The Chairman Speaks

- The third week of the shutdown begins, and with missed paychecks for federal workers having already started military checks are due today. Treasury Secretary Bessent made mention of altering payment priorities to allow for the military payroll to be made, but that remains a wish rather than a reality. It could be, as in the 2018-2019 shutdown, that it will end when TSA staff take leave and air travel grinds to a halt. That’s what ended the 2018-2019 shutdown and so it may do so again. Currently, the 10yr Treasury is yielding 4.01%, down 1bp on the day, while the 2yr note yields 3.47%, also down 1bp in early trading.

- With the government shutdown showing no signs of abating, market analysts and scribes are thankful that Fed Chair Powell found time to address the National Association of Business Economics (NABE) annual meeting in Philadelphia yesterday. That speech, thankfully, generated a decent amount of content that we could pick over, otherwise, it might have been another day of wondering what to write about.

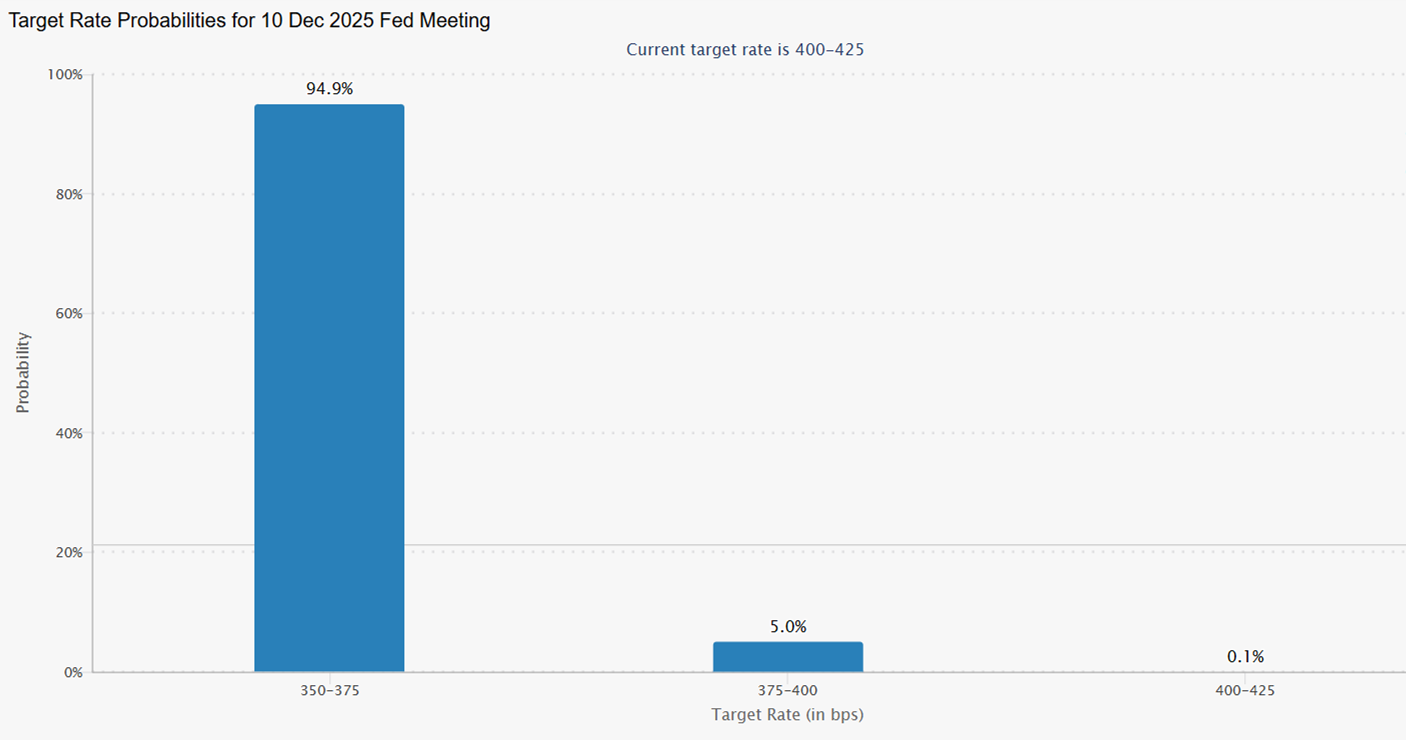

- On the economic front, Powell mentioned not much had changed from when the FOMC cut rates in September, but that even with the data blackout it’s obvious from a variety of indicators that “rising downside risks to employment have shifted our assessment of the balance of risks. As a result, we judged it appropriate to take another step toward a more neutral policy stance at our September meeting. He added the usual caveat that there is no risk-free path for policy as they navigate the tension between their employment and inflation goals. He concluded, “we will set policy based on the evolution of the economic outlook and the balance of risks, rather than following a predetermined path.” To us, that means unless the October 24th CPI numbers are clearly above expectations another 25bps cut will be adopted with a similar outlook for December.

- Speaking of the blackout, the BLS has ordered back enough staff to prepare the CPI report for September, which will be released on Friday, October 24th. The reason for the callback is not that the BLS feels sorry for our data blindness, rather, it’s for cost-of-living adjustment calculations for the turn-of-calendar 2026 Social Security payments. Whatever the rationale, we’ll take the data, but the BLS was quick to add it won’t be doing staff callbacks for other data as long as the shutdown remains in place. To refresh memories, the consensus Bloomberg expectation has headline CPI increasing 0.4% (3.1% YoY) and core up 0.3% (3.1% YoY).

- Back to Powell and his NABE speech. He spent a fair amount of the address detailing the quantitative tightening program (QT), aka balance sheet runoff, and the interplay between that and the level of reserves (essentially bank deposits held by the Fed). He had previously mentioned that the runoff would wind down when reserves reached the “ample” level. With reserves having dipped to around $3 trillion, we are approaching that level in Powell’s estimation which means to us an end to QT is probably a first half of 2026 event, with comments at the December FOMC meeting setting the stage for such a shift.

