Slowly Filling in the Missing Pieces

- Global risk markets (read: stocks) have started December under pressure as a renewed selloff in crypto and hawkish comments from the Bank of Japan weighed on early sentiment. Domestically, the early returns are in on Black Friday sales and although up 4.1% from 2024 adjusted for inflation (i.e., tariffs) it wasn’t as stellar as the headlines imply. Online sales, however, were the clear winner, increasing 10.4% from Black Friday 2024, another sign of gloom for brick-and-mortar retail. New data for November begins flowing today but the headliners of jobs and inflation data will have to wait until mid-December. Currently the 10yr Treasury is yielding 4.05%, up 4bps on the day, while the 2yr note yields 3.50%, up 1bp in early trading.

- After the long Thanksgiving weekend, we’re in a new month and a fair amount of data, but not the November jobs report. That will be forthcoming on Dec. 16 followed by CPI on Dec. 18. Despite the absence of those marquee reports, we do get ISM Manufacturing today at 10am ET. Expectations are the headline index will improve from 48.7 to 49.2. That would still be contraction territory but would connote a slightly higher level of activity. The sub-indices like Prices Paid, New Orders, and Employment will get thorough vetting as well given the delayed jobs and inflation reports.

- Tomorrow the only data point will be November car sales. Expectations are that 15.50 million new cars were sold on an annualized basis vs. 15.32 million in October. The pre-pandemic run rate on new car sales was approximately 17.0 -17.55 million, so down from those salad days with affordability a factor. On Wednesday, the delayed Import and Export Report for September will finally see the light of day. That will be the last piece of the PCE inflation puzzle for September with that report due on Friday. Import prices are expected to increase 0.10% MoM vs. 0.30% in August with the YoY rate up 0.40% vs. 0.00% in August. Export prices are expected to decrease -0.10% vs. 0.30% the prior month. Later that same morning, the September Industrial Production numbers will be released (10am ET). MoM production is expected to be unchanged with manufacturing up a slim 0.10%, same as the August increase.

- The headline release for Wednesday will be the ADP Employment Change Report for November. The October report found 42 thousand new private sector jobs, but the weekly updates from ADP during November mostly revealed a net loss of jobs so we’ll see if that comes to fruition in the monthly report. Given the delayed BLS release, this report will get plenty of attention as will the look at annual wage gains which have been trending gently lower as well.

- Vying for top billing on Wednesday will the November ISM Services release due at 10am ET. Expectations are the index will be relatively unchanged at 52.2 vs. 52.4 in October. And just like with today’s Manufacturing numbers, the Prices Paid, New Orders, and Employment indices will get plenty of attention given the delayed BLS reports for November.

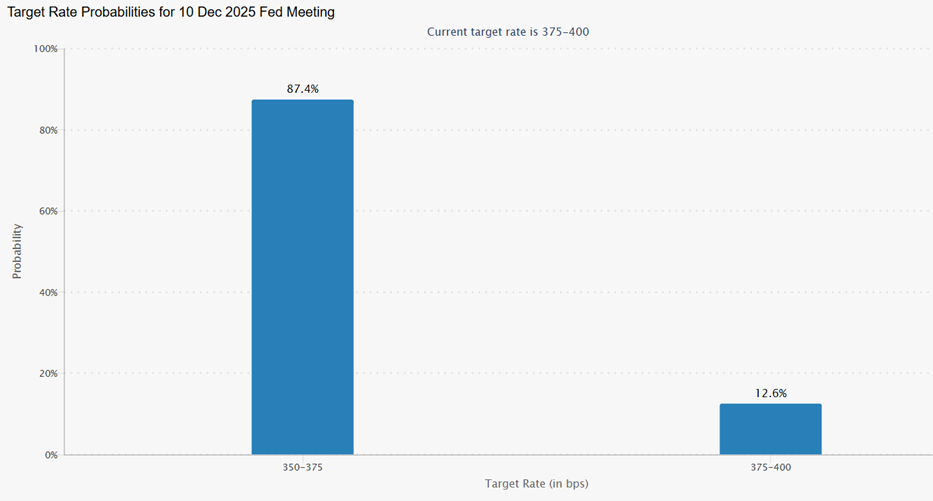

- Finally, Friday will provide the last of the inflation and spending numbers for September with the Personal Income and Spending Report. Expectations are that core PCE will be up 0.2% MoM with the YoY rate unchanged at 2.9%. With the stale nature of the data, along with high odds of a December rate cut (see graph below), it will take a big miss to the upside to derail a cut at this late date. And that is unlikely as the PCE has been easier to predict with the other inflation numbers already released which helps analysts fill in the PCE picture.

