Softer May Data Providing a Continuing Treasury Bid

Softer May Data Providing a Continuing Treasury Bid

- Treasuries are finding more bids as a string of softish reports so far this week have traders expecting more of the same with today’s data. ADP already reported private sector job growth below expectations, but the ISM Services report for May awaits at 10am ET. Currently, the 10yr note is yielding 4.31%, down 3bp on the day while the 2yr is yielding 4.76%, down 2 bp on the day.

- As this week of first-tier data rolls on, the market’s radar is firmly fixed on any signs of weakening in the economy and labor market and the ISM Manufacturing Index on Monday delivered with a big drop in new orders which contributed to the Treasury rally. Yesterday’s, JOLTS Survey delivered as well with a bigger drop in job openings than expected with the openings to unemployed ratio dropping to 1.29 which is in the pre-pandemic level. This is a report that several Fed officials have mentioned lately as a good measure of labor market tightness, so the dip in many of its metrics to three-year lows, and some to pre-pandemic levels, speaks to the recent softening in labor market conditions, or at least, less tightening than was the case just a few months ago.

- While probably not as influential with the Fed, today’s ADP Employment Change report was also a bit softer than expected. It reported 152 thousand private sector jobs vs. 175 thousand expected. Moreover, the April result was revised lower from 192 thousand to 188 thousand. Today’s number was the lowest since January’s 111 thousand print. The market’s BLS estimate of private sector job growth is 165 thousand. So, while the correlation between ADP and BLS is not the greatest it does seem to imply a BLS report that won’t be hotter-than-expected.

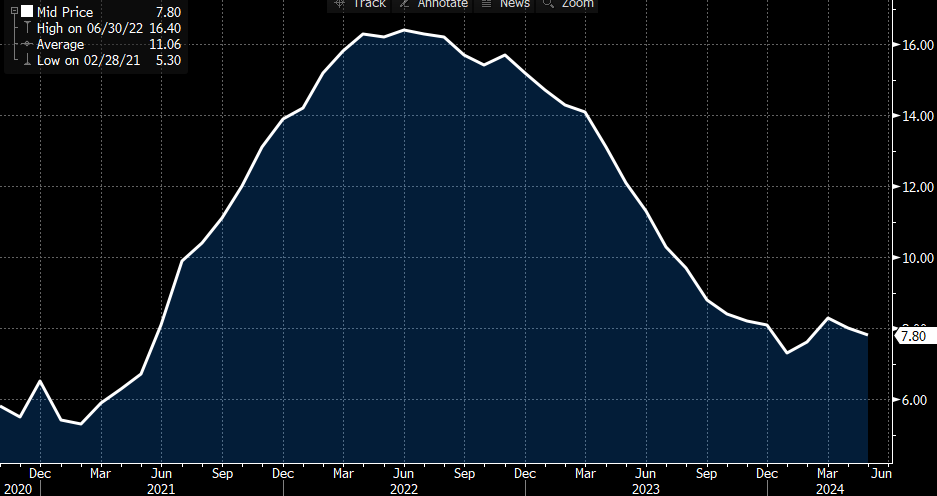

- Two other metrics in the ADP report that garner mention are the annual pay gains for job-stayers at 5.0% for the third straight month, but that’s down from the high 6% to high 5% range that prevailed last year. The rate for job-leavers was 7.80%. While still higher than the Fed would like to see for wage gains it’s been trending lower from the mid-teens dating back to 2022 (see graph below). So, the steamy wage gains of the last couple years are definitely slowing and that plays into the weakening employment picture as well.

- Probably the important report today is due at 10am ET with the May ISM Services Index. Given the weakness from the manufacturing sector the market will be looking to see a similar result for the much larger, and stickier, services-side of the economy. Expectations are for the headline number to tick higher from 49.4 to 51.0. Perhaps more important is what the prices paid, employment, and new orders components print. The manufacturing sector had quite the drop in new orders and priced paid drifted lower. Despite expectations for similar prints vs. April, the market is heading into this report probably looking for some weakness given the trend so far for May numbers.

- Given the recent softening trend, expectations for Friday’s employment report are edging slightly lower. Headline job gains are now at 185 thousand vs. 175 thousand the prior month but the unemployment rate expectation remains unchanged at 3.9%. These expectations could get pulled lower if today’s numbers continue the softening trend.

- As an example of the softening, the Atlanta Fed’s GDPNow estimate for 2nd quarter GDP is down to 1.85%, primarily from the softer ISM Manufacturing numbers. Recall, the GDP estimate stood at 3.5% just before the Memorial Day weekend. So, expect more adjustment to the forecast after today’s actual numbers are loaded into the model.

ADP Job-Changers YoY Wage Gains – Employers Getting Stingier with Job Offers

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.