Sparse Data Awaits Investors During This Holiday-Shortened Week

Sparse Data Awaits Investors During This Holiday-Shortened Week

- Treasuries are trading a bit heavy this morning as the upcoming Thanksgiving holiday has investors distracted and disinterested so many are sitting on their hands for now. Additional supply this week (20yr and 10yr TIPs) is also contributing to some reluctance on the part of traders as the week begins. Presently, the 10yr Treasury is yielding 4.47%, down 8/32nds in price and the 2yr Treasury is yielding 4.90%, down 1/32nd in price.

- As is appropriate for a holiday-shortened week the data flow will be light leaving more room for the turkey, and Fed speak will be nonexistent lest it interrupt our tryptophan-induced nap. We do, however, get the Fed minutes from the November 1 FOMC meeting tomorrow. Discussions over tightened financial conditions due to higher rates is likely to get some focus as the subsequent dip in yields has removed some of that tightening. So, we’ll try to determine how much that tightening in conditions contributed to the decision to pause, or was it merely a convenient excuse?

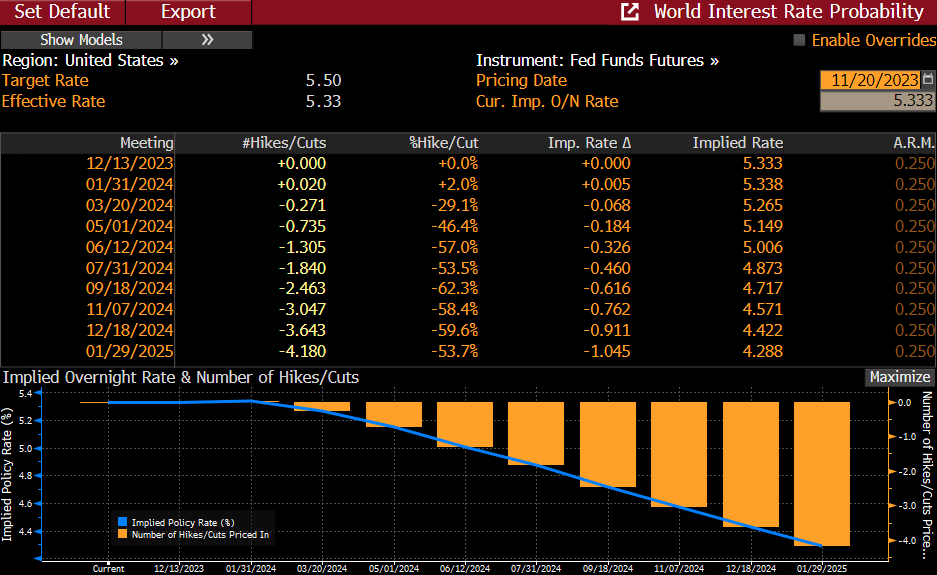

- Regardless, the minutes aren’t likely to shift current policy expectations. As the table below shows the fed funds futures market has odds of another rate hike virtually nonexistent, with 29% odds of rate cut as early as March and 46% odds for a May 1 cut. With early fourth quarter GDP estimates around 2% anticipating a cut by the end of the first quarter seems to imply considerable slowing in economic activity in early 2024. Once Fed speak resumes next week, the pushback on those rate-cutting forecasts is likely to resume in earnest.

- One of the few reports we do get this week that will get some attention will be the early Wednesday release of the weekly jobless claims data. Recall that last week’s claims rose above expectations, and more importantly the continuing claims series increased to 1.865 million which was above the 1.843 million expectation and the highest read since November 2021. While that total is not historically high the increasing trend is clear. Expectations are for continuing claims to increase again as workers losing jobs are finding it harder to secure new employment. Increasing continuing claims certainly plays well with the Fed remaining in pause position.

- While the markets have little in the way of obvious catalysts this week a pair of Treasury auctions will likely keep the expected low volume trading on the heavy side. The Treasury will auction $16 billion in 20-year Treasuries later this afternoon and the relatively new maturity tends to tail with many traditional investors passing on the issue. Tomorrow, $15 billion in 10yr TIPs will be auctioned, and while they have tended to be greeted more warmly, the recent rally and softer inflation expectations may dent some of the demand.

Rate Cutting Odds Appear in First Quarter 2024 – Expect the Fed to Disagree

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.