- Fed speak is expected to be light this week with Fed Chair Powell offering opening remarks tonight at the George Shultz Memorial Lecture Series. The event kicks off at 8pm ET so any comments from Powell will have to wait until tomorrow to be acted upon but given the nature of the event, George Schultz’s economic policy contributions, it’s doubtful Powell will dominate the night’s proceedings with an updated view of the upcoming FOMC meeting. Other than Powell, Michelle Bowman will testify to the House Financial Services Committee tomorrow, but the topic is on reining in bank regulations, and we already know Bowman is very much in the cut camp for December.

Futures Odds See High Chance for December Rate Cut

Source: CME Group

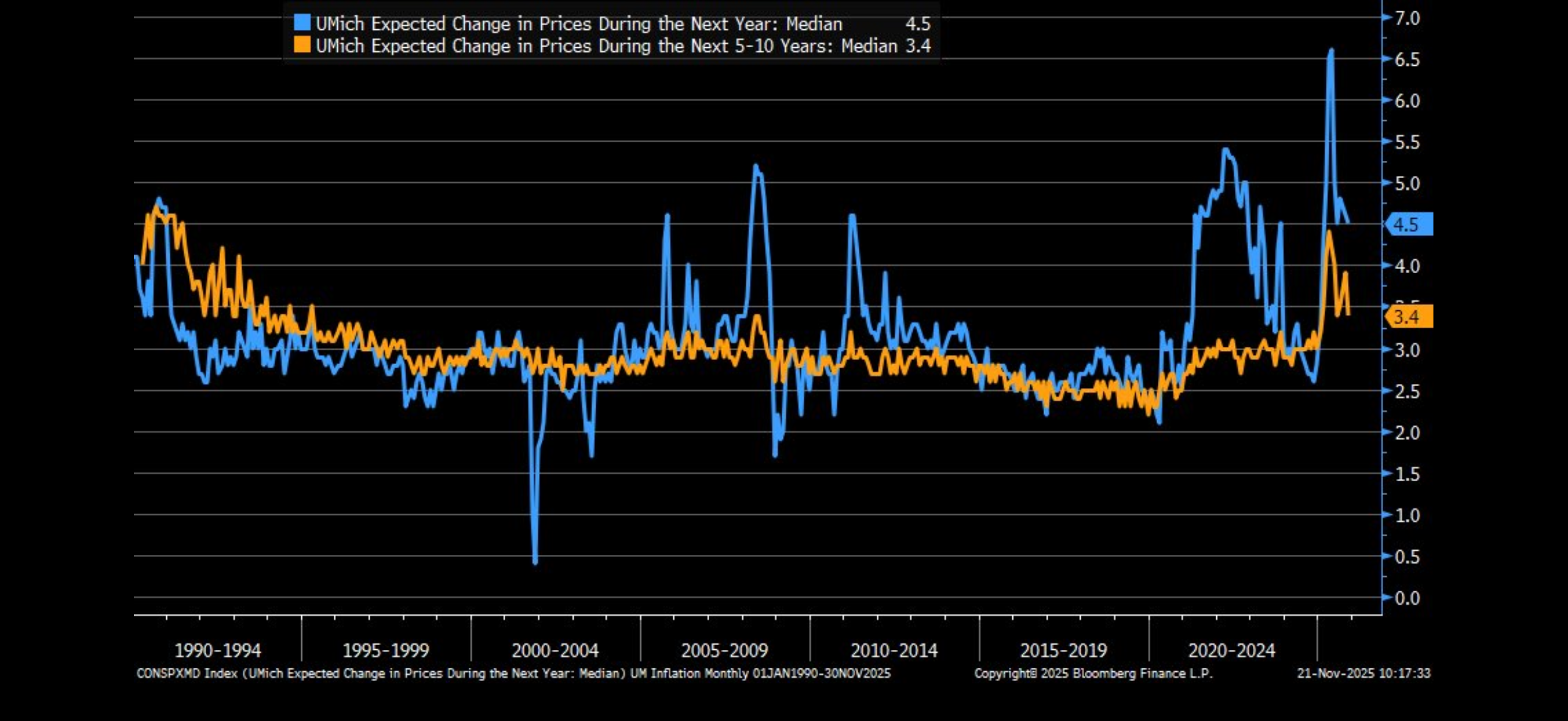

November University of Michigan Sentiment Survey – Inflation Expectations Trend Lower

