Treasury Yields Drift Higher as Election Odds and Deficits Weigh on Markets

- Treasury prices are under modest pressure this morning as a light data calendar has traders focused on election odds and the increased budget deficit for FY2024, and the lack of concern from either party to seriously address the issue after the election. So, while investors wait for first-tier data next week, an in-range drift higher in yields appears to be the order of the week. Currently, the 10yr Treasury is yielding 4.14%, up 6bps on the day, while the 2yr is yielding 3.99%, up 4bps on the day.

- This should be a week of marking time until more notable first-tier economic data flows in next week, namely the PCE inflation series and the first estimate of third quarter GDP on Halloween, and the jobs report on Nov. 1. While the calendar is light this week, a few items will spur some limited interest by the market.

- This morning it’s the Leading Indicators for September which is expected to print a -0.3% vs. -0.2%. The indicator has been calling for a recession for over a year now to no avail (see graph below), so today’s report will be greeted with a healthy dose of derision. A negative print today would be the seventh straight month. In addition, the only non-negative month over the past two years has been February’s unchanged reading.

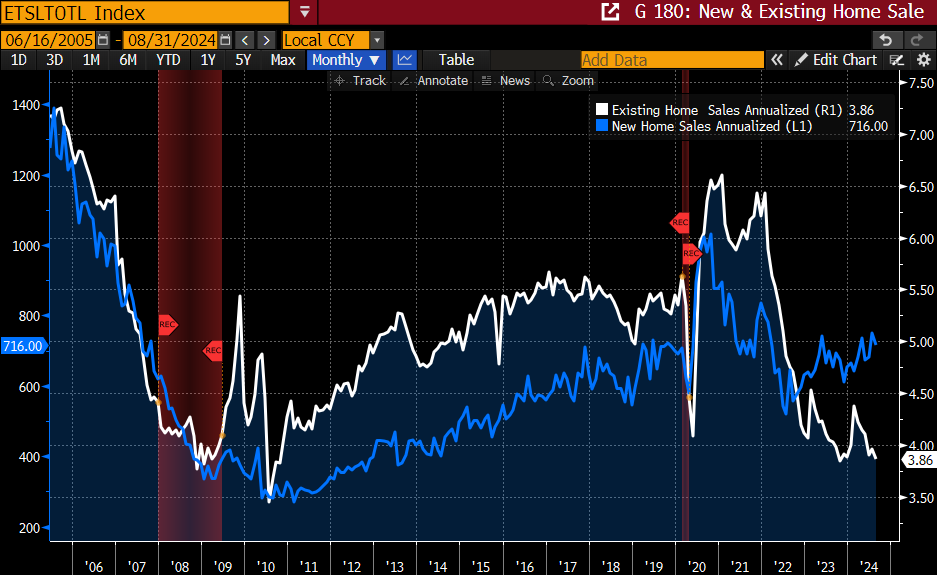

- Existing Home Sales follows on Wednesday and New Home Sales on Thursday. Both are expected to show ever-so-slight improvement from August, but with mortgage rates heading higher, along with Treasury yields, don’t expect much improvement in the residential real estate sector anytime soon (see graph below).

- Also on Thursday, S&P Global will issue its preliminary manufacturing and services PMI readings for October. Manufacturing is expected to remain in the doldrums with a 47.5 print expected vs. 47.3 in September. S&P Global uses the same methodology as the more famous ISM series where 50 is the dividing line between an expanding sector and contracting one. The services-side of the economy is expected to continue to carry the water for the economy with a 55.0 print expected vs. 55.2 in September.

- The preliminary read on Durable Goods Orders for September will finish the week on Friday with lackluster results expected. Overall orders are expected to decrease -1.0% vs unchanged in August. Orders ex transportation are expected to be nearly flat at -0.1% vs. 0.5% in August. The ongoing strike at Boeing is expected to keep the headline number under pressure as the labor issue creates hesitancy for potential buyers. 2024 probably can’t end soon enough for the aerospace company.

- Fed Speak may help keep things from getting too boring, as eight speakers are scheduled to appear during the week, along with the Beige Book on Wednesday. This will be the basis for the economic discussion for the November FOMC meeting so the outlook and business anecdotes will be of interest. Given the strong retail sales numbers last week, it will be interesting to see if businesses reported a similar rebound, or if the slowing noted in the last Beige Book continues.

Leading Economic Indicators (YoY) – Has Been Wrongly Signaling a Recession for a Couple Years Source: Bloomberg

Source: Bloomberg

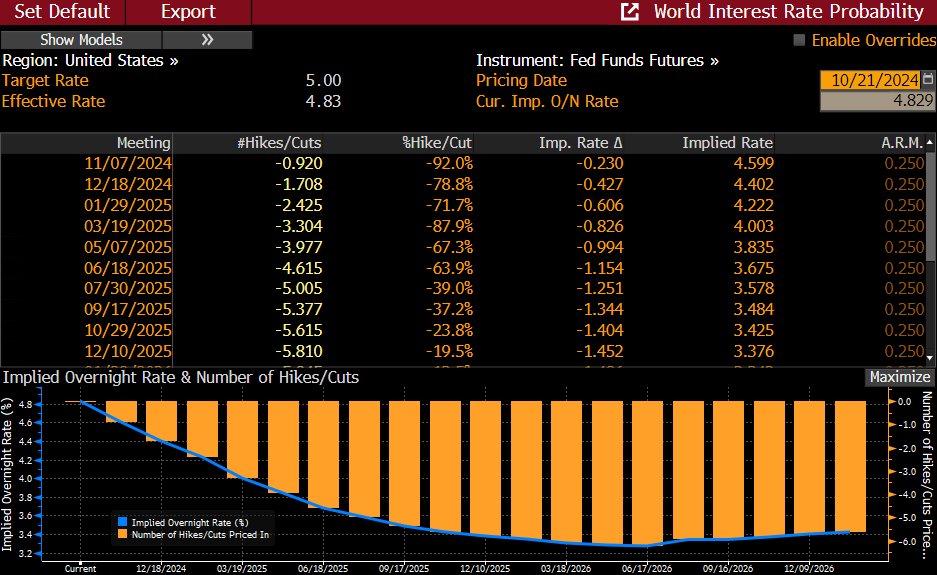

Futures Market Sees 92% Odds of a 25bps Cut in November and 86% Odds of Another in December Source: Bloomberg

Source: Bloomberg

New and Existing Home Sales Expected to Show Little Improvement for September Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.