September Jobs Report Surfaces this Thursday

- As we note below, we will see a jobs report this week, but it will be from September, and it will be released on Thursday. When we get our hands on other delayed reports is still a guess, but we should get updates this week on a calendar of revised release dates. There’s also plenty of Fed speak this week, but it’s likely to be more of the recent communications, (i.e., a reluctance to push for a Dec. cut in the absence of new data). That said, a weak Sept. jobs report may begin to shift that view later in the week. Currently, the 10yr Treasury is yielding 4.12%, down 3bps on the day, while the 2yr note yields 3.60%, down 1bp in early trading.

- On Friday afternoon, the BLS released a revised schedule that has the September jobs report set to be released on Thursday at 8:30am ET and September Real Earnings on Friday, also at 8:30am ET. The Census Bureau will also be publishing August’s updates on Construction Spending (Monday), Factory Orders (Tuesday), and the Trade Balance (Wednesday). Those second-tier reports, along with the staleness of the data, aren’t likely to impact investor thinking of the US economy. The BLS has yet to announce its stance on the October data, particularly CPI and NFP. Data collection via the Household Survey was not done, thus anything for October will have to come from the Establishment Survey; thus, no unemployment rate, labor participation rate, etc., only payrolls and wage information. The CPI data could suffer the same fate of incomplete data as surveys and real-time price gathering were not done during the shutdown.

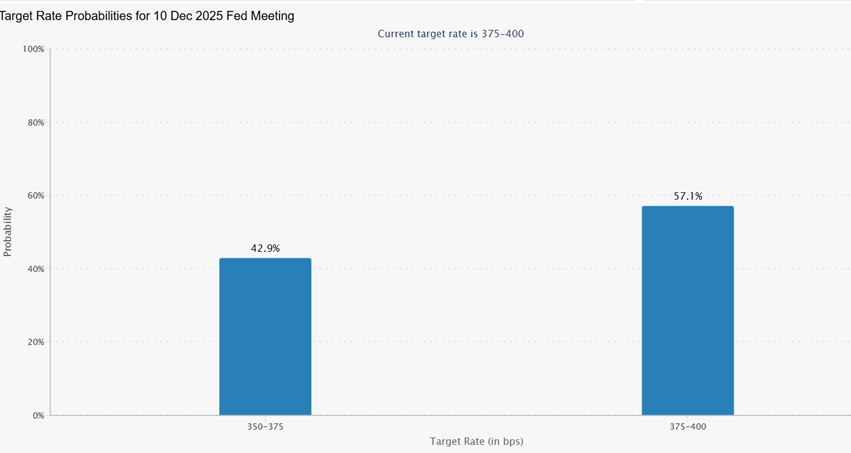

- As far as the dated nature of a September jobs report that should have been released way back on Oct. 3rd, any strength in the report is likely to be shrugged off given the staleness, while weakness will probably boost odds for a December rate cut. Those odds have slipped to less than 50% after a parade of Fed speakers over the last couple weeks have not exactly banged the table for another cut next month.

- As far as Fed speakers go this week, we have Fed Governor Jefferson kicking things this morning at 9:30am ET giving us his economic outlook. Jefferson has usually voiced a cautious approach to policy so I can see him siding with the pause camp. This afternoon, Minneapolis Fed President Neel Kashkari will speak at 1pm ET, and Fed Governor Waller will be speaking from London on his economic outlook. Waller has been one of the more vocal members pulling for a December rate cut, so if we hear anything different today that will be news.

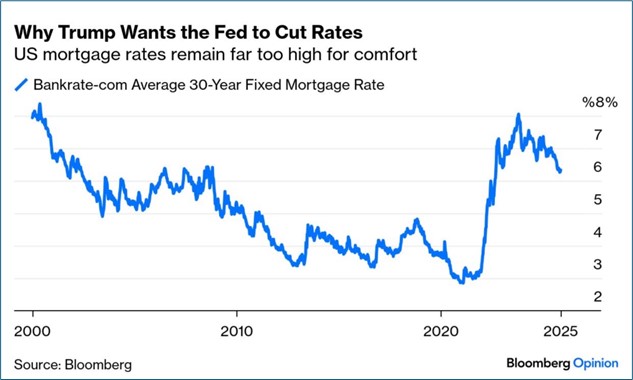

- On Wednesday, Fed Governor Miran will be speaking again, this time on bank regulation and the Fed’s balance sheet. Miran is another vocal member of the cut-in-December camp, but I’m more interested in his thoughts on the Fed’s balance sheet. If he wants lower rates, which he obviously does, then he may talk some about QE and the Fed balance sheet in helping nudge longer term rates lower (read: mortgage rates); although, QE is more likely to be a second half 2026 topic if it enters the chat at all.

- On Wednesday, we get the minutes from the October 29th FOMC meeting. That should give us a better sense of the divide within the committee over the inflation/jobs issue. Chair Powell’s comments in the post-meeting press conference in October mentioned that that there was not a clear consensus to cut in December, and that’s obvious given the Fed speak since then. However, the discussion in the minutes should provide additional color around the subject.

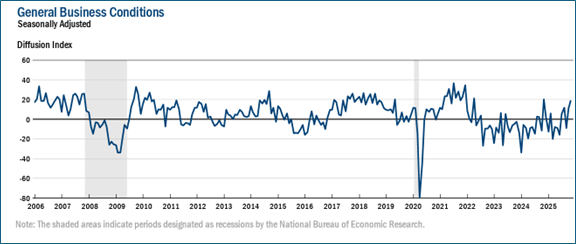

- Another bit of information we received this morning was the November Empire Manufacturing Report from the NY Fed and it was positive. The manufacturing survey index from the tri-state New York area rose eight points to 18.7, its fourth positive reading in the last five months. New orders and shipments increased significantly. Delivery times lengthened modestly, and supply availability worsened somewhat. Inventories expanded. Labor market indicators improved, pointing to a small increase in employment and a longer average workweek. Expectations were for a modest bump to 5.5 compared to 10.7 in October.

Fed Pause Talk has Odds Under 50% for December Rate Cut

Source: CME Group

Empire Manufacturing (NY Fed District) – Nice Pop in November Activity Source: NY Federal Reserve

Source: NY Federal Reserve

Mortgage Rates Remain Historically High – QE Can Help That

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.