Trade Deal with Japan has Markets in Risk-on Mood

- The week of light data rolls on but at least we have trade deals to talk about. The announced deal between Japan and the US on tariffs has markets in a risk-on mood and that has Treasuries on the back foot, but after a five-day rally in 10yr notes a little breather can be expected. Currently, the 10yr Treasury is yielding 4.37%, up 3bps on the day, while the 2yr note yields 3.82%, up 2bps in early trading.

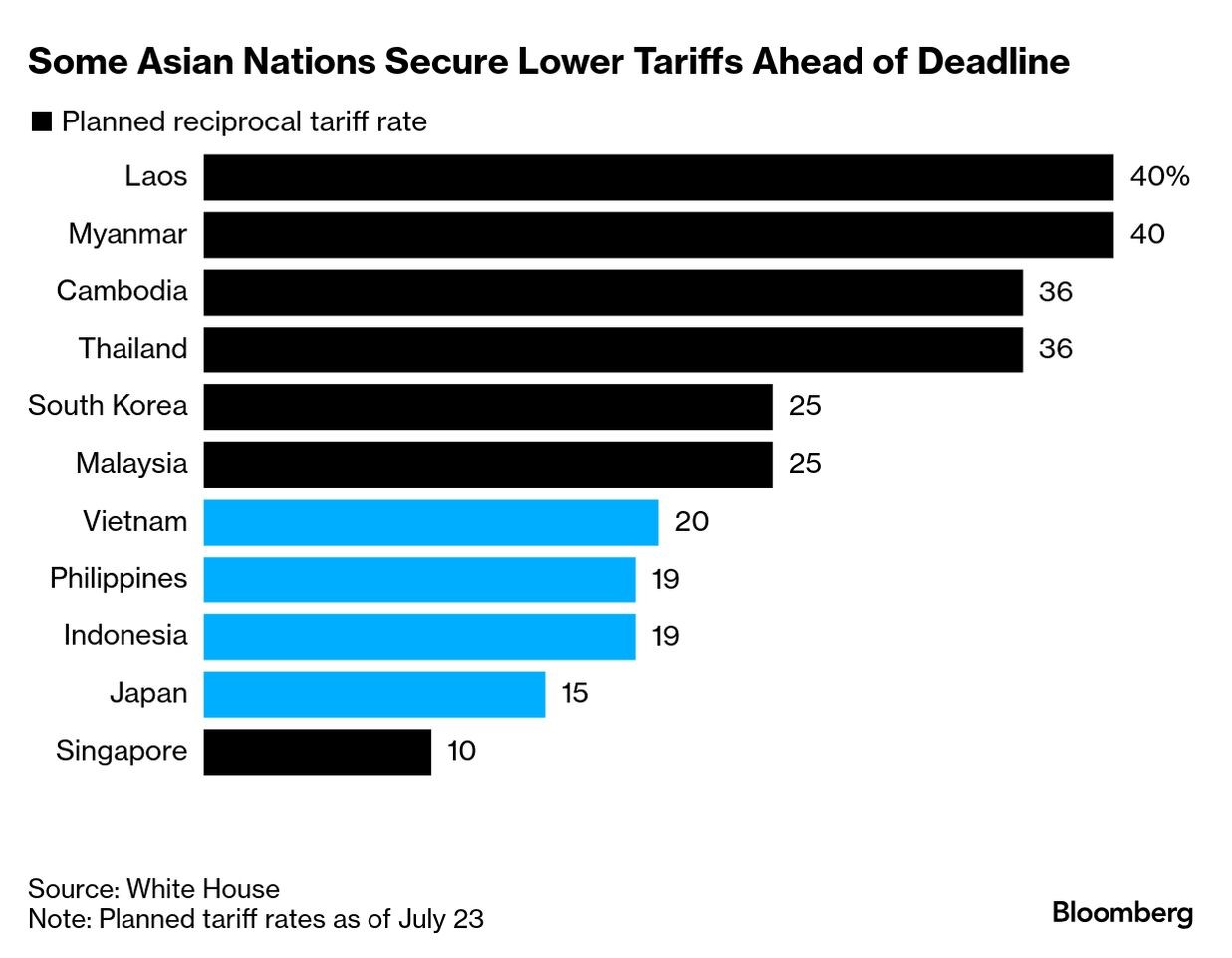

- Yesterday, the White House announced a deal with Japan that sets tariffs on the nation’s imports at 15%, including autos — by far the biggest component of the trade deficit between the two countries. Japan will also reportedly open its markets to US goods and invest $550 billion into the US. It’s expected that this will be a template for South Korea, among others. A separate agreement with the Philippines set a 19% rate, the same level as Indonesia agreed and a percentage point below Vietnam’s 20% baseline level, signaling that the bulk of Southeast Asia is likely to get a similar rate.

