Treasury Curve Flatter on Today’s Data

- We’re seeing a bit of curve flattening action this morning as long-end Treasury yields are a touch lower as a solid third quarter GDP print, with friendly inflation numbers, mixes with an October ADP Employment Change report that was hotter-than-expected which is keeping the short-end under pressure. Currently, the 10yr Treasury is yielding 4.23%, down 3bps on the day, while the 2yr is yielding 4.13%, up 3bps on the day.

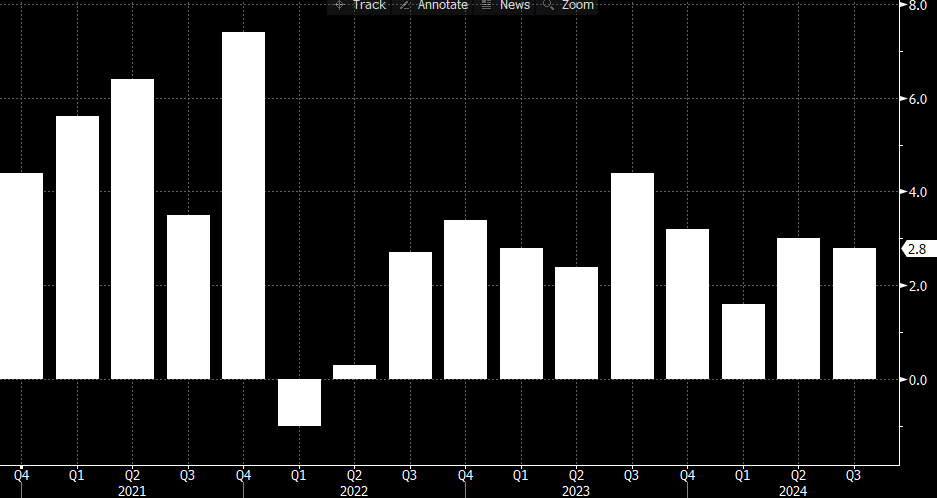

- The data deluge continues this morning with the first estimate of third quarter GDP coming in at 2.8% vs. 2.9% expected and 3.0% in the second quarter. The Atlanta Fed GDPNow model had it nailed with its final estimate matching today’s print. The consumer carried the quarter with consumption increasing 3.7% which is well above the 3.3.% expectation and 2.8% consumption in the second quarter. Surprisingly, the increased spending was driven more by goods purchases rather than services. It’s the largest jump in consumer spending since March 2023 when it soared 4.9%. Stripping out some of the more volatile components like inventory changes, foreign trade, and government spending the Final Sales to Private Domestic Purchasers metric rose 3.2% vs. 2.7% in the second quarter, another indicator that the consumer powered the quarter.

- The price indexes were well behaved too. Overall PCE rose 1.8% on a quarter over quarter basis annualized and that compares to a 1.9% expectation and 2.5% in the second quarter. That’s the lowest print since the fourth quarter last year when it touched 1.5%. The core (ex-food and energy) PCE Price Index increased 2.2% annualized vs. 2.1% expected and 2.8% in the prior quarter. That’s also the lowest since the fourth quarter of 2023 when it bottomed at 2.0%. The docile inflation read should keep an expected 25bps rate cut for next week’s FOMC meeting firmly on the table.

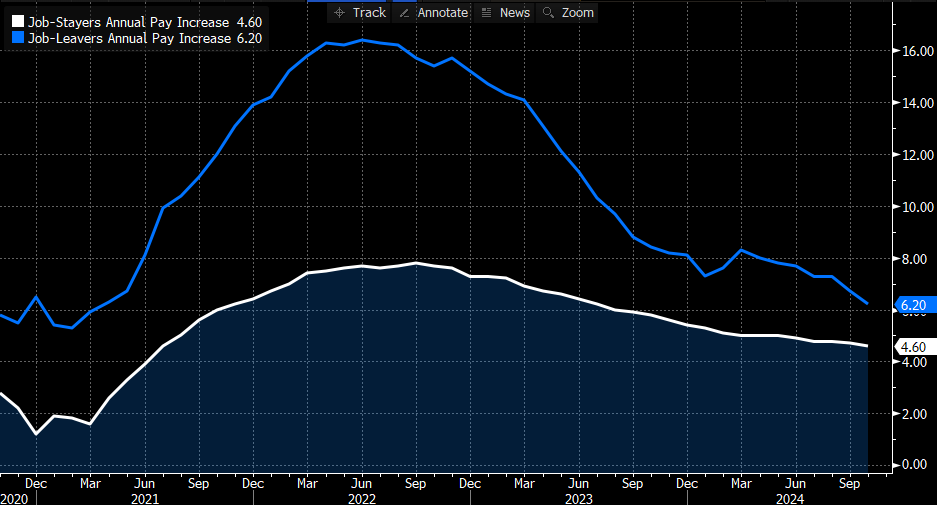

- Meanwhile, the ADP Employment Change Report for October found private sector employment increased 233 thousand vs. 111 thousand expected and 159 thousand in September. The solid beat builds some angst that Friday’s BLS report will repeat September’s strength and keep yields elevated. That report is expected to see private payrolls increase a modest 70 thousand, so quite a bit under the ADP print today. Large employers (500+ employees) and Medium (50-499 employees) drove the gains while small firms (<50 employees) saw a net decrease of 8 thousand jobs. The service sector generated 101 thousand of the total jobs while the goods sector added 42 thousand. Annual pay continues to edge lower with Job-Stayers seeing a 4.7% increase and Job-Changers a bit better at 6.6% but well off the gains from 2022 (see graph below).

- With today’s GDP data it does steal some of the surprise from tomorrow’s Personal Income and Spending report for September as those numbers are part of the quarterly GDP totals. Expect spending to be strong (0.4% expected vs. 0.2% in August) with core PCE increasing 0.3% MoM and 2.6% YoY.

- Finally, initial jobless claims tomorrow is expected to remain tame with 230 thousand new claims vs. 227 thousand the prior week. Perhaps more attention will be paid to the continuing claims series which has been edging higher for a month now. That’s an indication of the no hiring/no firing nature of the job market at present.

Third Quarter GDP Grew at 2.8% – Driven by Strong Consumer Spending Source: Bloomberg

Source: Bloomberg

ADP Employment Report – Job Leavers Seeing Annual Pay Increases Continue to Moderate Source: Bloomberg

Source: Bloomberg

Continuing Jobless Claims – Climbing for the Past Month Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.