Treasuries Trading Heavy as New Supply Looms

Treasuries Trading Heavy as New Supply Looms

- Treasuries open the holiday-shortened week on the back step as additional coupon supply will be auctioned today, tomorrow, and Wednesday and that should keep any rally attempts on a short leash. Presently, the 10yr Treasury is yielding 4.24%, down 10/32nds in price while the 2yr note is yielding 4.63%, down 2/32nds in price.

- With the bond market closed for Good Friday the holiday-shortened week offers a smattering of new economic releases along with Treasury supply. The headline report will be February’s PCE inflation numbers, not to mention the income and spending totals. Given they will be released on Friday, however, delays any market impact to next Monday.

- Core PCE YoY is currently at 2.8% (2.849% unrounded), not far from the Fed’s updated forecast of 2.6% by year-end. With CPI and PPI in hand, the forecast is for core PCE to print at 0.3% with the YoY rate unchanged at 2.8%. Looking ahead at base effects, the next three months will see 0.3% prints rolling off then the monthly rates from last year drop into the 0.1% to 0.2% range. That means it will be tough to move the needle on the YoY pace if we keep printing 0.3% monthly rates.

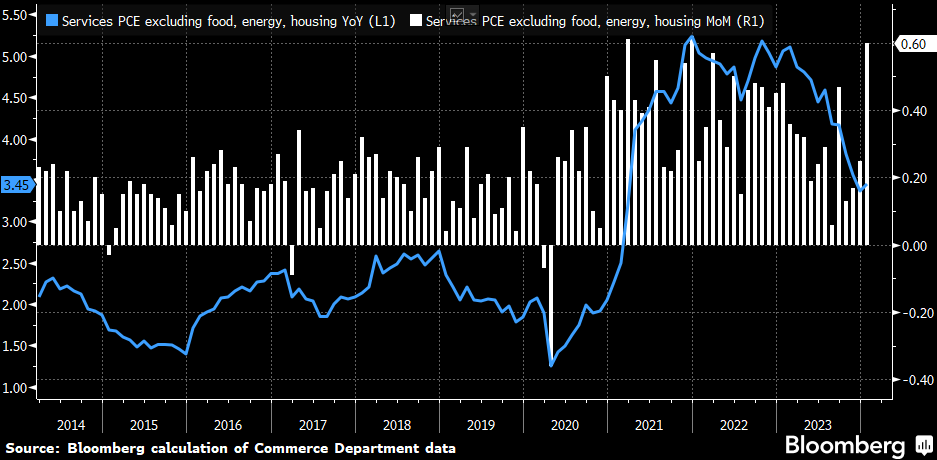

- Forecasting three rate cuts in 2024, albeit by a slim one-dot margin, implies a view that the hot prints of January and February are likely to ebb in the coming months. The question is does the sticky service-side inflation ex-housing start to ease? It was 0.6% in January, the highest pace since December 2021, and certainly a big contributor to that month’s 0.4% increase in core PCE. Given the Fed’s updated forecast, both on inflation and the three rate cuts, and Powell’s FOMC press conference comments where he did mention the seasonal volatility with January, it seems he, and the committee, are expecting those steamy January prints to ease. We shall see.

- In addition to the PCE numbers, the market will digest more coupon supply starting today with $66 billion in 2yr notes, followed by $67 billion in 5yr notes tomorrow and $43 billion in 7yr notes on Wednesday. That supply may keep Treasuries trading heavy until the new debt is put away.

- This morning, we received new home sales for February and after last week’s surprising beat on existing home sales it’s surprising that new home sales disappointed with sales decreasing slightly -0.3% to 662 thousand annualized vs. 677 thousand expected and 664 thousand in January. Perhaps the miss is not that surprising given new home sales are based on signed contracts (not closings), and mortgage rates increased to a high of 7.4% during the month but have since moved slightly lower. Despite the slight miss today, with the spring selling season commencing, it wouldn’t surprise us to see annualized activity rebound above 700 thousand, putting it near the highs from last year (728 thousand in July 2023).

- Finally, the University of Michigan’s final look at consumer confidence will be released on Thursday with inflation expectations garnering most of the attention. The 1yr inflation outlook is expected to remain unchanged at 3.0%, while the 5-10yr outlook is also expected to be unchanged at 2.9%. The Fed is big on keeping inflation expectations “well anchored” so unchanged to lower readings will be what the Fed is looking for.

Core Services Ex-Housing – Looking to Improve on January’s Hot 0.6% Print

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.