The Fed’s Dual Mandates Face Increasing Tension

- The light data week rolls on and that allows the focus to build on Jackson Hole and what we may learn this Friday. Fed Chair Powell will deliver the keynote address, and while the market wishes for clarity akin to the mountain water surrounding the venue, we’re not likely to get that crystal clear insight on future policy (more on that below). Meanwhile, the Treasury will be selling $16 billion in 20yr bonds today, and after auctions that all tailed last week in the more traditional maturities of 3yr, 10yr, and 30yr bonds, the betting is the red-headed stepchild that is the 20yr issue will follow the trend, albeit without undue stress across the Treasury complex. Currently, the 10yr note is yielding 4.30%, unchanged on the day, while the 2yr yields 3.75%, also unchanged.

- With Jackson Hole approaching, Fed Chair Powell released the title of his address as “Economic Outlook and Framework Review”. While investors hope for a revelation on the September FOMC rate decision, we’re not likely to get the specificity that he provided last year when he stated, “the upside risks to inflation have diminished and the downside risks to employment have increased…the time for policy to adjust has come.” It was as a clear a signal one gets from the Fed that rate cuts were coming in September.

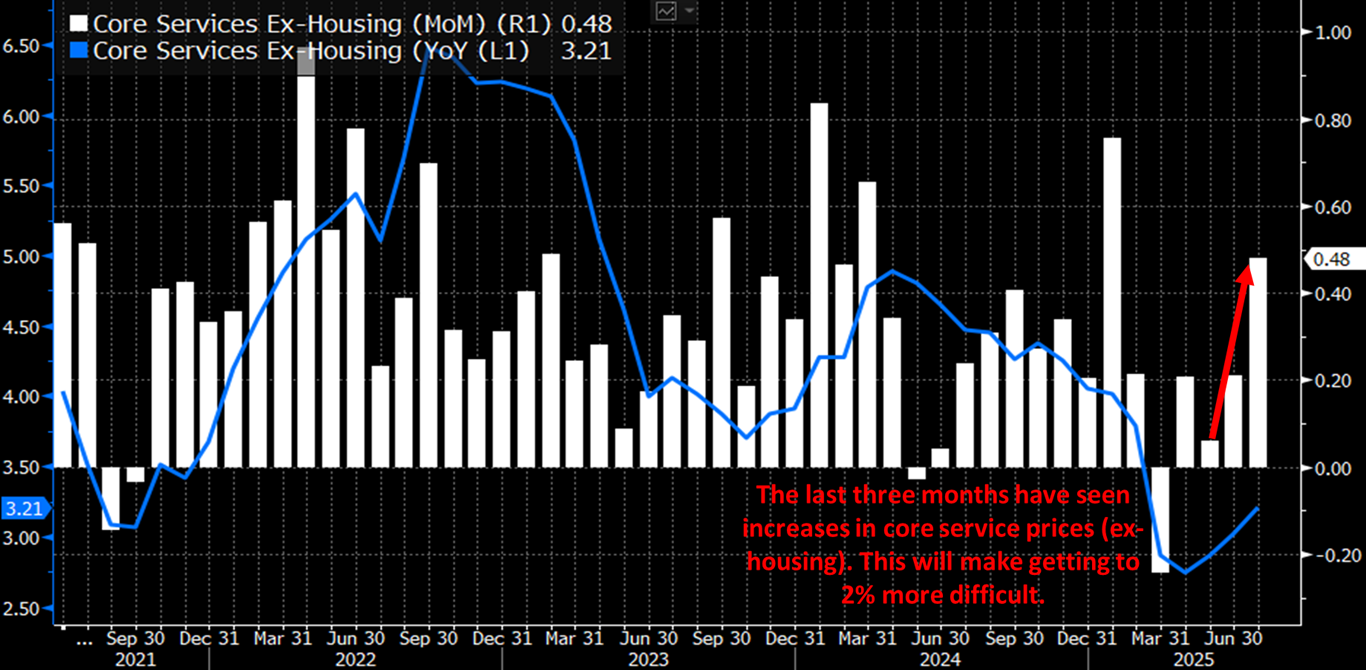

- With the near-term inflation trend still uncertain in the face of tariffs, and what must be an unsettling uptick in core services inflation for July, Powell is not in the position to say the inflation threat is receding like he did last year. Furthermore, while the employment market and economy are showing signs of slowing momentum, larger fissures in the market have yet to appear.

- Regardless, this will be the first public comments from Powell since the disappointing July jobs report and how he chooses to characterize it will be important. Does he call it a one-off? Not likely as there are plenty of other labor indicators that have been softening for months. But does he go to the other extreme of calling it a moment to begin full on rate-cutting? Hard to see that too as the phrase “one report does not a trend make” comes to mind. It does show, however, that there is clear tension right now between the two mandates for price stability and full employment and how Powell chooses to frame that tension will go some way in determining the future reaction function of the Fed as we move closer to the fourth quarter.

- In the end, maybe the August jobs report holds as much importance as Friday’s speech. Another weak report like July and a case for 75bps in rate cuts by year-end will gain favor once again. If the Fed truly believes that tariffs are a one-time price increase, admittedly one that is scattered across the next several months if not quarters, then policy will likely switch to combating a weakening labor market with more aggressive rate cuts if those fissures appear to be opening.

