Treasuries Open in the Red as Investors Reconsider Last Week’s Rally

Treasuries Open in the Red as Investors Reconsider Last Week’s Rally

- Treasuries are under some pressure as the week opens as investors take some gains after last week’s run, and as this week’s economic releases are expected to show no dramatic slowing in the economy. Presently, the 10yr Treasury is yielding 4.26%, down 16/32nds in price and the 2yr Treasury is yielding 4.62%, down 5/32nds in price.

- The first full week of the month always has a ton of new economic information and this one is no different. The marquee event will be the November jobs numbers on Friday but there will be plenty for investors to chew on before then.

- The numbers really start rolling in tomorrow with ISM Services for November and JOLTS Job Openings for October. The services index is expected to improve slightly from 51.8 to 52.3, with the prices paid and employment sub-indices getting some attention for both the labor market and inflation impact. The JOLTS Job Openings are expected to ease again to 9.300 million vs. 9.553 million in September. The Fed has referenced this report often in the last year as an indicator of labor market tightness. Openings peaked at 12.000 million in March 2022 and have drifted lower, but it did tick up in September, so a continued softening is what the market, and the Fed, are expecting as labor market tightness is assumed to continue easing in the months ahead.

- The weekly jobless claims numbers will garner some added attention as last week’s continuing claims figure jumped to the highest level since late 2021 as those newly unemployed are apparently finding it tougher to secure new employment as employers, while not aggressively cutting positions, appear to be reluctant to hire at the previous pace which is another indication of easing tightness in the labor market.

- Friday brings the November jobs report and all that that implies about the Fed’s future stance on monetary policy. Expectations are for a slight improvement from October’s read with 180 thousand new jobs vs. 150 thousand in October as private sector jobs rebound from 99 thousand to 158 thousand as previously striking workers return to their jobs. The unemployment rate is expected to remain at 3.9% while average hourly earnings tick up to 0.3% MoM vs. 0.2% in October with the YoY rate dipping to 4.0% vs. 4.1% the prior month. That would be lowest YoY rate since June 2021. In summary, if the report comes as expected it will represent a steady-as-she-goes labor market with some improvement from the strike-affected October numbers, and certainly no dramatic softening which plays well with the higher-for-longer theme.

- Finally, the University of Michigan Sentiment Survey is due on Friday and after the jump last month in inflation expectations, the new report will get some attention to see if that was a one-off, or a trend in higher expectations. Last month, the 1yr inflation expectation was 4.5% while the 5-10yr expectation was 3.2%. Those figures fly in the face of the recent trends in CPI and PCE, but it does seem to reflect the public’s view that the price hikes of recent years may be slowing but certainly not receding and that no doubt has contributed to their expressed sour views on the economy.

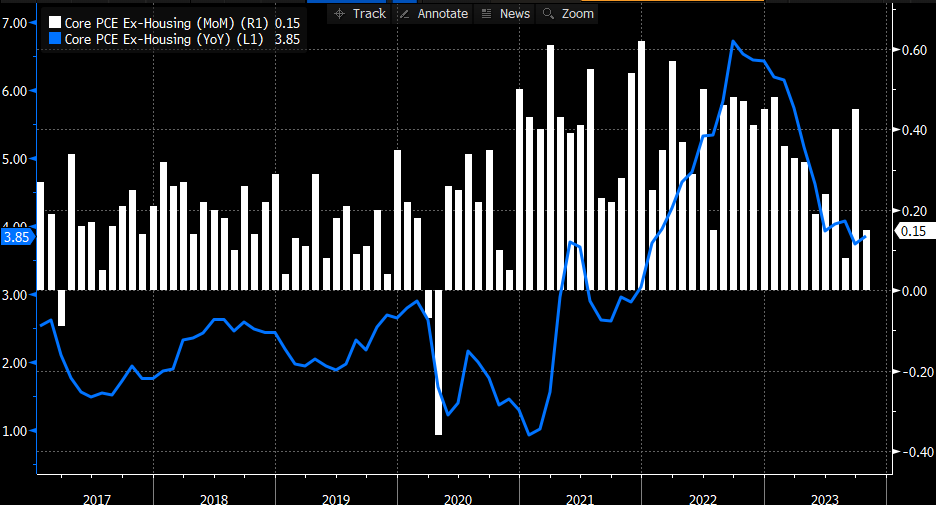

Core Services Ex-Housing PCE Slowed in October – But Still Remains Elevated Hinting that Higher for Longer Will Remain a Theme

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.