Treasuries Rally on Friendlier Inflation and Slowing Retail Sales

Treasuries Rally on Friendlier Inflation and Slowing Retail Sales

- Treasuries are rallying on a better inflation report for April – not great but better than the first quarter- and retail sales that disappointed and adds to other recent reports that point to some slowing in both jobs and consumption (more on both below). Rate-cutting odds are still sitting around the November FOMC meeting with increasing odds of a second cut at the December meeting. Currently, the 10yr note is yielding 4.37%, up 18/32nds in price, and the 2yr is yielding 4.75%, up 4/32nds in price. Both are at the lowest yield in six weeks.

- For the first time this year we have an inflation report that can’t be characterized as disappointingly hot. Core CPI increased 0.3% (0.292% unrounded vs. 0.4% (0.359% unrounded) in March. In fact, the first quarter printed 0.4% core in each month so slipping back to 0.3%, even if we were aided by rounding down instead of up this month is something of a small victory. The YoY pace dipped to 3.6% vs. 3.8% in March, matching expectations. It is the lowest YoY core rate in three years.

- Meanwhile, the overall CPI rate followed suit increasing 0.3%, coming in under the 0.4% expectation and halting, at least for a month, the 0.4% trend in 2024. The YoY pace dipped to 3.4% from 3.5%, matching expectations. Gas price increases and shelter expense accounted for 70% of the overall index’s gain. Motor vehicle insurance was another problem rising 1.8% in April but that’s improved from the 2.6% gain in March.

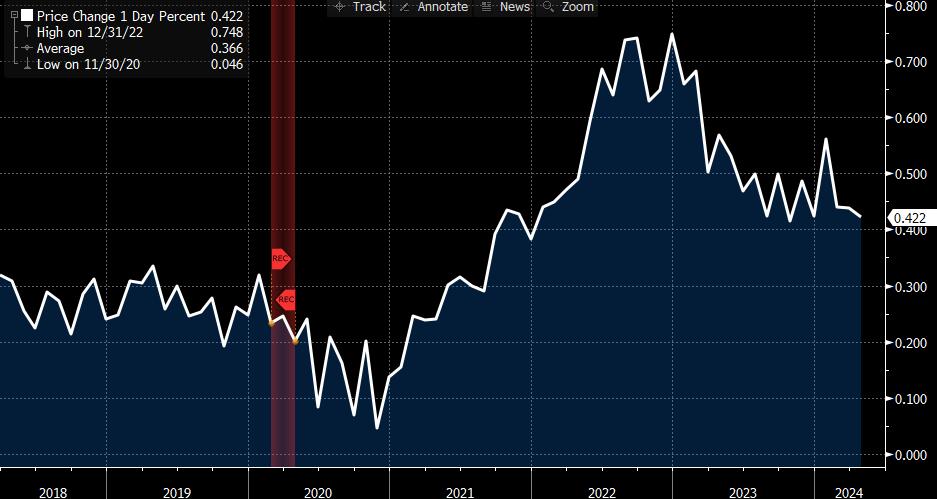

- Two key metrics in the report were only so-so but at least didn’t build on increases in the first quarter. The all-important Owner’s Equivalent Rent component rose 0.4% for a third straight month and is up 5.8% YoY. With a CPI weighting of 27% it’s going to be hard to see significant improvement in inflation without further improvement in OER. It was averaging 0.2% – 0.3% MoM pre-pandemic but the post-covid world has been tough. First it was double-digit yearly home price appreciation rates coming out of lockdowns, and prior to Fed rate hikes, that helped elevate OER. Now, it’s a lack of inventory due to higher mortgage rates (from the Fed rate hikes) that is keeping the rate above pre-pandemic levels.

- Another interesting observation from this report, food at home declined -0.2% while food away from home (think restaurants) rose 0.3%. On an annual basis it’s 2.2% at home vs. 4.1% away. Seems it’s time to push-back on the inexorable price increases at our favorite eateries. Just saying.

- The other key metric is the core services ex-housing and that did improve to a 0.42% increase vs. 0.65% in March and the lowest print this year while the annual rate is at 4.91%. While there was improvement in April the price gains are still above the pre-pandemic range of 0.2% – 0.4%. So, again a friendlier read in April vs. the first quarter but getting down to the Fed’s 2% target is going to be a challenge. We’ve mentioned that before, but it still stands given the limited improvement in these heavily weighted metrics.

- Away from inflation, April Retail Sales were released this morning, and it was a disappointing month for the consumer. Recall, last month surprised to the upside and that strength was also evident in the broader Personal Income and Spending Report. For April, sales were flat vs an expected 0.4% increase and 0.6% in March while sales ex-autos and gas declined -0.1% vs. 0.2% expected and 0.7% in March (revised lower from 1.0%). The Control Group, which is a direct GDP feed, fell -0.3% vs. 0.1% expected and 1.0% the prior month.

- The soft retail sales reading joins a growing list of other reports that are picking up hints of slowing. We’ve had the April jobs report, ISMs, and JOLTs all point to some slowing, albeit slight at this point. The disappointing performance by consumers adds to the case that second quarter growth will likely struggle to match the pedestrian first quarter results. We will note, however, that retail sales are more heavily weighted towards goods vs. services and that is where the spending action has been focused of late. The more comprehensive spending numbers will come on May 31st when April’s Personal Income and Spending figures are released. We’ll reserve judgment on the consumer and whether they are tightening purse strings when that report is released.

Owners Equivalent Rent (MoM) – Improving But Still Above Pre-Pandemic Levels

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.