- Powell gave a brief history of quantitative easing (QE) that occurred during the early Covid period when the balance sheet increased by $4.6 trillion (roughly from $4 trillion to over $8.6 trillion) when QE ended in March 2022, as rate hikes commenced. Since June 2022, with QT now the policy, the Fed has reduced the size of the balance sheet by $2.2 trillion—from 35% to just under 22% of GDP, and in Powell’s words, “all the while maintaining control over interest rate policy.

- Powell looked forward and said, “Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision. Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates. The Committee’s plans lay out a deliberately cautious approach to avoid the kind of money market strains experienced in September 2019. Moreover, the tools of our implementation framework, including the standing repo facility and the discount window, will help contain funding pressures and keep the federal funds rate within our target range through this transition to lower reserve levels.”

- Powell went on to state that the balance sheet will not return to its pre-QE size since non-reserve liabilities are $1.1 trillion larger, and reserves have risen as well with the growth in the banking system and the overall economy. He talked too about the composition of the balance sheet going forward noting that, “relative to the outstanding universe of Treasury securities, our portfolio is currently overweight longer-term securities and underweight shorter-term securities. The longer-run composition will be a topic of Committee discussion. Transition to our desired composition will occur gradually and predictably, giving market participants time to adjust and minimizing the risk of market disruption. Consistent with our longstanding guidance, we aim for a portfolio consisting primarily of Treasury securities over the longer run.” Thus, it looks like shorter-term Treasuries will be the Fed’s favored security once QT is halted. It’s nice to know what a size buyer like the Fed is planning for portfolio purchases (see 2yr Treasury Yield graph below).

- Finally, despite the data blackout Powell mentioned the Fed’s sources continue to produce useful information and that will include today’s Beige Book of economic conditions via anecdotal feedback across the 12 districts. Expect that release at 2pm ET to garner some market reaction given its heightened status in the barren data fields of the shutdown.

Futures Market Convinced We Get Two 25bps Cuts by Year End Source: CME Group

Source: CME Group

10Yr Treasury Yield – Challenging 4.00% Source: CNBC

Source: CNBC

2Yr Treasury Yield – Trades Below 3.50% After Powell’s QT Comments Source: CNBC

Source: CNBC

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.