So, it was 50bps. What’s Next?

So, it was 50bps. What’s Next?

- Treasury yields are waffling around unchanged this morning, and with an empty economic docket for today investors are likely to keep the market rangebound. The large risk-on move yesterday in equities did bump yields higher, but after a brief foray above 3.75% 10yr yields fell back to the low 3.70% range and that is where we find them this morning. Currently, the 10yr is yielding 3.73% down 1bp on the day, while the 2yr is yielding 3.61%, unchanged on the day.

- They cut 50bps, that much we know, and it was what we were expecting after all the trial balloons from ex-Fed officials during the Quiet Period. There was, however, plenty of handwringing over the outsized move with the 25bps crowd particularly unhappy. We pointed out Powell’s comment at Jackson Hole that the Fed “does not seek nor welcome further cooling in the labor market,” as a clear signal of where they would be focused. A disappointing July employment report was followed by a tepid one in August (with nagging worries over downward revisions to come) and add in secondary indicators like job openings to unemployed, jobs plentiful vs. hard-to-get, and the Quits Rate all dropping to, or below, pre-pandemic levels it left no doubt the labor market is cooling. And with the new comment in Wednesday’s statement that the “Committee has gained greater confidence that inflation is moving sustainably towards 2%”, it made clear that the full employment mandate is now driving the policy bus.

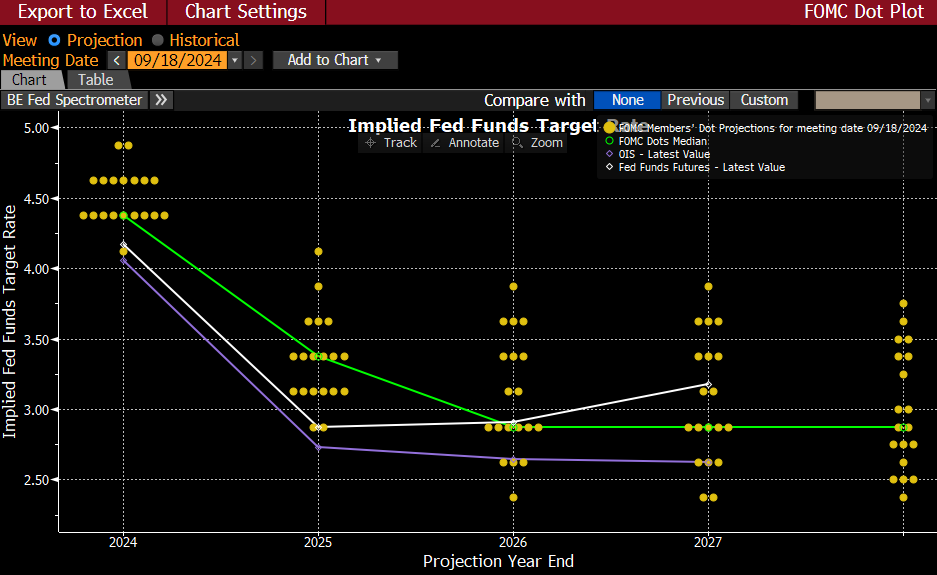

- From here, it becomes a case of looking at the September and October jobs reports which will land before the November 7th FOMC meeting. Powell did a good job in calling the 50bps cut a “recalibration of policy” and that future decisions would be based on the data (with that data focused on the labor market – our opinion). The Fed would love to see the November and December rate cuts at 25bps each, just like the updated Dot Plot revealed, but should either or both job reports show further weakening a case for 50bps will again build.

- That weakening, however, didn’t show up in yesterday’s Weekly Initial Jobless Claims. They came in at 219 thousand vs. 230 thousand expected and 231 thousand in the prior week. The 219 thousand was the lowest since May. The claims figure also coincides with the survey week for the September employment report which gives it a little more weight.

