September Start Echoes August

September Start Echoes August

- The Treasury market is benefiting from the risk-off start to September that is continuing again this morning. Global markets added to the risk-off tone after watching the action in the US yesterday. A plethora of employment-related reports are due every day this week so any signs of weakness will add to the risk-off tone and drive Treasury yields lower. Currently, the 10yr is yielding 3.82% down 1bp on the day, while the 2yr is yielding 3.84%, down 3bps on the day.

- Investors are scratching their collective heads trying to come up with reasons for the extreme selling yesterday, particularly in the tech sector. The selling was led by Mag 7 darling Nvidia down nearly 10%, and that had the whole complex trading down and bleeding into the broader market. While a DOJ subpoena against the company didn’t come until after the market close, perhaps there were rumors floating around about the action? That could be since early indications this morning have Nvidia down just 1.5% pre-market. One would think if the subpoena news were a surprise pre-market bids would be much lower.

- The August ISM Manufacturing report gets some blame as well as it was better than July, but still well below the 50 dividing-line but new orders were poor and prices paid were higher. While I’m not too worried about the prices paid piece because if demand is weakening prices will eventually follow. The drop in new orders and comments that inventory was building unintentionally (i.e., slowing demand) contributed to the slowing theme.

- Another item that didn’t get much attention but probably contributed to the selling was the S&P Global Manufacturing PMI report. It painted a picture that not only is manufacturing slowing in the US, it’s also a global phenomenon and many other developed markets depend more heavily on manufacturing compared to the US. It revives the old saying that when the US catches a cold the rest of the world gets pneumonia. To be fair, much of the slowing in European manufacturing is a function of China’s problems rather than dramatic slowing in the US. Comments mirrored the ISM report that unintentional inventory build will require reductions in output, and perhaps labor. That, no doubt, contributed to the negative tone that global markets may be shifting into a lower gear faster than central banks may have been anticipating.

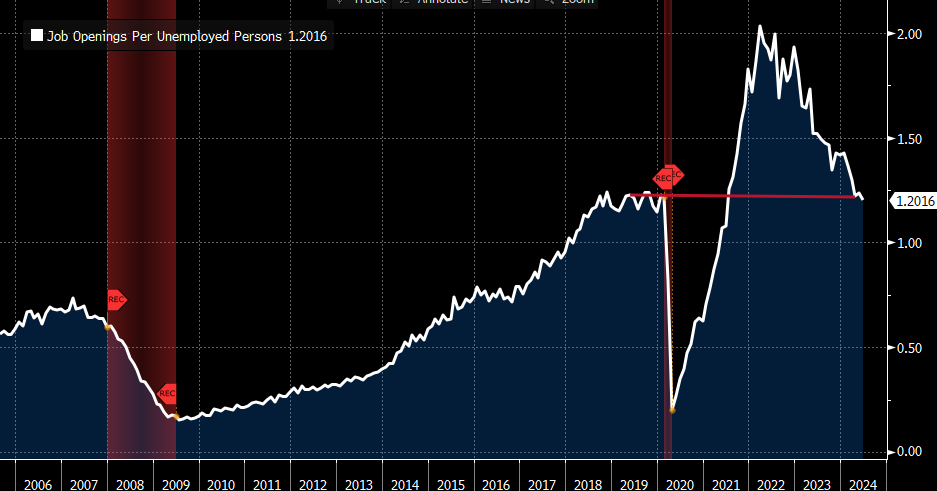

- On the heels of the weak manufacturing PMIs, today’s Job Openings and Labor Market Report (JOLTS) rises in importance, and the fact it often gets mentioned by Powell means they will be watching this morning’s numbers at 10am ET. Job openings are expected to slip some from 8.184 million to 8.100 million, but it’s the ratio of openings to unemployed that will get the most attention. It currently sits at 1.2 openings per unemployed, equal to pre-pandemic levels, but with the increase in the July unemployment rate the ratio could slip even lower with some calling for a 1.7-type result (see graph below). That would be another signal of further labor market weakening.

- The Quits Rate at 2.1 will get attention as well. The 2.1 rate, which is the percentage of employed quitting voluntarily, is a signal of worker confidence, or lack thereof, in finding another, better paying job. The 2.1 rate is already below pre-pandemic levels so any further deterioration will only add to the slowing labor market momentum.

- Tomorrow, weekly jobless claims, ADP Employment, and ISM Services for August will provide more breadcrumbs of labor market data before we get to Friday’s BLS Nonfarm Payroll report. Much like the jobs report, early expectations for all these reports are for a steady-as-she-goes result, but with the negative reaction over the manufacturing PMI any miss will bring another bout of risk-off trading with Treasuries benefitting in such a scenario.

Job Openings to Unemployed Persons – Weakening Below Pre-Pandemic Levels

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.