Treasuries Recoup Some of Yesterday’s Losses

Treasuries Recoup Some of Yesterday’s Losses

- Much of the increase in yields following yesterday’s disappointing 30yr auction is being reversed this morning as traders reassess and perhaps breathe a sigh of relief that at least the new supply has been put away, albeit with some difficulty. 30yr auctions have typically struggled and the earlier 3yr and 10yr auctions didn’t earn high marks so there was some expectation the 30yr would follow suit, and it did, but with the second largest tail since 2011. In any event, you might find it interesting that despite all the volatility the 30yr yield, currently at 4.72%, is below the 4.76% opening level on Monday.

- Also contributing to the heavy trade yesterday was Fed Chair Powell’s comments that were taken as overly hawkish, although they varied little from the post-FOMC press conference. But with phrases like “we have little confidence we’re restrictive enough to return inflation to 2%” sprinkled into yesterday’s comments it added to the pressure in Treasuries that were already reeling from the poor 30yr auction.

- Looking at the Fed speak for the week it was consistent in expressing little confidence that the job against inflation was done. Also, we think there was a fair amount of jawboning going on with the Fed speak. Part of the rationale for pausing at last week’s meeting was the tighter financial conditions brought on by higher yields. So, the subsequent rally after the meeting, and again after the soft jobs report, could be interpreted as loosening some of the recent tightening. So, enter the Fed and the hawkish commentary that we heard that contributed to yields backing up.

- The preliminary University of Michigan Sentiment Survey for November was released this morning and it provided another disappointing read on inflation expectations. The 1yr inflation expectation rose again from 4.2% to 4.4%, exceeding the 4.0% expectation. It’s the highest inflation read since April. Meanwhile, the 5-10yr inflation expectation rose from 3.0% to 3.2%, exceeding the 3.0% expectation. That’s the highest read since March 2011 which was also at 3.2%. Suffice it to say this is not what the Fed wants in their quest to keep inflation expectations “well anchored” lest those higher expectations become self-fulfilling. The bump in expectations is somewhat surprising as this survey aligns pretty well with the price of gas, and with prices falling in October a softer inflation expectation was the consensus heading into the report. If these expectations hold, or go even higher in the coming months, it will play into the higher-for-longer theme and could even prompt calls for additional rate hikes.

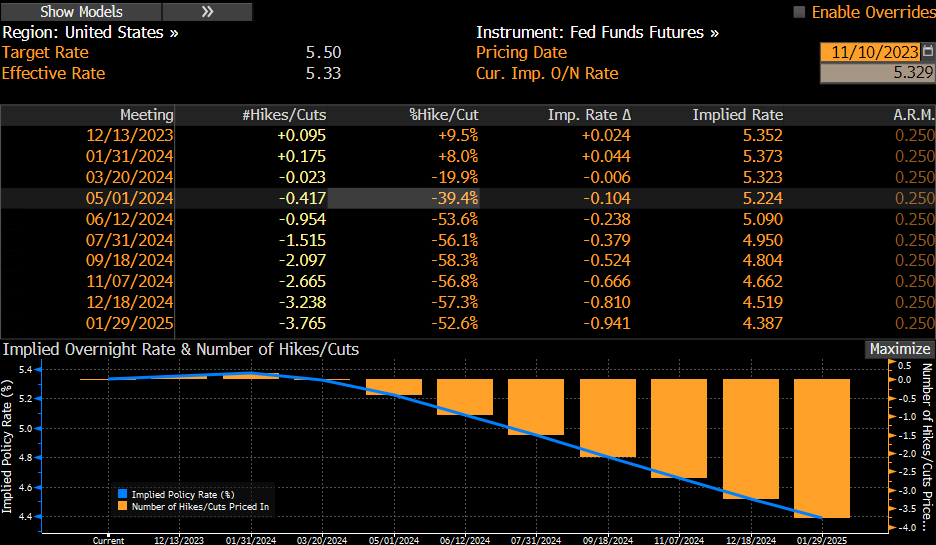

- One thing that was clear from this week’s Fed speak is that inflation remains the number one focus with little concern so far about the impact of higher rates on the slowing labor market. That heightens the attention to next Tuesday’s October CPI numbers. The overall is expected to be up 0.1% vs. 0.4% in September as some of the decrease in energy costs gets reflected in the results. Given a steamy 0.5% MoM figure from last year rolling off the YoY pace is expected to dip from 3.7% to 3.3%. The core rate, however, is expected to increase 0.3% for the third straight month with the YoY pace unchanged at 4.1%. So, the recent “stickiness” in core services inflation looks to continue in October which will play with the higher-for-longer crowd, and if it surprises to the upside odds of a December rate hike will increase from the current 10% (see table below).

- Meanwhile, retail sales for October, due next Wednesday, are expected to be soft with overall sales down -0.3% vs. 0.7% in September while sales ex autos and gas are expected to be up 0.2% vs. 0.6% the prior month. So, the consumer looks to have taken a breather in October after finishing the third quarter in a strong spending mood. The question for the market and the Fed will be if the expected softening in October spending is a one-off or the start of a trend where the consumer turns cautious?

Fed Funds Futures – December Hiking Odds at 10%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.