- By the way, the Trump administration expanded its 50% steel and aluminum tariffs to include more than 400 additional product categories on Monday, vastly increasing the reach and impact of this arm of its trade agenda. The new tariffs now cover products such as fire extinguishers, machinery, construction materials and specialty chemicals that either contain, or are contained in, aluminum or steel. “Auto parts, chemicals, plastics, furniture components—basically, if it’s shiny, metallic, or remotely related to steel or aluminum, it’s probably on the list,” Brian Baldwin, vice president of customs at Kuehne + Nagel International AG wrote on LinkedIn. After this expansion of tariff items, it may be that those tariff hits will spill across quarters and not just months.

- Later today we’ll get the minutes from the July 30th FOMC meeting and while a rate cut in September looks to be a good bet, investors will be scanning the minutes for any more clues about the Fed’s reaction function between their dual mandates of price stability and full employment. Recall, this is the meeting having two Fed governors dissent (Bowman and Waller) in favor of a July rate cut, so the minutes may cast a glimpse of whether there were others close to dissenting or not. Could make for some interesting reading.

- We did get some housing news yesterday with July starts at a seasonally adjusted annual rate of 1,428,000. This is 5.2% above the revised June estimate of 1,358,000 and is 12.9% above the July 2024 rate of 1,265,000. Single-family housing starts in July were at a rate of 939,000; this is 2.8% above the revised June figure of 913,000.

- Alas, it wasn’t all good news as July permits fell to a seasonally adjusted annual rate of 1,354,000. This is 2.8% below the revised June rate of 1,393,000 and 5.7% below the July 2024 rate of 1,436,000. Finally, completed housing stock remains tight as completions in July were at a seasonally adjusted annual rate of 1,415,000. While this is 6.0% above the revised June estimate of 1,335,000, it’s 13.5% below the July 2024 rate of 1,635,000. Limited supply and still high mortgage rates will continue to be a challenge in trying to lift activity in the residential housing sector.

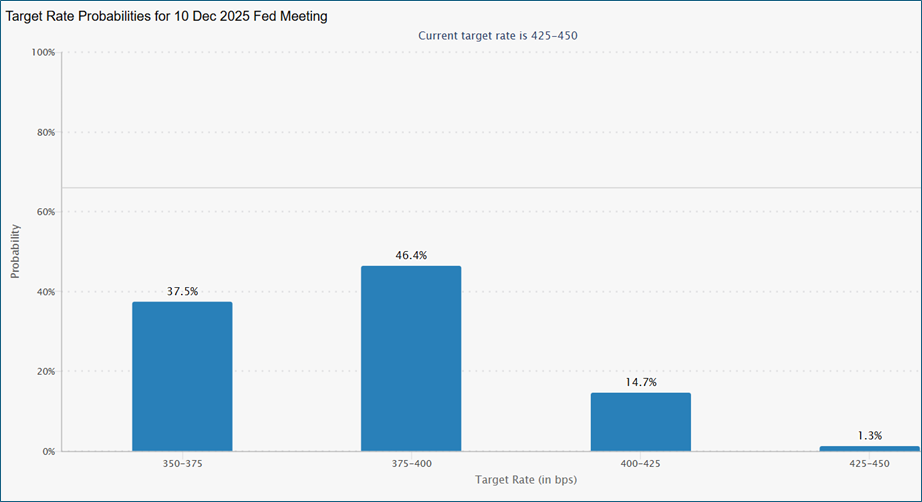

December Futures Leaning Towards 50bps in Cuts by Year End. We’ll See after the Jackson Hole Speech

Source: CME Group

Core Services Inflation Heading Higher – Hard to Blame that on Tariffs, or is it Sympathy Price Hikes?

Source: Bloomberg

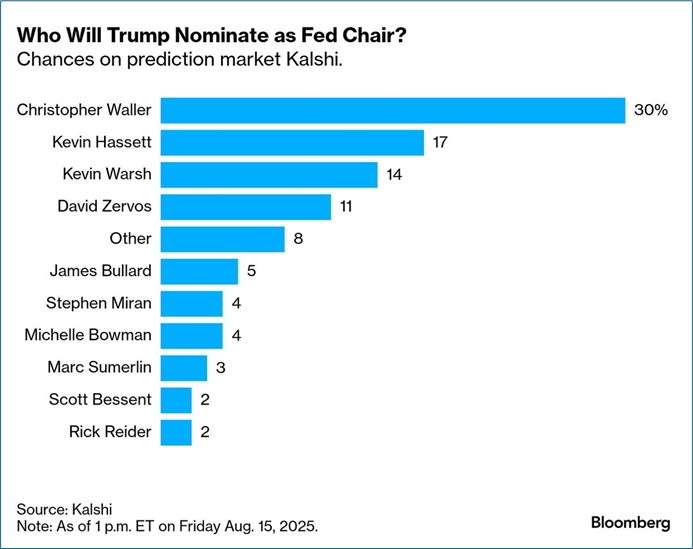

Who Will Give the Jackson Hole Address Next Year?

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.