The Sore Spots in Inflation Returned in August

The Sore Spots in Inflation Returned in August

- Treasury yields are slightly higher this morning as August core CPI came in a bit hotter than expected, dashing hopes of a 50bps cut next week, and the usual sore spots, Owner’s Equivalent Rent and core services, returned as sore spots in August (more on that below). Currently, the 10yr is yielding 3.65% up 1bps on the day, while the 2yr is yielding 3.63%, up 3bps on the day.

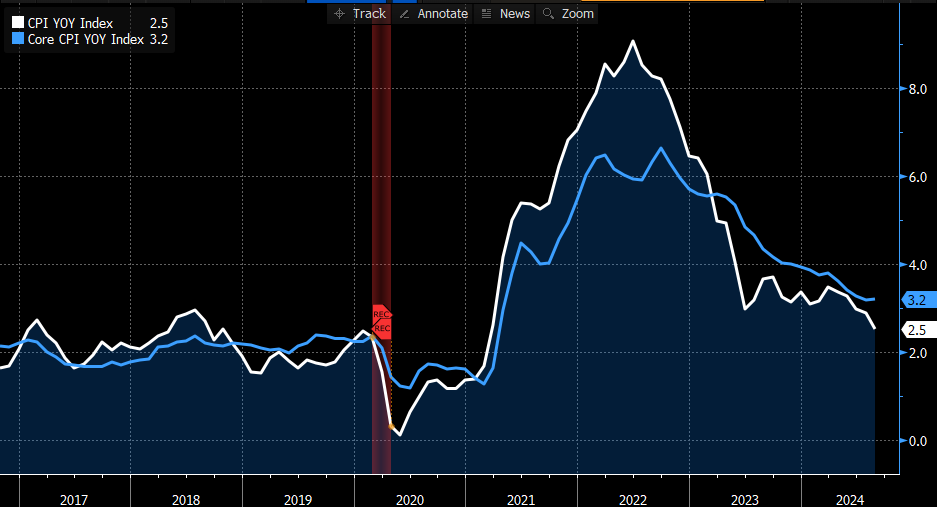

- Core CPI rose 0.3% (0.281% unrounded) vs. 0.2% expected and that will deal a blow to the 50bps rate cut crowd. The YoY rate remained at 3.2%, which met expectations. Although the 0.3% can be characterized as “moderately low” given the unrounded figure, it still shows inflation at the core level, and especially the sticky components like housing costs and core services ex-housing, bounced higher in August.

- The overall rate rose an as expected 0.2% (0.187% unrounded), matching July’s, with the YoY rate tumbling from 2.9% to 2.5% as a big 0.5% from last August rolled off. A 0.4% will roll off next month which should bring the overall close to 2.0% if a 0.2% or lower is printed for September. After September, the comps will get tougher with 0.1% and 0.2% prints rolling off into year end. That said, the YoY rate is the lowest since February 2021 while the 3-month annualized average dipped to 1.1%.

- Indexes which increased in August include shelter, airline fares, motor vehicle insurance, education, and apparel. The indexes for used cars and trucks, household furnishings and operations, medical care, communication, and recreation were among those that decreased over the month. We do have to mention that while the food at home category rose a modest 0.1% (2.1% YoY), the food away from home category (think restaurants) rose 0.3% (4.0% YoY). So, if you’re still seeing menu prices increase at your favorite eating establishments it’s not a mirage.

