Treasuries Rally Ahead of Powell’s Congressional Testimony

Treasuries Rally Ahead of Powell’s Congressional Testimony

- With Fed Chair Powell set to testify on Capitol Hill over the next two days, investors are hoping to gain additional color around the Fed’s reaction function towards rate cuts. Alas, Powell’s opening remarks offered little change from the patient pause approach, but his comment that rate cuts are likely this year is providing an early bid to Treasuries (more on those below). Presently, the 10yr Treasury is yielding 4.11%, up 10/32nds in price while the 2yr Treasury is yielding 4.53%, up 2/32nd in price.

- As mentioned, Fed Chair Powell is scheduled to testify before the House Financial Services Committee at 10am ET this morning and follow that up tomorrow in front of the Senate Banking Committee. His opening statement was just released and didn’t offer any real change from what we’ve been hearing from most recent Fed speak. The money quote in what is a short opening is, “the Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” Although he did offer that rate cuts are likely at some point this year. While there isn’t any expectation of policy changes, today’s testimony will still be a focus for the markets. The full text of Powell’s opening remarks can be found here.

- ADP released their estimate of private sector job gains in February and it came in at 140 thousand vs. 150 thousand expected and 111 thousand in January. Goods-producing jobs totaled 30 thousand and service-side jobs totaled 110 thousand. Again. that disparity reflects the greater strength in the services-side of the economy vs. the goods-side, and that plays into core services price pressure that remains the sticky part of inflation right now.

- Recall that ADP’s January report had just 111 thousand jobs (originally reported as 107 thousand), then the BLS reported a 317 thousand increase in private sector jobs. Quite the disparity, and the fact ADP adjusted their January total only slightly does beg the question whether the BLS strength was legitimate or more a factor of tricky seasonal adjustments. Before waving off ADP, keep in mind it uses a much larger survey pooi with nearly 10 million companies which dwarfs the survey sample used by the BLS. How it all plays out is still a key questions, but it does add some additional intrigue for Friday’s BLS numbers. Stay tuned.

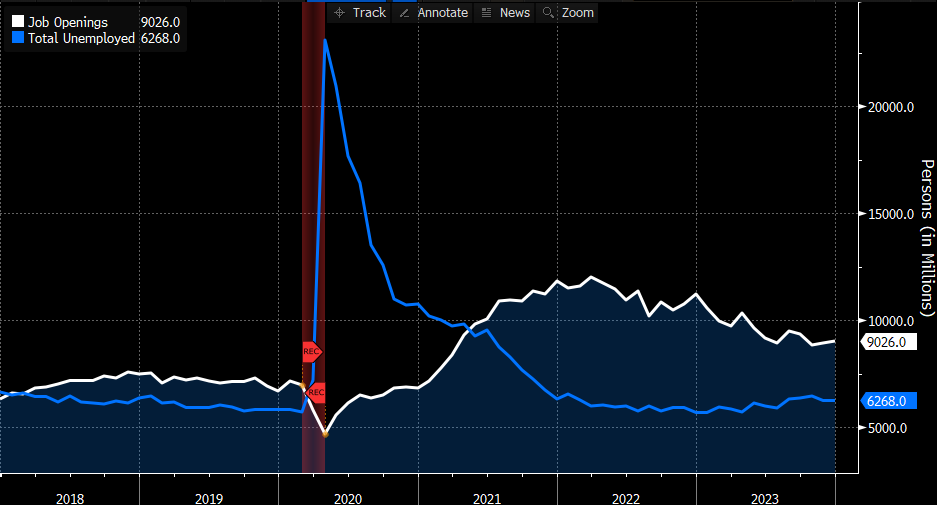

- At 10am ET, the JOLTS Job Openings Survey will be released with 8.850 million January job openings expected vs. 9.026 million in December. The January expectation would challenge the 8.852 million openings in October which was the lowest since April 2021. It peaked at 12 million in March 2022. The number is often cited by Fed officials as a measure of labor market tightness given that there are just over 6 million unemployed, so they want to see the openings continue to drift lower.

- We mentioned on Monday that this week would go a long way in confirming or disputing the strength in January. So far, the two ISM surveys, both manufacturing and services, surprised to the downside and while those misses were not major the prices paid and employment components were weaker than expected which does imply some softening in the economy in February. With the BLS on Friday and CPI on Tuesday we’ll have a more complete picture of February’s labor market and inflation position by this time next week.

Job Openings – Trending Lower But Still Above Pre-Pandemic Levels

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.