Treasuries Trade Weaker as Supply and More Inflation News Awaits

Treasuries Trade Weaker as Supply and More Inflation News Awaits

- Treasuries are trading weaker today as $22 billion waits to be auctioned this afternoon. After yesterday’s so-so 10yr auction discretion appears to be the better part of valor today. Also, tomorrow and Friday offer more inflation news with PPI tomorrow and Import/Export prices on Friday. Expectations are for bond-friendly numbers, but traders may be holding back until the event risks pass. Presently, the 10yr Treasury is yielding 4.18%, down 7/32nds in price while the 2yr Treasury is yielding 4.61%, down 1/32nd in price.

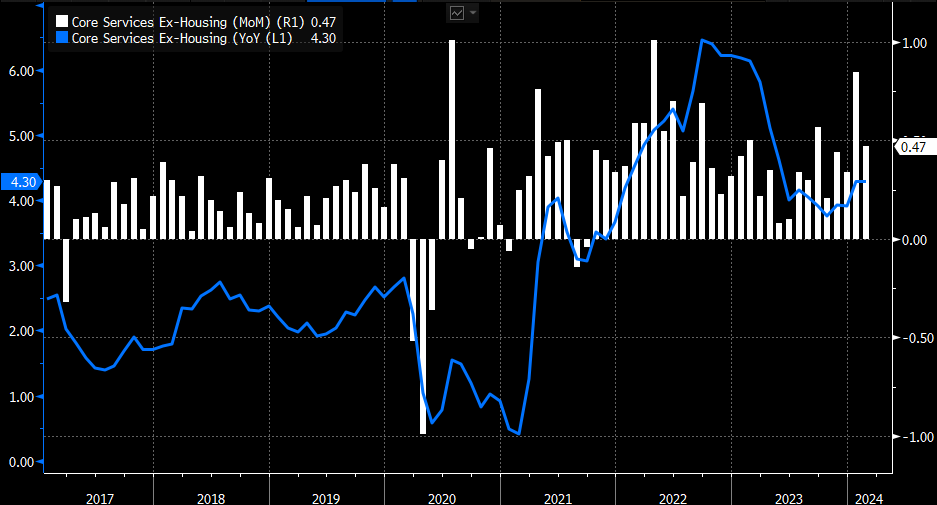

- Some thoughts on CPI. While the monthly gains were above expectations, the trend towards lower YoY rates continued for the core as unrounded the gain was 0.358%, so call it a skinny 0.4% when rounded. Also, Owners Equivalent Rent declined to 0.4% from 0.6%, and with the largest single weighting in the CPI basket at 26% it obviously influences the direction of inflation. Food costs moderated too with food at home unchanged while food away from home rose just 0.1%, well off the 0.5% January print. The beat on core came mostly from healthy airfare increases and apparel. Also, the key core services ex-housing number improved from 0.85% to 0.47% but that’s still above the 0.2% to 0.3% that the Fed would like to see. This is the “sticky’ part of inflation right now.

- In addition, the reduction in food inflation isn’t part of the core number (remember ex-food and energy), but it is included in core PCE. Also, the airfare category is not in core PCE, so the impact of both is to imply the potential for a decent PCE inflation number at month-end.

- Speaking of PCE, tomorrow we receive February PPI numbers. Expectations are for final demand to be up 0.3% matching the January gain, while core PPI is expected to increase 0.2% vs. 0.5%. Final Demand PPI YoY is expected to increase slightly from 0.9% to 1.2% while core PPI YoY is expected to be up 1.9% vs. 2.0% in January. Recall, some of the PCE data is pulled from PPI so it will give us another indication of what to expect from the Fed’s preferred inflation gauge.

- Away from inflation news, tomorrow also brings February retail sales. Expectations are that February had a nice pick-up in spending after soft weather-impaired January numbers. Overall sales are expected up 0.8% vs -0.8% in January while sales ex auto and gas are expected up 0.3% vs. -0.5% in January. The control group category (GDP data) is expected to reverse the January dip 0.4% vs. -0.4%. So, with better weather, the consumer is expected to have returned to their spending ways in February. The spending and inflation numbers so far seem to imply a Fed continuing to maintain existing policy until more improvement in inflation and signs of a slowing labor market definitively appear.

Core Services Ex-Housing: Improved From January But Still Too High

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.