Treasury Yields Dip on Softening Job Numbers

Treasury Yields Dip on Softening Job Numbers

- Treasury yields are taking a breather from their post-debate climb as some softer economic numbers are increasing odds of a September rate cut (more on that below). Currently, the 10yr note is yielding 4.40%, down 3bp on the day, and the 2yr is yielding 4.73%, down 1bp on the day.

- With the July 4th holiday tomorrow, the economic calendar has been crammed with items we normally see on a Thursday, so there is plenty to chew on before the early close today (2pm ET).

- First, the ADP Employment Change report found 150 thousand new private sector jobs in June vs. 165 thousand expected and 157 thousand in May (revised up from 152 thousand). Service sector jobs increased 136 thousand while only 14 thousand jobs were created in the goods-producing sector. Just another sign of the dominance of the services-side of the economy lately. As far as wage gains, job-stayers saw annual pay increase 4.9% while job-changers saw a 7.7% increase. Those levels are the lowest since 2021, which is another indication of a moderating labor market.

- We won’t mention the lack of correlation between ADP and BLS on job gains lately but just to remind you after ADP reported 152 thousand private sector jobs in May the BLS surprised with 229 thousand private sector jobs. The expectation for Friday’s BLS report on private sector jobs is 160 thousand. So, do with that what you will.

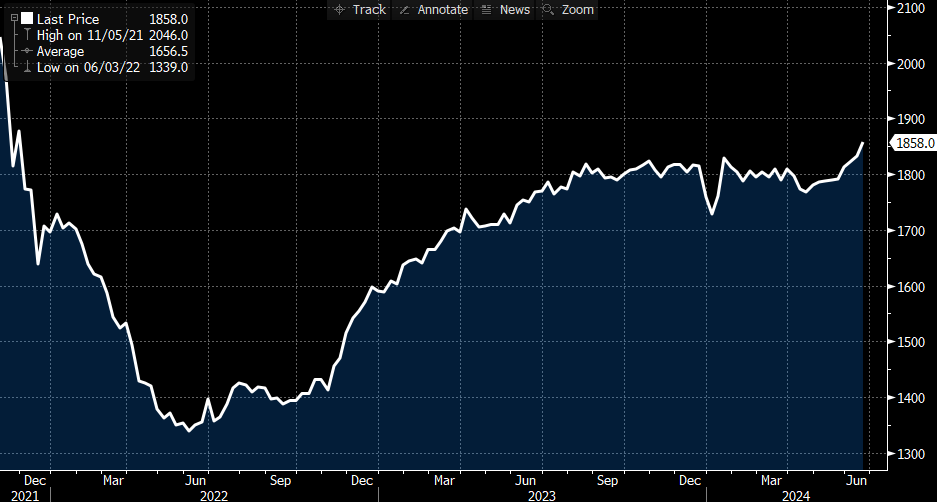

- Initial jobless claims for last week came in at 238 thousand vs. 235 thousand expected and higher than the 234 thousand from the prior week. After ranging in the 200 – 220 thousand area for 2024, every week in June has printed 234 thousand or higher. Moreover, continuing jobless claims rose from 1.832 million to 1.858 million, the highest since November 2021 (see graph below). As these metrics trend higher it’s another signal of a slowly weakening labor market.

- The ISM Services Index for June will be released at 10am ET with expectations for the service sector to tick lower from 53.8 to 52.7. The prices paid index is expected to dip to 56.7 from 58.1, while the employment index is expected to tick higher from 47.1 to 49.5. Finally, new orders are expected to tick lower to 53.6 from 54.1. Recall, the ISM Manufacturing report on Monday disappointed to the downside across all the metrics so the market is alert for another disappointment here. As we know, however, the services-side of the economy has been where the action is so if it does disappoint it will be a rather loud signal that economic weakening is spreading.

- The FOMC minutes from the June 12 meeting will be released at 2pm ET with most of the attention focused on discussions around inflation expectations. Recall, that meeting occurred just as the cool May CPI report was released, but Powell mentioned that most participants didn’t update/change their rate and economic forecasts following that inflation-friendly report. Speaking of Powell, he made some comments yesterday from Portugal that sounded very familiar to our ears regarding inflation. Essentially, he said the latest inflation reports have been encouraging, but more is needed to get the requisite confidence that it’s trending to 2%. The market is taking those comments with a grain of salt as odds of a September cut have been trending up this week. They currently stand at 66%.

Continuing Jobless Claims Climb to 3-Yr High

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.