Thanksgiving Awaits

Treasury Yields Press Against Resistance

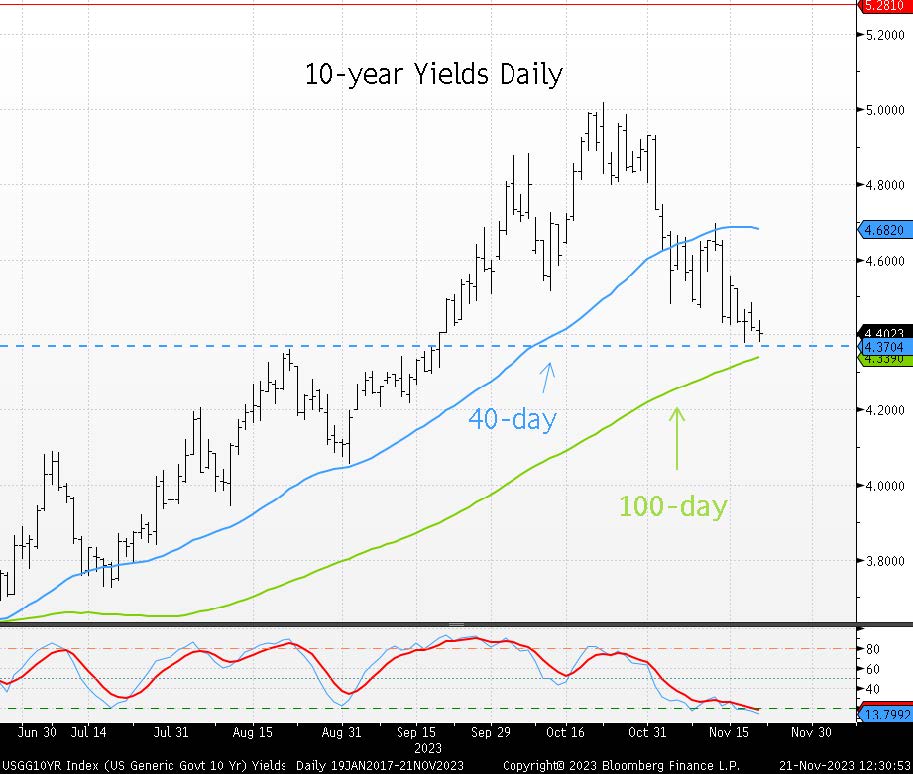

- Despite a 10yr TIPs auction that didn’t go great yesterday Treasuries this morning are extending gains and hitting two-month low yields. Also helping the pre-Thanksgiving trade were Fed minutes that really didn’t offer up any surprises (more on that below), and the market took that as a bit of relief. Presently, the 10yr Treasury is yielding 4.38%, up 8/32nds in price and the 2yr Treasury is yielding 4.89%, unchanged on the day.

- The minutes from the November 1 FOMC meeting offered little surprises and the market traded it that way with a slight downward yield bias. The theme was essentially that the Fed stands ready to hike again if the data, specifically backsliding in inflation, calls for that. Tightening in financial conditions, via higher yields, also got a fair amount of discussion along with the expected economic slowdown that they portend. With the subsequent dip in yields, the question is how that will be handled by the Fed from a policy perspective. This quote from the minutes provides something of an answer: “persistent changes in financial conditions could have implications for the path of monetary policy and that it would therefore be important to continue to monitor market developments closely.” Thus, we read it as lower yields don’t alone call for hikes, but if it results in rebounding economic activity, hikes will become more likely.

- Today’s weekly jobless claims numbers didn’t follow the script that had been building of increasing claims and especially continuing claims signaling early signs of softening in the labor market. The latest data surprised to the downside with weekly claims at 209 thousand vs. 227 thousand expected and 233 thousand from the prior week. Continuing claims also reversed the recent increasing trend at 1.840 million vs. 1.875 million expected and 1.862 million the prior week. The 1.862 million was the highest since November 2021. The latest numbers certainly caution against writing off the labor market just yet. In addition, last week’s data corresponds to the survey week for the November jobs report so that could portend positive news for that report. IF that comes to pass it probably keeps a potential rate hike in early 2024 firmly on the table.

- Meanwhile, the preliminary read on durable goods orders for October did reflect a slowing economy, at least on the goods side. Headline orders fell -5.4% vs. -3.2% expected and 4.0% in September. Orders less transportation were flat, missing the 0.1% forecast and 0.2% increase in September. Orders ex-air and non-defense, a proxy for business spending, fell -0.1% vs. a 0.1% expected gain and 0.5% increase in September.

- The New York Fed’s quarterly Consumer Expectations Credit Access Survey had some interesting findings that also speak to a possible slowing in economic activity. It found that demand for credit applications across all segments from mortgage to car loans declined while the rejection rate increased for those applications filed. Also, it did find one area where applications increased and that was for credit card limit extensions. So, it’s another indication consumers are dipping further into their credit cards to fund consumption while at the same time pulling back on seeking other types of credit. The impact of the long and variable lags in monetary policy may be starting to show.

- Finally on a programming note, given the Thanksgiving holiday the next Market Update will be on Monday, November 27. Have a safe and Happy Thanksgiving!

10yr Yield – Pressing Against Resistance

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.