Treasuries Rally on Cool PPI Report as March Rate Cut Odds Increase

Treasuries Rally on Cool PPI Report as March Rate Cut Odds Increase

- A cool PPI report has Treasuries rallying, especially on the short end, as March rate cut odds got a boost from the inflation numbers (more on that below). With the Fed’s preferred inflation series, PCE, not coming until Jan. 26, PPI provides a clue as many of the numbers flow into the PCE series; thus, traders are anticipating a Fed-friendly report. Presently, the 10yr Treasury is yielding 3.93%, up 9/32nds in price and the 2yr Treasury is yielding 4.13%, up 7/32nd on the day. The 2yr yield is the lowest since last May.

- A US-led coalition launched strikes on Houthi rebel targets in Yemen overnight to staunch their attacks on vessels transiting the Red Sea. That has oil trading higher as a first consequence ($74.39/bbl +$2.39), but there is also the geo-political headline risk that may follow from promised countermoves by the Houthi’s. That could generate flight-to-safety trades, particularly as the long weekend looms. Longer-term is the potential inflationary effects if higher oil, and shipping costs continue to lift. It’s something to ponder as we digest CPI/PPI data and the potential odds of March rate cuts.

- Despite the slightly hotter-than-expected CPI report, the short-end, after a knee jerk move higher in yield, reversed course through the balance of the day as the theme that the report wasn’t bad enough to derail a March rate cut gathered steam, and so the 2yr Treasury ended the day 11bps lower at 4.25%.

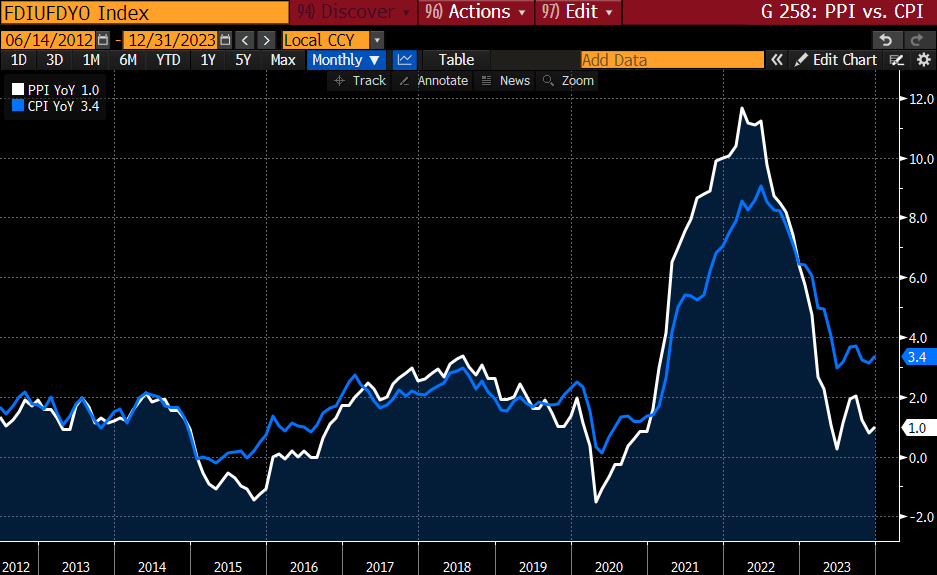

- While December CPI may have come in on the hotter side, December PPI came in cooler than expected and that is increasing odds for a March rate cut which currently stands at 85%. Overall PPI was down -0.1% vs. 0.1% expected and November was revised lower from unchanged to -0.1%. The YoY pace ticked up from 0.8% to 1.0% but was better than the 1.3% expected. PPI ex-food and energy was unchanged matching November but was better than the 0.2% expected increase. The YoY pace dipped from 2.0% to 1.8%. That’s the lowest YoY rate in three years.

- The cooler PPI numbers bode well for the PCE series coming at month end as many of the measures in that series are lifted from PPI. That explains the reaction in the fed funds futures market, as well as short maturity Treasury prices, as investors anticipate a more friendly read on the Fed’s preferred inflation gauge. And looking across the data landscape, there’s not much in the way of first-tier reports between now and month-end that have the potential to derail the current trading dynamic until we get those PCE inflation numbers on Jan. 26.

- The market’s reaction to the inflation data this week has come despite the Fed’s attempts to push back against it. New York Fed President John Williams spoke earlier this week and downplayed both an early cut to the QT program and possible March rate cuts. Cleveland Fed President Loretta Mester spoke yesterday on Bloomberg TV and said that “March is probably too early in my estimate for a rate decline because I think we need to see some more evidence.” To be fair, before the March meeting there will be two more monthly inflation reports and employment reports so the Fed will get their “more evidence.”

PPI vs. CPI – PPI Has Been Leading CPI Lower Since Early 2022 With CPI Having More Room to Fall

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.