Treasury Yields Continue to Recalibrate after Strong Jobs Report

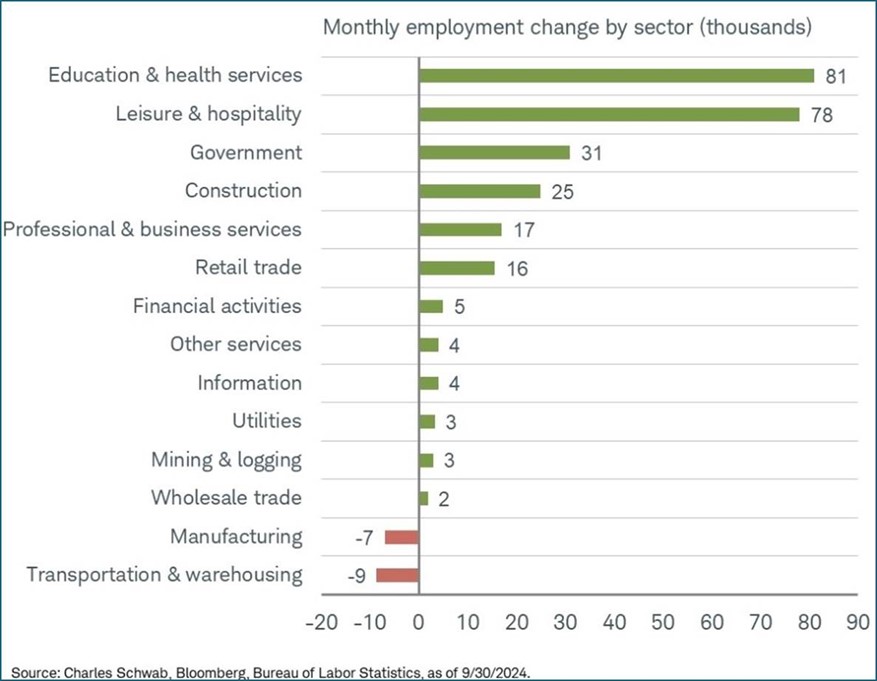

- The recalibration in the fixed income markets continues after Friday’s surprisingly strong jobs report. Futures markets have dialed back thoughts of 50bps rate cuts, and new supply this week will also keep rally attempts on a short leash. Given the magnitude of the yield back-ups, we suspect it will entice enough interest that the auctions should go well as 4-handle yields are once again more commonplace. Currently, the 10yr Treasury is yielding 4.01%, up 4bps on the day, while the 2yr is yielding 3.98%, up 6bps on the day.

