Treasuries Trade Well with New Supply and CPI Looming

Treasuries Trade Well into Looming Supply and CPI

- Treasuries continue to trade well this week after a tough start to the year last week, and that positive tone comes even with new supply on tap and a CPI report looming tomorrow. Presently, the 10yr Treasury is yielding 3.99%, up 7/32nds in price and the 2yr Treasury is yielding 4.33%, up 2/32nd on the day.

- The data calendar is light today with the focus continuing to be the December CPI numbers tomorrow. So, Treasury supply takes centerstage today as the Treasury auctions $37 billion of the current 10yr note. The 3yr auction yesterday was bid well with a stop through of 1.4bp even with a yield matching the lowest level since June 2023.

- Last year, 10yr auctions stopped through only two times (January and February) and given the friendly reception to the 3yr note there is a decent feel that the 10yr will also go well with the yield hovering around the 4% level. It’s somewhat surprising that we’re trading well into the auction, and with CPI looming tomorrow, but it does speak to the solid tone that is prevailing after last week’s selling.

- Speaking of CPI , it’s expected to be something of a status quo month with overall inflation forecast to increase 0.2% MoM vs. 0.1% in November and with the YoY ticking up to 3.2% vs. 3.1% in November. Core CPI is expected to increase 0.3%, matching the November increase, but the YoY pace is expected dip two-tenths from 4.0% to 3.8%. As we mentioned on Monday, for the next six months the MoM numbers rolling off the YoY calculations are 0.4%, or higher, so as long as we’re seeing something less in the new prints the YoY pace should continue moving lower through the first half of this year, perhaps flirting with a 2-handle. After June, the base effects become more challenging which could bring back the stickiness topic again.

- Combined with the more challenging base effects on CPI hitting around mid-year, the disinflationary trend of PPI is expected to slow which will limit the pass-through of lower prices to retail sellers and the potential for price cuts there. Thus, we suspect that the market’s expectation of nearly 150bps in rate cuts this year could go by the board as the Fed sees the final mile from 3% to 2% more challenging in the second half of 2024. If that looks to become reality the short end could come under pressure as the aggressive rate cut projections are dialed back.

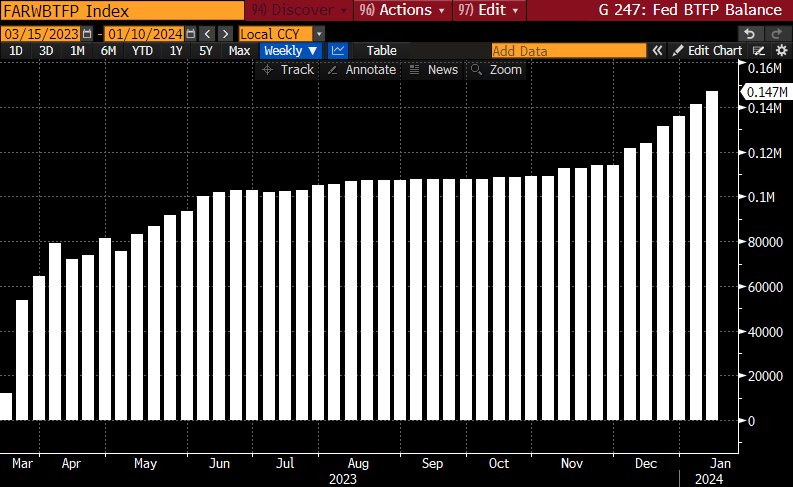

- Finally, it’s becoming more likely the Fed will let the Silicon Valley-era emergency lending program (Bank Term Funding Program) expire on March 11 as it has become a source of arbitrage funding (lower rate vs. other Fed alternatives), and the more dire liquidity scenarios coming out of the March 2023 crisis never materialized. Balances have climbed lately as more bankers became aware of the arbitrage opportunity (see graph below). If you have tapped the liquidity provided by the program now is a good time to talk with your SouthState rep about our brokered CD program and the liquidity that can be provided from that source in 2024.

Fed’s Bank Term Funding Program Balances – Program Expected to Expire in March

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.