Treasury Secretary Pick Pleases Markets

- Treasury yields are lower this morning as both equities and bonds are applauding Trump’s Treasury Secretary pick (more on that below). With a holiday-shortened week and no data on Friday, the incoming information will be stuffed into the first three days this week, especially Wednesday. Currently, the 10yr Treasury is yielding 4.30%, down 10bps on the day, while the 2yr is yielding 4.31%, down 7bps from Friday’s close.

- The pick of Scott Bessent as Treasury Secretary is being well received by both equity and fixed income markets. He’s seen as being a steady, levelheaded hand that knows his way around both debt, equity, and currency markets. He could serve as a checks and balances guy that may temper some of the more aggressive Trump tariff proposals while pursing fiscal policy cost-cutting and signaling approval of the 2017 tax cut extensions. He’s been known to promote a 3-3-3 view of policy which is 3% GDP, 3% deficits by 2028 and 3 million extra barrels of oil production. The deficit goal, especially with tax cut extensions, will be the toughest to accomplish. In any event, his selection is a big uncertainty that is removed from things to worry about which has lifted both stocks and bonds in early trading.

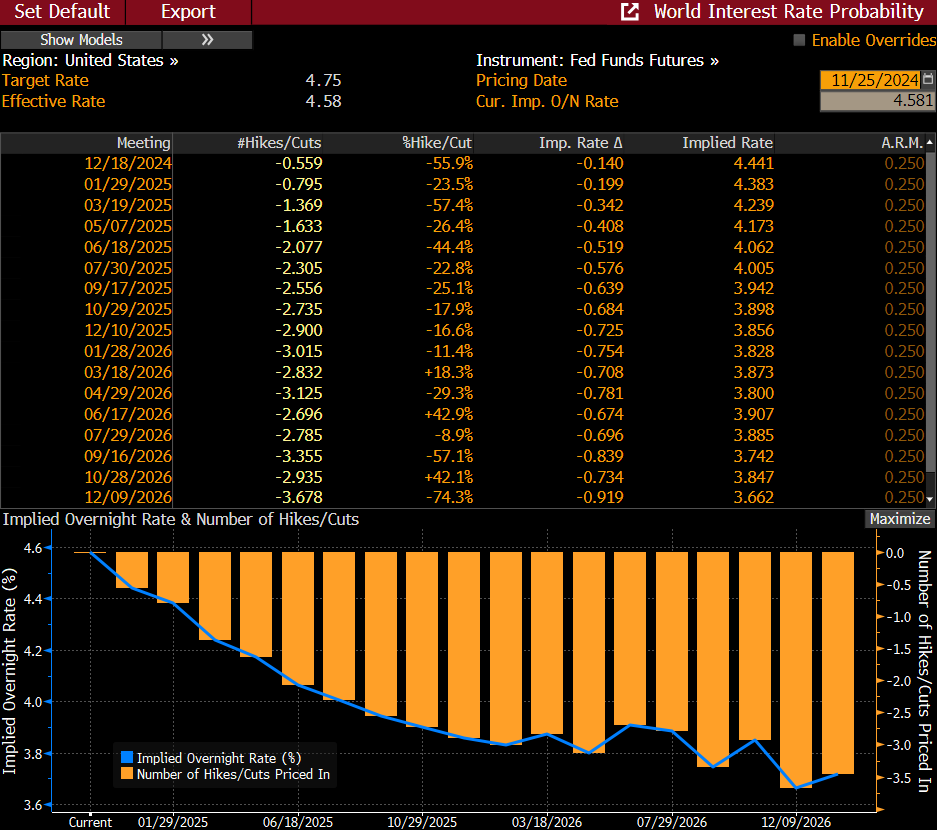

- The holiday-shortened week has plenty of data between now and Wednesday with the headline being the October Personal Income and Spending repot on Wednesday. With CPI/PPI and Import/Export Prices already in hand the estimates for core PCE are coming in at 0.26%, or 0.3% rounded, but a “low” 0.3% which should not rile markets. Powell has already mentioned that inflation is traveling a bumpy path so a 0.3% core PCE wouldn’t necessarily dim odds of a December rate cut but anything above that will call a cut into question.

- The second biggest report for the week will be tomorrow’s Conference Board’s Consumer Confidence reading for November, and with the survey week covering some of the post-election period it will be interesting to see the degree to which confidence readings improved. Expectations are for confidence to improve to 111.8 vs. 108.7.

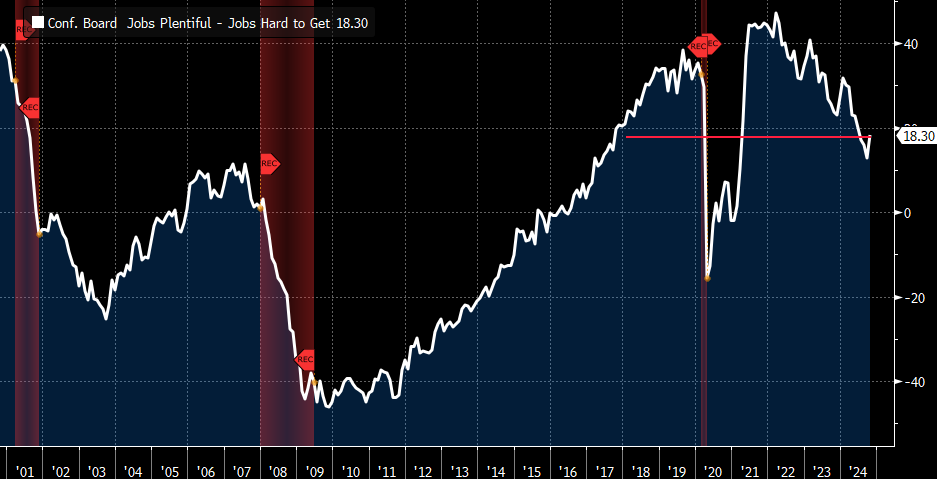

- The other big number from this report will be the Jobs Plentiful less Jobs Hard to Get reading. It’s been trending lower as labor market momentum slows, so it will be interesting to see if that weakening is continuing into November. As Powell mentioned back in August, “the Fed does not welcome nor seek additional labor market cooling.”

- The FOMC minutes from the November meeting will be released tomorrow afternoon and the discussion around the rate cut and perhaps discussions about a possible December rate cut will be pounced on by traders. There are no Fed speakers scheduled for this week so the minutes will have to suffice for official communications.

- With the Thanksgiving holiday, and the quasi-holiday of Black Friday, all the reports that would normally be issued on Thursday and Friday will be stuffed into Wednesday, so expect a flurry of activity early in the trading session as the releases hit the wires.

Odds for a December Rate Cut Down to 56% from 85% on November 1st Source: Bloomberg

Source: Bloomberg

Consumer Confidence Expected to Move Higher after Election Results Source: Bloomberg

Source: Bloomberg

Jobs Plentiful Minus Jobs Hard to Get Indicates Slowing Labor Market Momentum – Will That Continue in Nov.? Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.