Treasury Yields Drift Higher as New Supply Weighs on Market

Treasury Yields Drift Higher as New Supply Weighs on Market

- Treasury yields are moving a bit higher as supply weighs on the market, but a dearth of data this week should keep any moves limited. Corporate supply will be heavy this week, with most of it frontloaded into today and tomorrow, while a 20yr Treasury auction and a 10yr TIPS sale will add to the supply later in the week. Currently, the 10yr note is yielding 4.44%, down 5/32nds in price while the 2yr is yielding 4.84%, down 1/32nd in price.

- A light data week, in front of a holiday weekend, will be augmented by plenty of Fed speak along with new supply (20yr and 10yr TIPS) and that should keep the Treasury market action choppy and range-bound rather than trend changing. We do believe, however, that yields have a decent chance to trend lower in the coming months as the lower QT caps and Treasury repurchase program begin to be felt as the two size players up their purchases in the coming months. That trend could also get a boost if the month-end personal spending numbers confirm the slowing that the retail sales report revealed last week.

- On the Fed speak front there are at least eight officials slated to appear during the week, but not Powell. We expect to hear the continuing message of higher-for-longer combined with an abundance of patience in waiting for inflation to return to the 2% goal. Fed Governor Michelle Bowman spoke Friday afternoon and mentioned that she wouldn’t be opposed to another rate hike, but the market essentially shrugged off those comments. She was one of the last Fed members to accept the current rate as the terminal level, so it didn’t surprise investors that she would be the first to revisit the possibility of another rate hike.

- The higher-for-longer stance is no doubt a reflection that the Fed realizes a point we’ve made recently in that base effects become much more challenging in the second half of the year. The monthly gain in core PCE from May 2023 to December 2023 averaged 0.174% vs. 0.362% in the first quarter of 2023. Thus, to see any improvement in YoY rates we’ll need to see new monthly prints coming in below the second half 2023 average of 0.174%. That seems challenging given the prints so far in 2024 have been 0.30% or higher.

- Given the April inflation data in hand, analysts are penciling a high 0.2% core PCE for April, which would boost late-year rate-cutting odds, but the number could easily round up to 0.3% and that possibility will keep the oddsmakers at bay until the May 31st report. That implies the choppy action we expect this week to continue through next week as well.

- As for data this week, one of the more interesting will be Wednesday’s S&P Global Preliminary PMI figures for May. While not as famous as the ISM series it will still provide an early look at May activity. Expectations are for the manufacturing sector to dip from 50.0 to 49.9 while the services side ticks higher from 51.3 to 51.4. The employment and prices paid components will get attention as well for the information provided on inflation and the labor market.

- Finally, the minutes from the May 1 FOMC meeting will be released Wednesday but will likely be treated as somewhat stale, coming after the decent April CPI report and soft retail sales for the month. So, the expected hawkish rhetoric will likely be taken with a grain of salt given the latest economic releases.

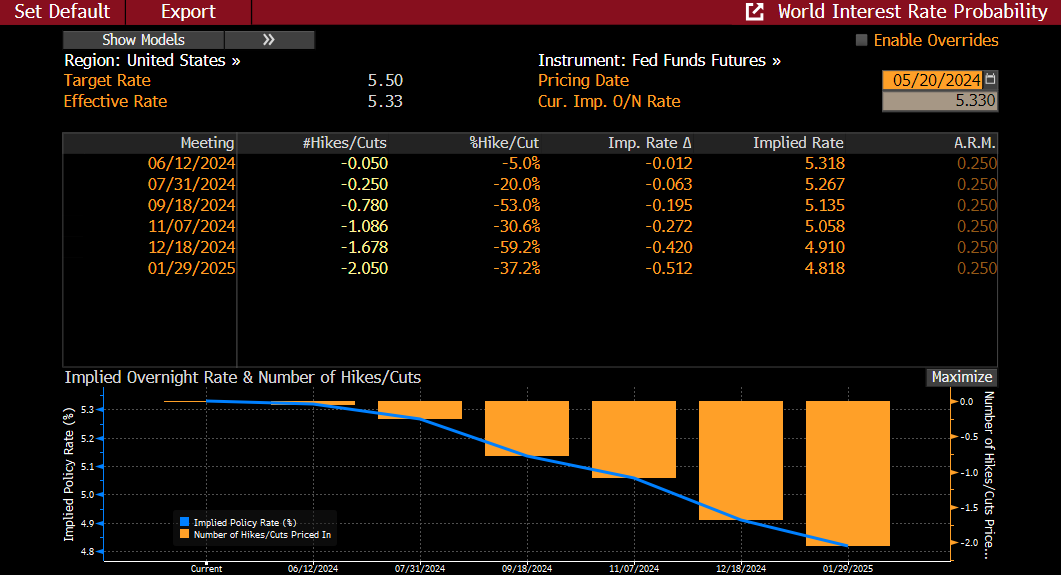

Rate-Cutting Odds Still Focused on November FOMC Meeting with Another in January 2025

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.