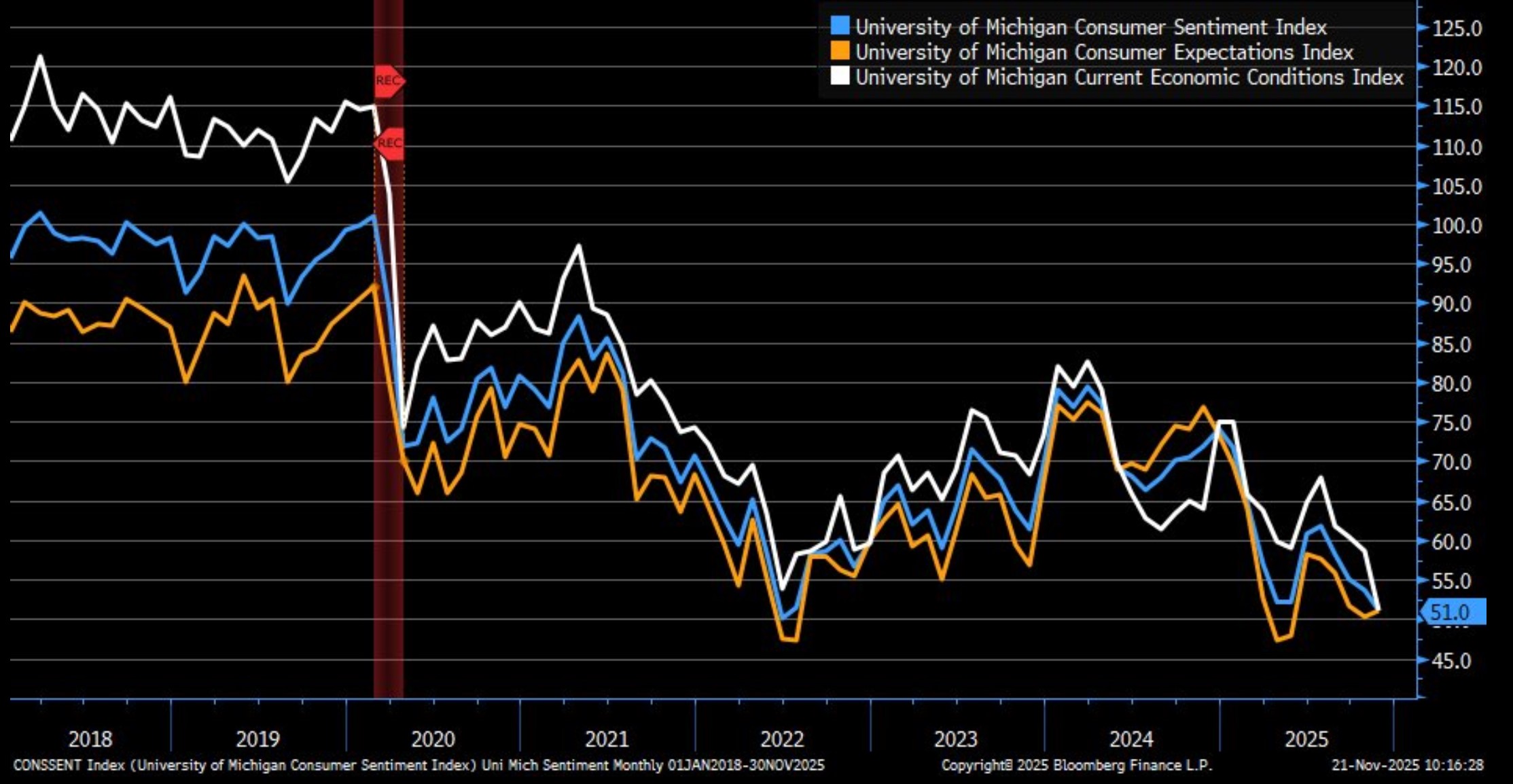

Alas, Consumer Sentiment Trended Lower as Well

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.