The Consumer Fails to Fold

- It’s another risk-on day in equities (Dow indicated up 270 points), and that has Treasuries standing in place as we open. There’s an element too of investors still pondering the true inflationary impact of yesterday’s PPI report. While some of the heat from the robust PPI print can be explained as less inflationary and more wealth creative (i.e., portfolio values increased, and therefore portfolio management fees increased), there were other items where higher prices cannot be explained away so easily. Those will have to be dealt with, but that appears not to be today’s concern. July Retail Sales is the big release of the day and detailed results are below. Currently, the 10yr is yielding 4.30%, unchanged on the day, while the 2yr is yielding 3.73%, also unchanged on the day.

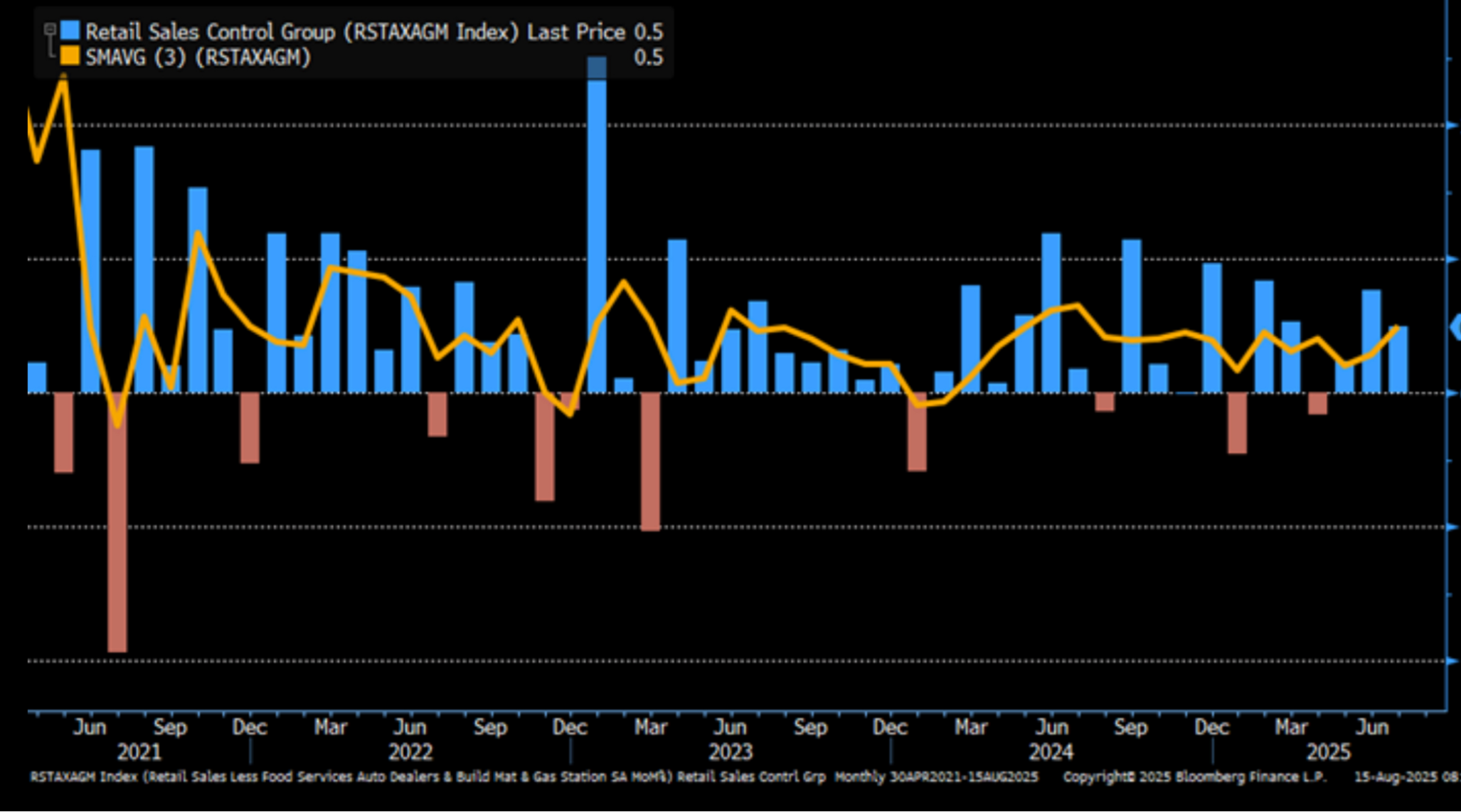

- After a solid performance in June which followed a weak May, the consumer managed to have back-to-back months of solid consumption, despite the worries of flagging confidence. Retail sales rose 0.5% for the month, just missing the 0.6% expectations. The June results were revised upward from 0.6% to 0.9%. The sales growth continues to be broad-based as 9 of 13 categories were up month-over-month vs. 10 of 13 up in June. The Control Group – a direct feed into GDP – rose a solid 0.5%, beating the 0.4% expectation but a touch below the 0.8% upwardly revised June print (original estimate 0.5%).

- As we often say, don’t be quick to write-off the American consumer and this report is another reminder of that, although the more comprehensive look at spending will come on the 29th with the Personal Income and Spending Report for July, so we’ll reserve judgment until then. In the meantime, evidence of stagflation – slowing economy and higher inflation – will have to wait a bit longer, at least the slowing economy part.