- The new agreements suggest the Trump administration is settling tariff rates around the 15% to 20% range — rates that would have been unthinkable before he took office, but as we sit here in late July, they seem more like a reprieve following the opening levels presented on April 2. And while higher goods prices have yet to fully filter into retail inflation numbers, GM reporting that tariff costs of $1.1 billion reduced their quarterly profits by a third is a reminder that that those customs receipts in the billions for tariffs are being mostly paid by Americans.

- This morning brings the latest existing home sales for June. Sales are expected to be 4.00 million annualized vs. 4.03 million in May as sales activity remains mired in mediocrity given steep valuations, and near 7% mortgage rates. Supply, however, is surging higher, especially in Florida, which may mean that lower prices may be coming and that could begin the rebound. New Home Sales for June will follow tomorrow with a slight increase in activity expected (650k annualized sales vs. 623k in May). While month-over-month improvement is encouraging, like the existing sales series, overall sales activity remains well below historical levels.

- Tomorrow also brings the weekly jobless claims series, and the trend lately has been for rather benign levels of initial claims (read low 200k range), but continuing claims have been trending higher as the low-hire, low-fire environment continues in place. Expectations are that initial claims will increase slightly from 221 thousand to 226 thousand while continuing claims remain virtually unchanged at 1.954 million vs. 1.956 million.

- The Treasury is expected to announce the next quarterly auction sizes today and that always brings the question of who is going to buy all the debt? It just so happens that we have a 20yr bond re-opening auction today, so we’ll get another chance, albeit belatedly after the buyer stats are announced, to see who is taking all that debt. The 20yr, given its limited history, is often viewed as the red-headed stepchild of Treasuries and may not be the best example to measure demand so there is that excuse at the ready should it be necessary.

- While we’ll have to wait for today’s auction details, we do have details from May auctions and the fear of foreigners turning their backs on US debt didn’t play out that way. Per BMO, private foreigners purchased $119.6 bn in long-term securities, a total that’s only been exceeded in two other months since the beginning of 2023. Foreign official money bought $26.7 bn in Treasury notes and bonds, the second-best month over the last year. When combining private and official money, May saw $146.3 bn in net foreign buying of Treasury notes and bonds, the most since August 2022 ($175.1 bn) and second highest of any month on-record; data since 1978. So, at least back in May a foreign buyers strike was more imagination than reality.

- Finally, I’d like to thank all those who took the time to attend our webinar yesterday. Kevin and I jammed a lot of information into 30 minutes (ok, 35), so if you’d like to take a more leisurely look, or you couldn’t attend, the link to the recording is here. Thanks again!

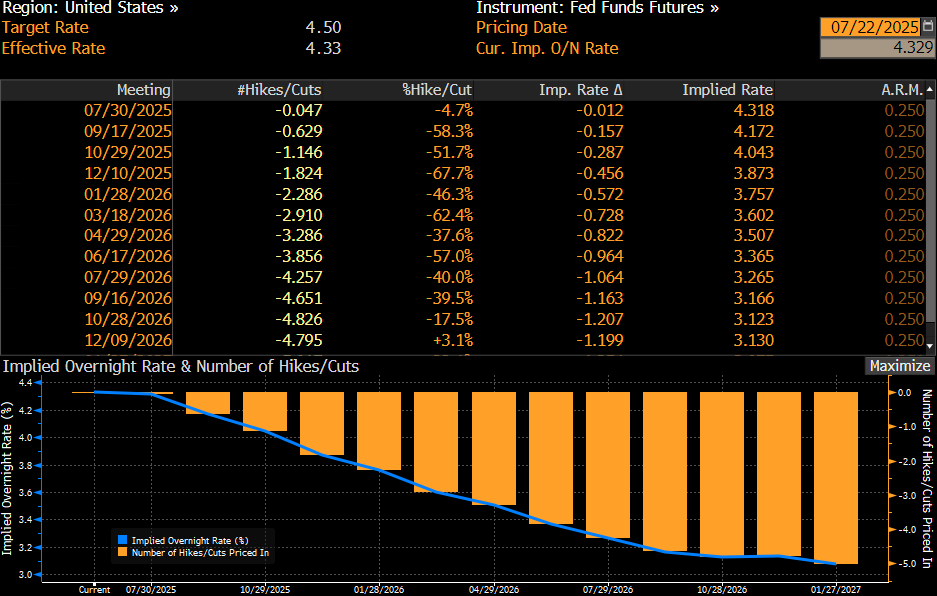

Futures Market Sees 58% Chance for a September Cut and 68% Odds for Two Cuts by Year End

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.