- While the 25bps crowd may point at the latest claims and think “see, there is no labor market weakness” but claims are just half the picture. While claims are holding at benign levels, that means employers aren’t resorting to greater layoffs of full-time employees, yet. They are, however, most definitely hiring less. If anything, these benign claims readings tell the Fed they are not behind the labor market curve. When reduced hirings are followed by an uptick in claims, the Fed would probably want to be several cuts into the easing cycle.

- Another interesting item from the meeting was the uptick in the unemployment forecast. For year-end 2024, they upped the rate from the June forecast from 4.0% to 4.4%. That’s probably an obvious move given we’re at 4.2% right now. They also increased the 2025 outlook higher from 4.2% in June to 4.4% now. Thus, they do see unemployment climbing higher than the June forecast and that partially explains the outsized rate cut, given they operate with long and variable lags as the saying goes.

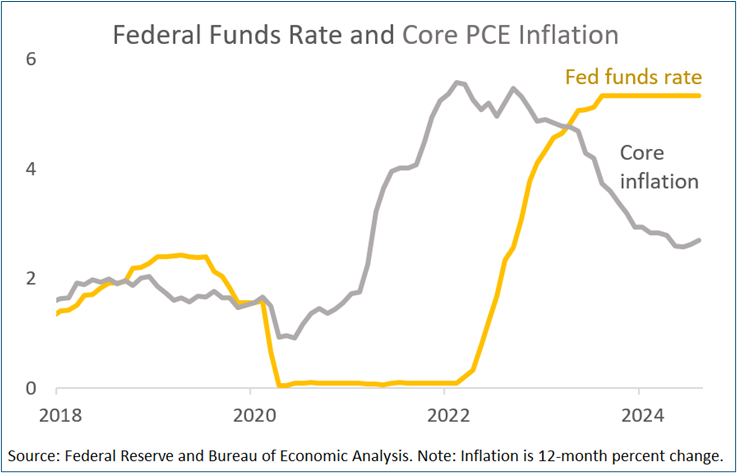

- One final point, for the third straight meeting they upped the long-run dot, or neutral rate, from 2.75% to 2.875%. It stood at 2.50% since 2019 before the recent hiking trend began. There’s little argument the economy is in a higher cost regime than pre-pandemic so bumping up the neutral rate estimate seems obvious. The question is where will the neutral rate settle? We think hitting 3.00% is inevitable with potential to edge higher. So, at 3.00% the reduced funds rate is still nearly 200bps in restrictive territory, and it’s expected to remain that way through 2025 (the dot plot sees the funds rate at 3.375% at year-end 2025). That’s another rationale for the 50bps cut vs. 25bps. Also, given the improving inflation rates, there’s a lot of tightness in current policy. So, if the Fed sees the labor market cooling and GDP weakening next quarter and next year, and they do, it does make sense to us that as Powell mentioned multiple times in the press conference that a “recalibration” in policy seemed appropriate.

- Looking to next week, it won’t carry the cache that this week held with the most consequential report being next Friday’s August Personal Income and Spending report. With CPI and PPI in hand, analysts are estimating core PCE to come in somewhere around 0.14% – 0.18% MoM. That rounds to either a “high” 0.1% or “low” 0.2%. In either case, it would be cooler than the latest core CPI print, and that should alleviate some lingering concerns from the inflation hawks at the Fed (looking at you Fed Governor Bowman).

- While the inflation numbers will get top billing in next week’s income and spending report, the spending numbers should garner some attention too. Recall, this week’s Advance Retail Sales report was decent, but we could nit-pick that 7 of the 13 categories saw declining sales from July. That compares to July when only 3 of the 13 categories were negative. The personal spending numbers in next week’s report are more comprehensive, including more services-side categories, so we’ll be curious what it shows. So far, the consumer has held strong, and we suspect that will continue but with some moderation as savings rates decline and wage gains slow.

Updated Dot Plot – Nearly 100bps in Rate Cuts Expected by Year-End & Another 100bps in 2025 Source: Bloomberg

Source: Bloomberg

The Steep Drop in Core PCE Inflation – Another Reason for the Outsized Rate Cut on Wednesday

Yet, Weekly Initial Jobless Claims Still Show Layoffs Remain Low

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.