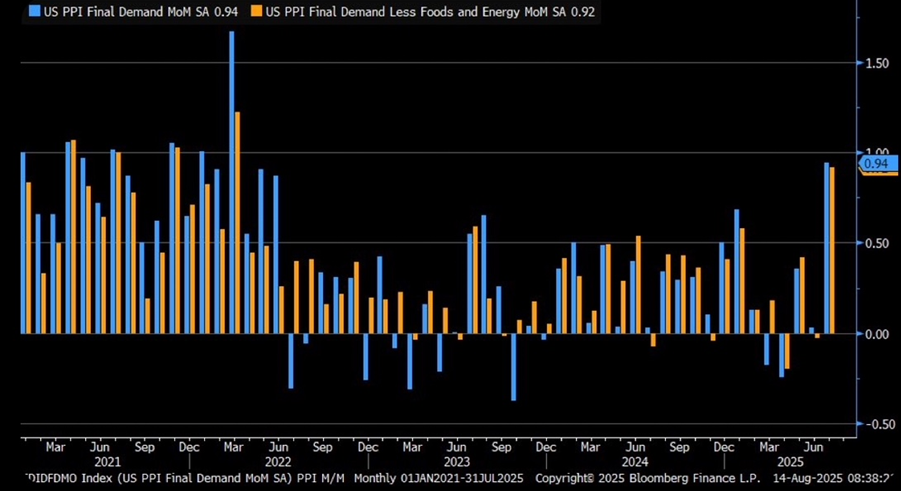

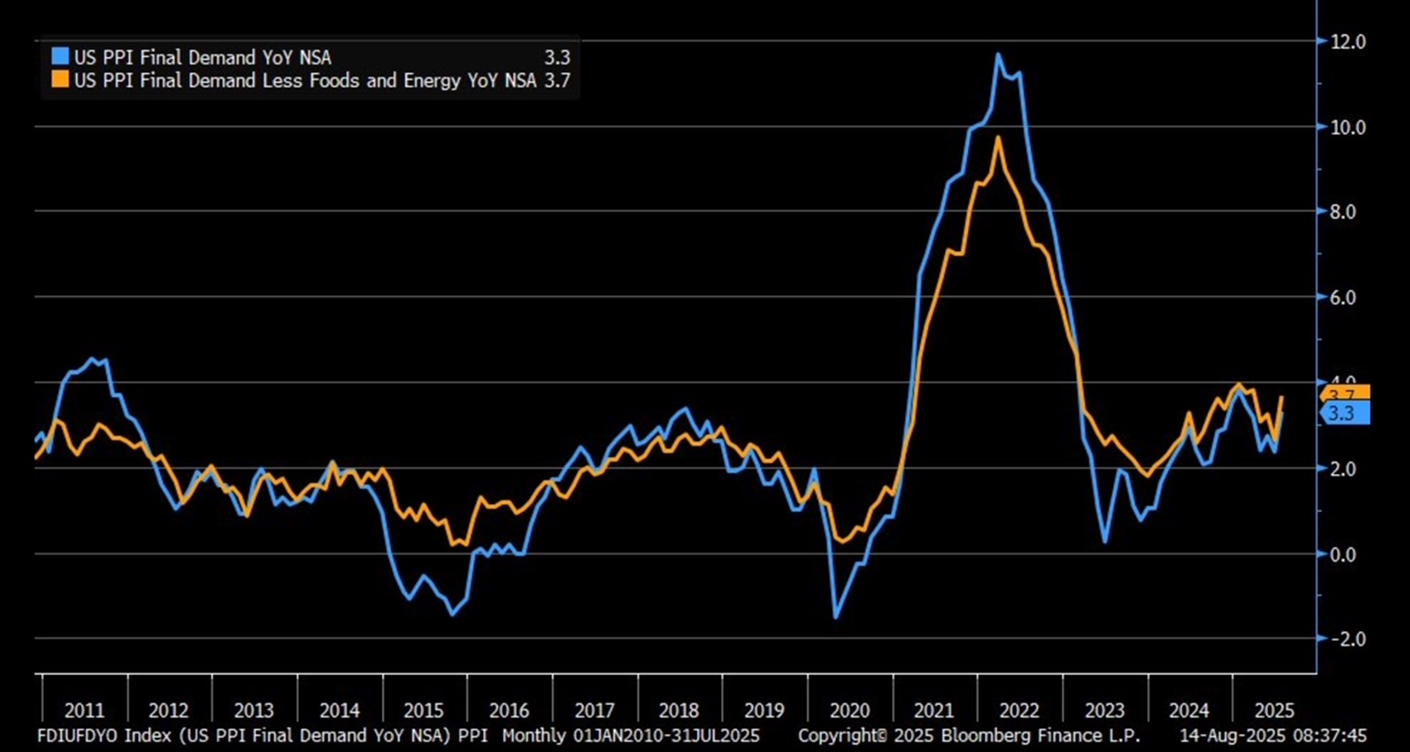

- Yesterday we saw the latest in wholesale pricing pressure with the July PPI and to call it hot is an understatement. Recall, part of the reason behind the big drop in retail-level inflation (read: CPI) in 2022 and 2023 was material disinflation in wholesale prices that was partially passed on in lower retail prices. Wholesale prices are no longer falling, and the question has become will tariff costs begin appearing in intermediate inputs? The July report provided a definitive answer.

- Overall PPI for July rose 0.9% in July, blowing away the 0.2% expectation and the highest monthly increase since 2022. The YoY rate increased from 2.3% to 3.3%. PPI Ex Food and Energy also increased 0.9%, besting the 0.2% expectations, and again the highest monthly increase in three years. The YoY pace increased from 2.6% to 3.7%.

- If one wanted to make excuses for the hot read you would start with the majority of the increase was in services at 1.1%, particularly financial services which benefited from the dual stock and bond rallies during July that boosted portfolio values and for things like portfolio management fees, which are imputed from the changes in portfolio values, that prompted big gains, but is that really inflation? But, alas, there were other notable gainers in other service categories, and it should be mentioned that in June total services were down -0.1%. So, while service costs were muted in June that most certainly wasn’t the case in July. That must be somewhat concerning to the Fed and other inflation watchers.