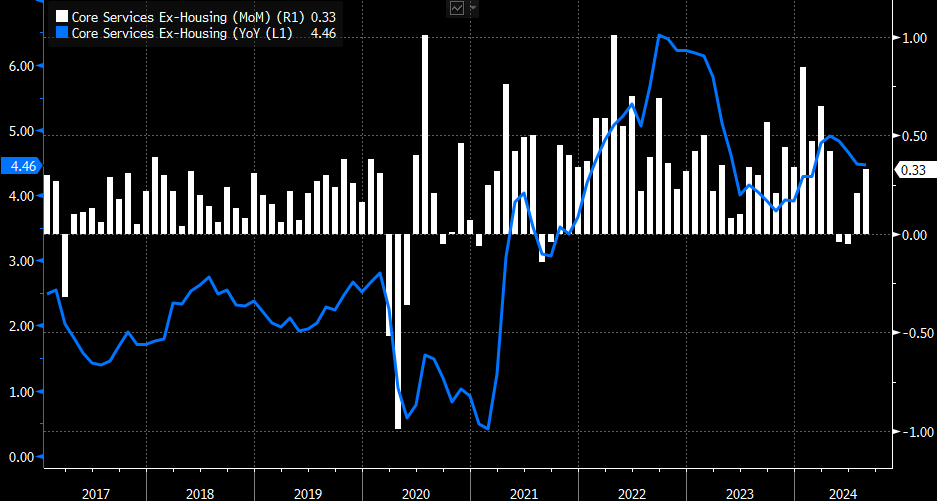

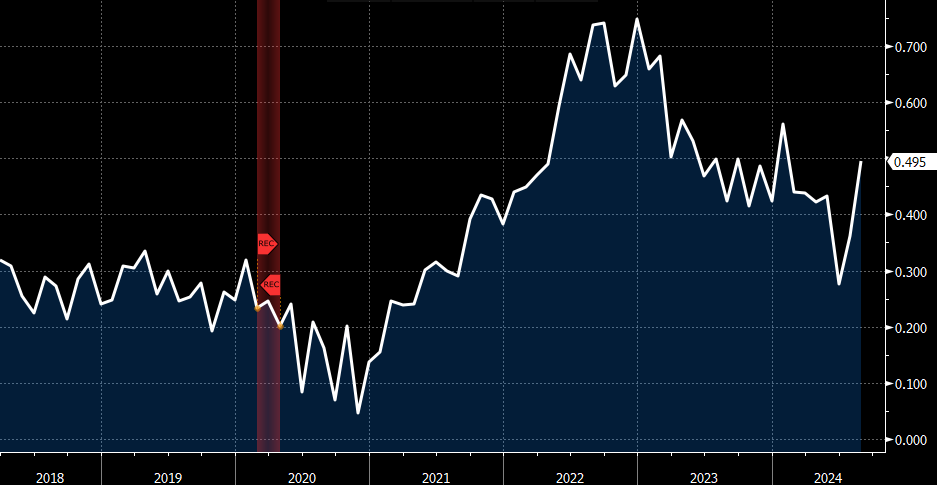

- The disappointing part of the report is in the core number which was the highest since April’s 0.292%. Housing costs/ OER refuse to roll over (0.5% vs. 0.4% in July), and core services ex-housing (0.33% vs. 0.21% in July) increased as well. So, the stickiest piece of inflation remained sticky in August. While the YoY rate held at 3.2%, the 3-month annualized rate rose from 1.6% to 2.1%. While a 0.2% print rolled off in August, the next four months will be a mix of 0.2% and 0.3% rolling off into year-end meaning improvement in the YoY rate before 2025 will be grudging at best.

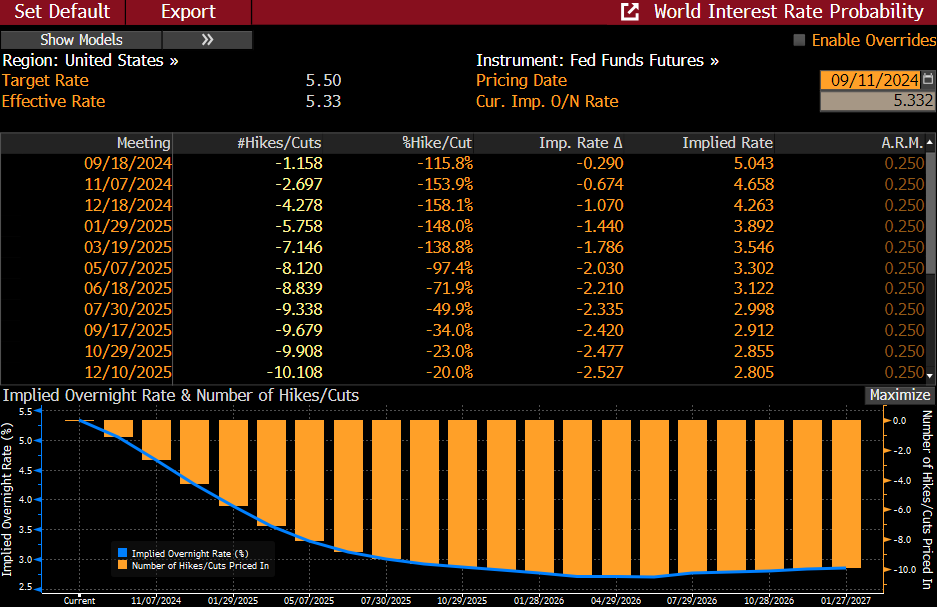

- The results seem to set in place for another month the Fed narrative that “more needs to be done” on the inflation mandate, which will most likely keep a 25bps rate cut as the prohibitive favorite for next week’s FOMC meeting.

- We get PPI tomorrow with benign numbers expected, but perhaps more importantly with both CPI and PPI in hand it will allow analysts the opportunity to begin estimating PCE inflation numbers, and while the PCE report will come after the FOMC meeting members will no doubt be aware of the estimates.

- At this point the only thing that could resurrect a possible 50bps rate cut would be an outsized increase in tomorrow’s weekly jobless claims (227k expected) and a fall off in retail sales due next Tuesday but moderate strength is expected (0.3% Control Group expected, matching July), so it will take a big miss to generate any momentum for a 50bps cut. While odds of a larger than 25bps cut have been dimmed by this CPI report, futures still see 100bps in cuts by year-end (see graph below). Hope springs eternal, I guess.

Core CPI Remains Stuck at 3.2% YoY While Overall CPI Continues Lower

Source: Bloomberg

Core Services Ex-Housing (Super Core) Remains Sticky in August

Source: Bloomberg

The Rollover in Owner’s Equivalent Rent Reversed in August

Source: Bloomberg

Futures Market Still Sees 100bps in Rate Cuts By Year-End

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.