The Fed Push Back Continues

The Fed Push Back Continues

- Treasury prices are lower this morning as Jay Powell used a 60 Minutes Interview last night as another opportunity to push back on thoughts of a March rate cut. While he didn’t add much to what was communicated after the FOMC meeting, the market is trading it more like fresh news given the degree of the moves (more on that below). Presently, the 10yr Treasury is yielding 4.12%, down 26/32nds in price while the 2yr Treasury is yielding 4.43% down 3/32nd in price.

- Fed Chair Jay Powell used a 60 Minutes interview last night to push back once again on thoughts of a March rate cut, stating that more confidence is needed on inflation heading to 2% before commencing down the rate-cutting path. That’s what has Treasuries under pressure this morning, although the interview didn’t break any new ground on the Fed’s reaction function. Keep in mind too, that the interview was taped Thursday, before the latest jobs report, which would have only buttressed his case against cutting in March.

- Speaking of the jobs report, while it was stronger than expected, the gathering suspicion is that seasonal factors once again played havoc with the data, just like it did last January which also posted a surprisingly strong report. The suspicion is that employers didn’t cut as many holiday workers as had been typical in pre-pandemic times, so the seasonal adjustment correcting for that was too large which contributed to the topline beat.

- The other suspicious data point in the report was the 0.6% gain in wages which was the largest since March 2022 and well above the 0.3% expectation and 0.4% in December. The jump in wages, which flies in the face of moderating wage gains from other recent reports like the more comprehensive ECI, came as weekly hours worked dipped from 34.3 to 34.1 hours, the lowest since March 2020 when lockdowns were starting. Some analysts speculated that more people couldn’t get to work due to inclement weather, but isn’t January weather typically inclement? In any event, that dip in hours worked could have goosed wages more than is customary. That has us speculating that February will have some downside adjustments that take away some of the strength exhibited in the initial report.

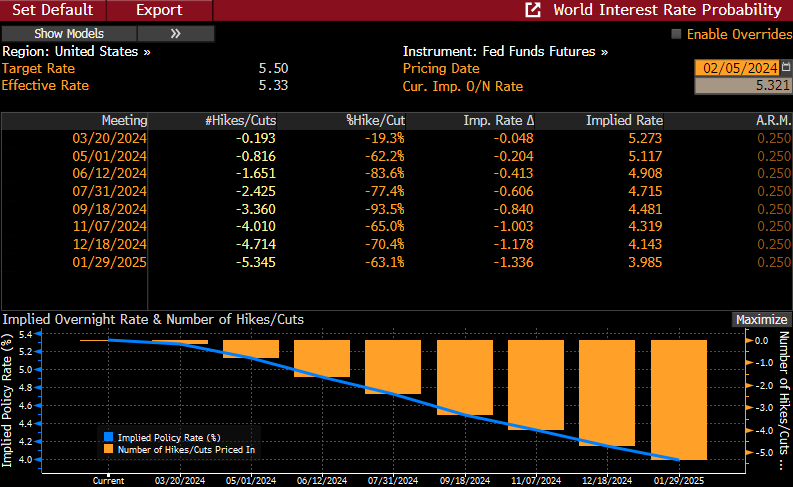

- Would a soft February jobs report put a March cut back on the table? Probably not. The report will come mere days before the March meeting, so it would have to take an extraordinarily weak report to rekindle hopes of a March rate cut. Even so, the Fed would likely call it a one-off that would need more conformation. That’s why odds of a March rate cut sit at 19% today vs. more than 50% a week ago (see table below).

- With a light data calendar, Fed speakers and Treasury supply will highlight the week. 3yr notes will be sold tomorrow, followed by 10yr and 30yr bonds so the backup this morning is setting up nice concessions heading into the auctions. In addition to Powell’s 60 Minute interview, more than half a dozen Fed officials will offer their latest opinions on policy this week. Chicago Fed President Austin Goolsbee and Atlanta Fed President Rafael Bostic are on tap today. They are both from the moderate to dovish wing of the Fed so it will be interesting to hear their take on the March meeting and the future of any rate cuts by mid-year.

- While there isn’t much data this week, the ISM Services is later this morning with expectations that it improves from 50.5 to 52.0. The prices paid, employment, and new orders sub-indices will also provide some details on the services-side of the economy. Coming after the jobs report, however, does take some of the market-moving potential from the report. Later this afternoon, the Fed’s quarterly look at lending conditions will be released with the Senior Loan Officer Opinion Survey. Recall, there was anticipation after the SVB moment last March that tighter lending conditions would follow, and while some tightening has been noted it hasn’t been excessive. We’ll see if that’s the case again this afternoon (2pm ET).

Rate-Cutting Odds for March Took a Real Hit in the Last Week – From 50% to 19%

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.