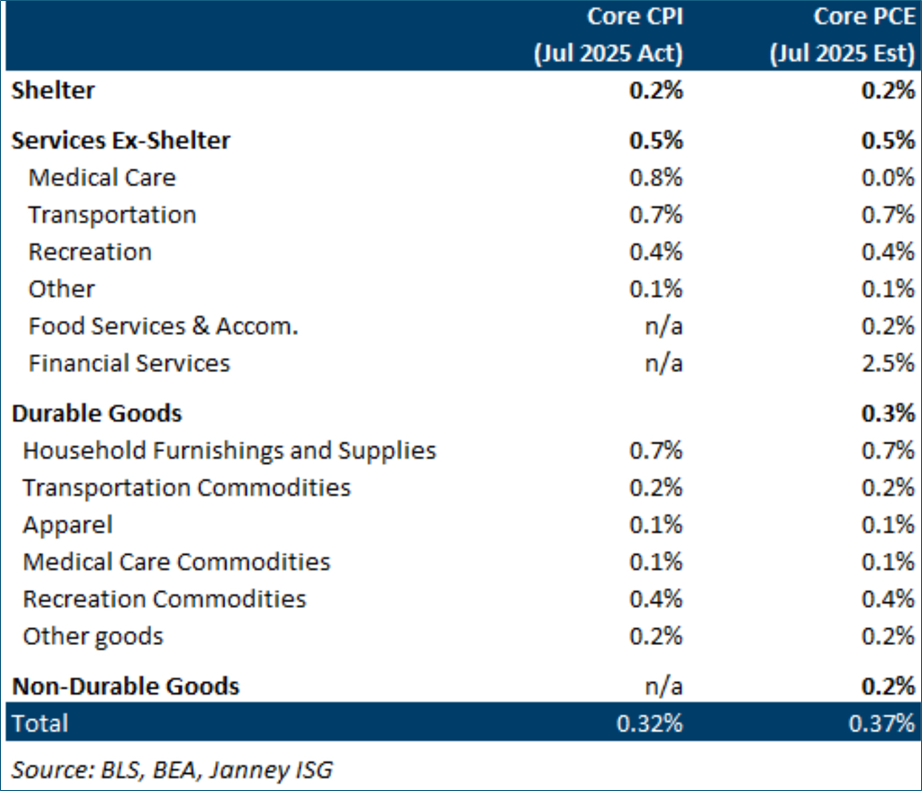

- Gains were also found in the goods side with prices up 0.7%, the largest advance since January and up from 0.3% in June. 40% of the goods increase can be attributed to food, which jumped 1.4%. The biggest chunk of the increase in food came from prices for fresh and dry vegetables, which jumped 38.9%. With CPI and PPI in hand, analysts are expecting the month end core PCE read to be around 0.4% (see table below). That might not be hot enough to derail a September rate cut, but it all but squashes any hopes for a 50bps cut.

- Meanwhile, initial jobless claims printed another routine report of flat initial claims with continuing claims remaining elevated, but down slightly from the previous week. In the week ending August 9, initial claims were 224,000, a decrease of 3,000 from the previous week’s revised level. The previous week’s level was revised by 1,000 from 226,000 to 227,000. Continuing claims for the week ending August 2 were 1,953,000, a decrease of 15,000 from the previous week’s revised level. The initial and continuing claims figures continue to signal a low-fire, low-hire labor market that has persisted for months now and shows no signs of changing.

- Later this morning the University of Michigan’s preliminary August Sentiment Report will be released. While some improvement in the headline sentiment measure is expected (62.0 expected vs. 61.7 in July), the inflation expectations will garner most of the attention, as they spiked in recent months over fears of tariff-induced price increases. The Fed wants long-term inflation expectations to be stable so seeing them retreat a bit from recent levels would sooth some of their inflation-angst and help keep hopes alive for more than just a September rate cut. The 1Yr inflation expectation is expected to edge lower from 4.5% to 4.4%, while the 5-10Yr inflation is expected to be unchanged at 3.4%.

Retail Sales Control Group – Consumer is Having a Solid Third Quarter

Source: Bloomberg

Largest Monthly Gains in PPI Since March 2022

Source: Bloomberg

The Days of PPI Disinflation Seem Long Ago

Source: Bloomberg

Core PCE Estimates Rounding to 0.4% – That Will Trouble the Fed’s Inflation Hawks

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.