to be available, down from 19.1% in January. 25.9% anticipated fewer jobs, up from 21.0% in January. This so-called labor differential (jobs plentiful – jobs hard to get) resumed its 2024 decline (see graph below)

- When you combine this soft result with the disappointing Retail Sales numbers, the similarly disappointing Univ. of Michigan Sentiment Survey, not to mention the S&P Global PMI series with it’s dip into sub-50 readings for the formerly hot services sector and it does give one pause. Sprinkle in the softer guidance on sales from Wal-Mart and now Home Depot and it does start to look like the consumer may be tightening the purse strings just a bit.

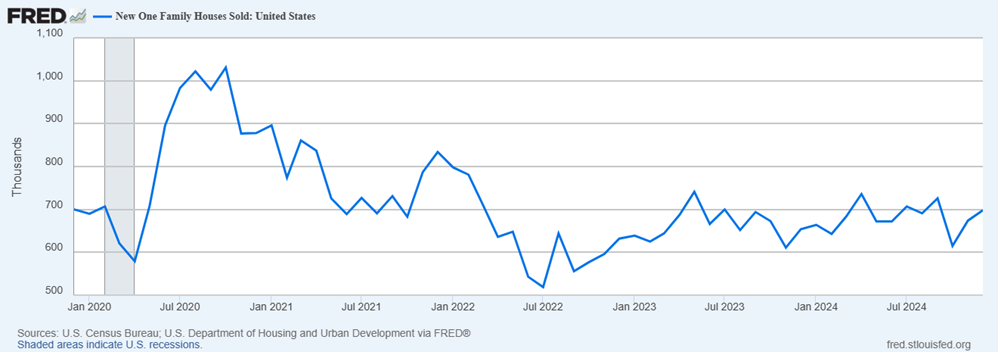

- The only economic data due today is New Home Sales for January which are expected to reach 680 thousand annualized sales vs. 698 thousand in December. This would keep it under 700 thousand units since September and provide another reminder of the struggles in the residential housing market. (see graph below)

Conference Board – Labor Differential Resuming its Decline

Conference Board – Expectations – Present Situation Declines Again Too

New Home Sales Expected to Remain Under 700 thousand annualized since September

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.