The Fed Affirms Their Patient Pause Approach

The Fed Affirms Their Patient Pause Approach

- Treasuries are marking time today with little data on offer and a pair of Treasury auctions awaiting on Monday. Those auctions, 2yr and 5yr, should keep any rally attempts in check, especially as this week’s Fed speak offered little hope of rate cuts anytime soon (more on that below). That talk of being patient on rates added upward pressure to yields this week, but the action this morning is rather muted, implying the market has priced in the updated information. Presently, the 10yr Treasury is yielding 4.33% while the 2yr Treasury is yielding 4.72%.

- The Fed speak has been hot and heavy this week, and the consistent message has been while one month of hotter-than-expected inflation data does not represent a trend change, it does warrant increased caution (read: time) before embarking on rate cuts. The latest to add to that chorus was Fed Governor Christopher Waller last night. In fact, the title of his address was “What’s the Rush?” and that was pretty much his message. He made the point that January can have tricky seasonal adjustments that bring more noise than signal so “a couple more months” of easing inflation data will be needed before considering rate cuts.

- Waller also brought up an interesting point in regard to the risk that delaying a cut could bring about a recession. He noted that during the rate-hiking cycle it was generally accepted that it could take up to 18 months before the impact was fully felt. Yet, those clamoring for rate cuts seem to imply the impact is virtually instantaneous. He remarked that he had seen no research to back up that claim. So, his point is that the Fed doesn’t really see a downside to being patient if policy does indeed work with “long and variable lags.” It was an interesting address and does provide a window into the Fed’s current reaction function. It’s a quick read and you can find the full text here.

- The FOMC minutes from the January 31 meeting had pretty much the same message, typically hawkish with concern that the risks for inflation were to the upside. And right on cue, the January CPI/PPI reports delivered an upside surprise. It was also interesting to note from the minutes that only 2 of the 19 participants voiced concern that leaving the funds rate unchanged could put economic growth at risk. That implies the vast majority of the FOMC has the same view as Waller. So, settle in, it could be awhile before that first rate cut.

- Also, the minutes were quiet on the idea of winding down Quantitative Tightening. Recall, the December meeting did mention that discussions regarding how to wind down QT would begin soon, but those discussions didn’t seem to happen in the January meeting. That implies they remain comfortable with the nearly $100 billion in monthly drawdowns that are occurring now, with little near-term need to course correct. There had been some thought they would begin to curb the drawdowns at the May meeting and then follow that with rate cuts at the June meeting. With the upside surprise to the January data, the timeline for slowing QT seems to be getting pushed back, just like those rate cuts.

- Meanwhile, the latest news from the labor market points to continued strength. Weekly jobless claims came in at 201 thousand vs. 216 thousand expected and was the third consecutive decline, hitting a five-week low. Oh, and it came during the BLS survey week for the February jobs report. The preliminary read on February PMI’s from S&P Global also pointed to increasing growth in the manufacturing sector, while service sector growth continued, but at a slightly slower pace. Thus, early indications point to continued strength in the labor market and that will certainly play into the Fed’s lengthy pause approach.

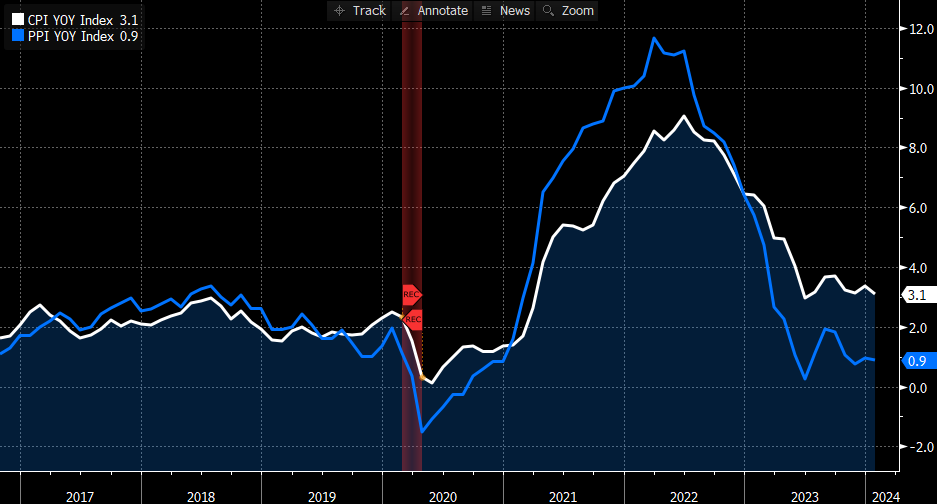

CPI vs. PPI – Looks Like Some of the Wholesale Price Cuts Have yet to Make it to the Retail Level

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.