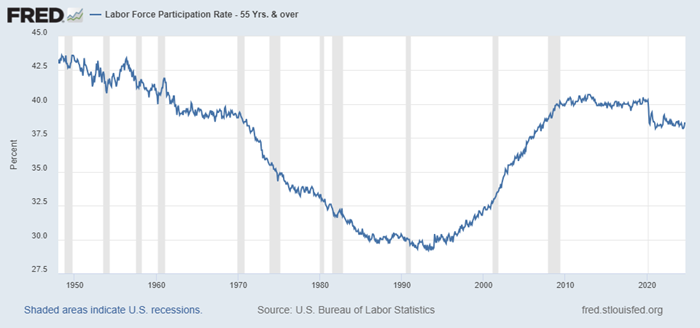

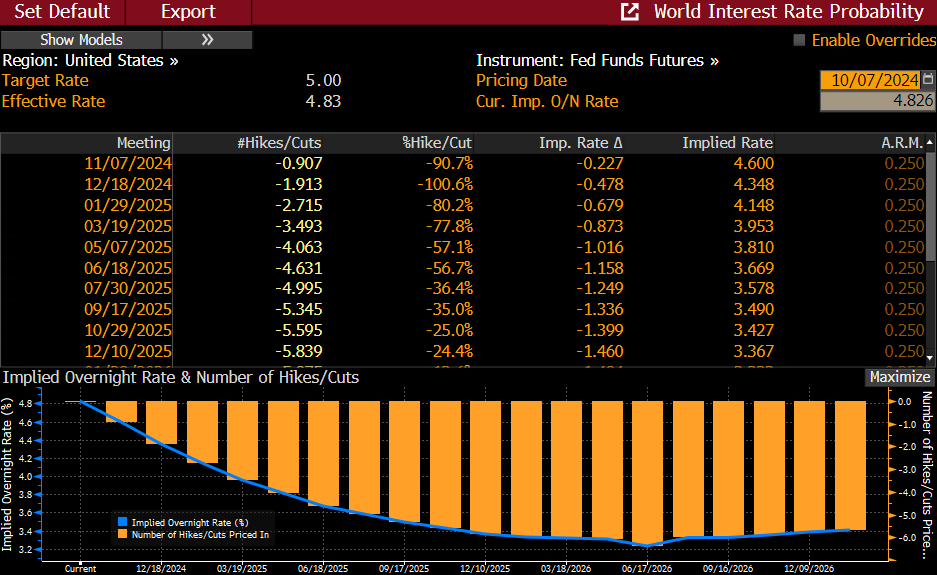

- The strong September employment report has recalibrated expectations for Fed rate cuts. 50bps cuts are no longer part of the conversation, and instead it’s more about will each meeting have a 25bps cut or will there be meetings with no cuts. The updated futures expectations are below, and you see only 48bps of cuts expected by year-end, and for the end of 2025 the funds rate is expected to be 3.36% when it was under 3% prior to the jobs report. That upward revision puts it nearly identical to the Fed’s September forecast. The question now will be does the Fed get more patient given the resilience in the labor market, which was the concern coming out of Jackson Hole.

- In that regard, there will be plenty of Fed speak this week which will give the market more insight into their thinking after the upbeat jobs report. Will the doves be less so and/or will the hawks feel emboldened? Recall, Fed Governor Bowman was the only dissent to the 50bps cut but there were probably a couple more that had their arms twisted to go along. Maybe we’ll hear from them this week.

- Not to be lost in this recalibration is the Fed will see the October jobs report before the November meeting along with September CPI this week and PCE at the end of this month. If the inflation numbers remain docile, the Fed still has open runway to continue with 25bps cuts. If we assume the neutral rate is around 3% policy is still nearly 200bps in restrictive territory. So, rate cuts could continue under the guise of returning to a more neutral policy stance rather than cutting rates into accommodative territory to stimulate the economy.

- Of course, those normalization cuts would have to come under the specter that inflation continues to drift towards the 2% target. Thursday’s September CPI report is expected to be just that with the overall expected up 0.1% MoM and core up 0.2% MoM. Challenging base effects, however, will make progress on the YoY core difficult and it’s expected to remain unchanged at 3.2%.

- This week’s inflation readings: CPI and PPI won’t, however, be the final word. Recall last month core CPI surprised with a 0.3% MoM print vs. 0.2% expected. Core PCE, however, surprised to the downside with a 0.1% print vs. 0.2% expected. PCE weights housing a bit less than CPI and the surprising increase in Owner’s Equivalent Rent (OER) in CPI led to the upside surprise there. Fed Chair Powell in recent comments remains confident that OER will eventually dip into pre-pandemic levels as more current reads on rental rates have been soft and softening for many months. So, no matter what we see in CPI this week, the Fed will wait on PCE on Halloween before assessing a November rate cut.

- Our view is the Fed forecast 100bps in cuts in the September dot plot and would like to get there, if inflation allows. Again, it would be more about normalizing policy rather than cutting to stem a slowing labor market, which doesn’t seem to be the case at present given the latest jobs report.

Futures Market Sees Strong Jobs Report Taking 50bps Cuts Off the Table Source: Bloomberg

Source: Bloomberg

Since September Low Yields, Curve Has Shifted Higher by Approximately 40bps

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.