September Jobs Report Highlights Plenty of New Jobs Data This Week

- With the Fed having moved the full employment mandate into the bus driver’s seat as to policy, this week will provide a raft of new employment data to ponder in the 25 or 50bps rate-cutting question. The headline will be Friday’s BLS jobs report for September but before then the Job Opening and Labor Turnover survey (JOLTS) will provide useful info for the Fed in fine-tuning the magnitude and pace of future rate cuts. The ISM Surveys will give insight into the manufacturing and services-side of the economy.

- The JOLTS survey for August will be released tomorrow with the expectation being for another dip in job openings from 7.673 million to 7.660 million. That would bring the openings-to-unemployed ratio to 1.1 which is near pre-pandemic levels and will be another sign that labor market cooling continues. The other metric to be reviewed in the report will be the Quits Rate which is the percentage of total employed that voluntarily left a job to presumably find another. It was 2.1% in July which is below the 2.2% to 2.3% rate that prevailed pre-pandemic. That indicates reduced confidence by workers in finding better, higher-paying jobs. It peaked around 3.0% when the labor market was much tighter in the last couple years.

- The next item on the labor market agenda will the ISM Manufacturing Index for September which is also due tomorrow. While the manufacturing sector is expected to remain in contractionary territory (i.e., <50 with 47.6 expected vs. 47.2 prior), the employment metric will get the most attention. That last reading was a disappointing 46.0, so definitely indicating weak employment in the manufacturing sector.

- After that, it’s the ADP Employment Change Report on Wednesday with a slight improvement from August with 125 thousand private sector jobs expected in September vs. 99 thousand in August. This report hasn’t had a great record matching the BLS private sector jobs totals (and frankly given the large revisions from the BLS lately maybe more respect is due for the ADP report). In any event, if the rebound comes as expected it could bolster expectations for Friday’s report.

- Thursday brings the ISM Services Index for September with the sector expected to remain in expansionary territory with little change expected at 51.6 vs. 51.5. Again, the employment metric will get plenty of attention. It held in expansionary territory in August, but just barely at 50.2. If it dips below 50 it could be one of the earliest indicators that the services-side of the economy, which has done the heavy lifting this year, is cooling which would add to the odds of a 50bps cut.

- Finally, on Friday we get the BLS jobs report with nonfarm payrolls expected to increase by 146 thousand vs. 142 thousand in August. The revisions, which have been decidedly on the downside for some time, will get plenty of attention. While the expected level of job growth is decent, if negative revisions continue, it could add to the softening tone. The unemployment rate is expected to remain unchanged at 4.2%.

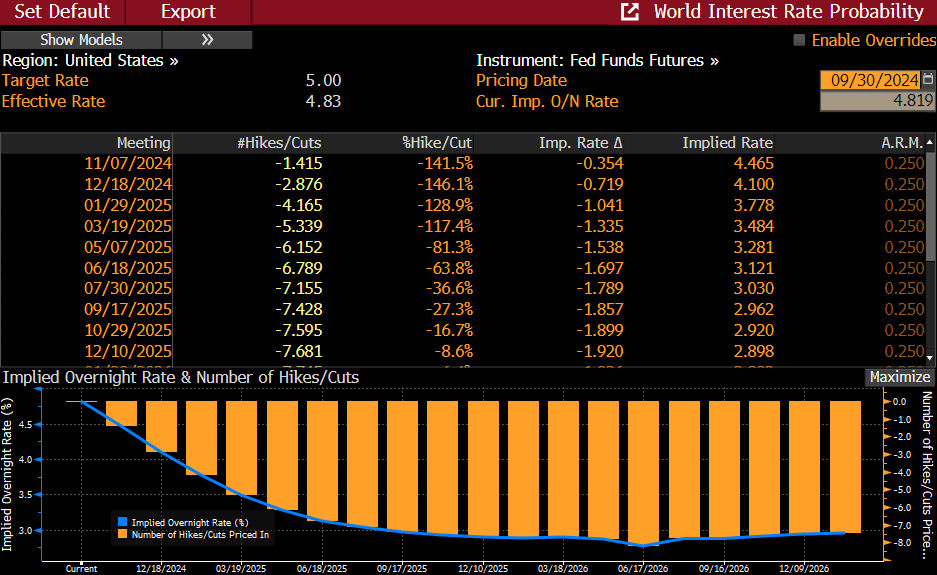

- After the decent inflation numbers from the PCE series last Friday, and the softish spending numbers, any softness picked up in this week’s labor market numbers will add odds of a 50bps cut in November.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.