Soothing Words from Waller

- Treasury yields continue to creep higher, but soothing words from Fed Governor Waller on inflation have at least stabilized the short end and kept larger moves at bay on the long end. The Treasury will finish its trio of auctions this week with $22 billion in 30yr bonds this afternoon and that will likely keep the longer end under pressure. The labor market data this morning is less bearish and that is also keeping the back-up in yields limited as well. Currently, the 10yr Treasury is yielding 4.68%, down 1bp on the day, while the 2yr is yielding 4.27%, down 3bps on the day.

- With higher yields a feature so far in 2025, Fed Governor Christopher Waller offered a more optimistic view that rate cuts are likely to continue this year in a speech to the Organization for Economic Cooperation (OECD) in Paris. He opined that improvement in inflation should continue this year and is not worried about long-term impacts from possible tariffs. He also noted that most of the backsliding in inflation late in the year came from imputed items, like OER and health insurance, that are not directly observable but derived from estimates and statistical modeling. When looking at items with more observable pricing, he noted inflation rates continued to move lower. Waller is one of the more influential members of the FOMC so his views are always of importance and for him to remain confident in rate cuts this year should shore up the short end of the Treasury curve, at the very least.

- The next of the labor market reports is out this morning with the ADP Employment Change for December and it missed lower at 122 thousand private sector jobs vs. 140 thousand expected and an unrevised 146 thousand in November. The Friday BLS private sector number is expected to be 140 thousand vs. 190 thousand in November. The lack of a strong correlation with the BLS number has been widely reported so take today’s information with a grain of salt, but a slowing in private sector hiring seems to be the direction, it’s more a matter of the degree of slowing.

- Also from ADP, after last month’s uptick in annual wage gains, the previous moderating trend continued with wage gains for job-stayers at 4.60% vs. 4.80% in November and 4.70% in October. For job-changers the story was similar with annual wage gains dipping from 7.20% in November to 7.10% in December. After increasing at a double-digit pace for much of 2023, wage gains for job-changers seem to be stabilizing in the high 6% to 7% range. With a Fed concerned about wage-push inflation pressure, this moderation will play well with those members inclined to continue rate cuts (see Waller above).

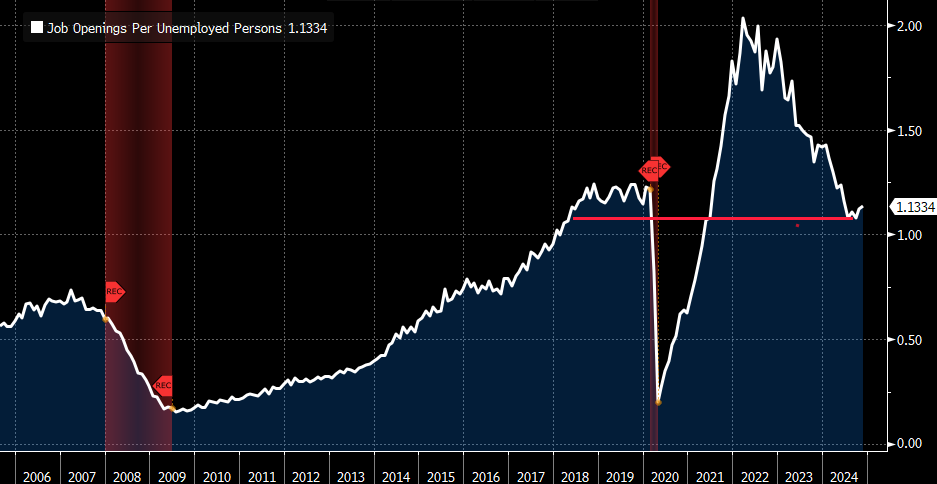

- Looking back at yesterday’s labor reports the November JOLTS Job Openings number surprised to the upside and that helped send yields higher, but the balance of the report was less optimistic. While the uptick in job openings from 7.839 million to 8.098 million sent the job openings to unemployed rate to a six-month high at 1.13, that’s still below pre-pandemic levels (see graph below).

- Meanwhile, the Quits Rate (workers voluntarily leaving as a percent of all workers), fell from 2.1% to 1.9%, matching the September low and below the pre-pandemic range. Another distinction to make in the report is that vacancies were heaviest in sectors that have licensing and other skill requirements that will make filling those positions challenging. Openings fell in the less-skilled areas which are some of the more cyclically sensitive areas. Finally, it must be said that the response rate to the survey has been rather low of late and that makes the report less reliable. Our take is that the upside in openings probably doesn’t signal a resurgence in the labor market that the kneejerk read would imply.

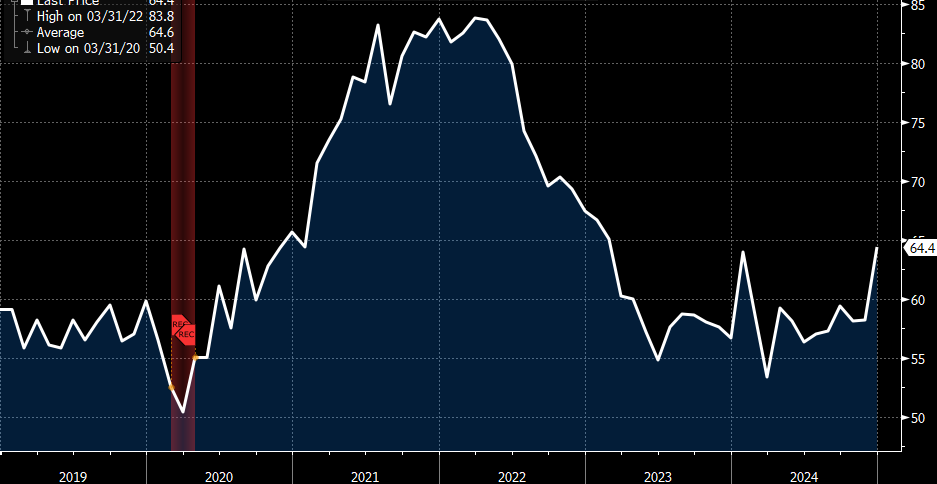

- Another number from yesterday that was negative for yields was the higher Prices Paid component in the ISM Services Survey for December. While the headline number was better than expected at 54.1 vs. 53.5 expected and 52.1 in November, strength in the services sector has been a well-known fact for over a year now. The Prices Paid metric, however, rose from 58.2 to 64.4, easily beating the 57.5 expectation. Looking at the graph below of the Prices Paid metric, one can see how in early 2021 it’s increase foretold the coming bout of inflation. So, an increase again in this metric is something to watch going forward and will certainly be something the more hawkish Fed members will note in coming rate deliberations. That said, seasonality factors, port strikes, and tariff concerns were some of the comments mentioned so we’ll have to see if the price increases are as long-lived as the post-lockdown experience. We tend to think not.

- Speaking of Fed deliberations, we’ll get the minutes from the December Fed meeting at 2pm ET, and with a dissent already noted in the vote to cut 25bps, the discussion about inflation concerns and future policy guidance will be interesting, for Fed watchers at least.

Job Openings per Unemployed Persons at a Six-Month High, but Still Below Pre-Pandemic Levels Source: Bloomberg

Source: Bloomberg

Meanwhile, the Quits Rate is Back to a Cycle Low and Below Pre-Pandemic Levels – Signaling Less Worker Confidence Source: Bloomberg

Source: Bloomberg

ISM Services Prices Paid Component – It Signaled the Coming Inflation Post-Lockdowns. Is it Signaling that Again?

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.