Risk-On Tone Prevails As Investors Await Updated Inflation Numbers

Risk-On Tone Prevails As Investors Await Updated Inflation Numbers

- The risk-on tone that took flight on Friday is back again with equity futures pointing to more gains, and record highs, and Treasuries are also finding a bid as investors are in a buying mood as they await updated inflation numbers at the tail end of the week. Presently, the 10yr Treasury is yielding 4.09%, up 8/32nds in price, while the 2yr Treasury is yielding 4.38%, unchanged on the day.

- With the Fed now in its pre-meeting quiet period, and with only a couple of upcoming economic releases of interest to markets, it should prove to be a week of choppy price action. Fourth quarter GDP on Thursday and core PCE on Friday will be the data highlights as the market sees dimming hopes of a March rate cut as most of the economic numbers of late continue to impress.

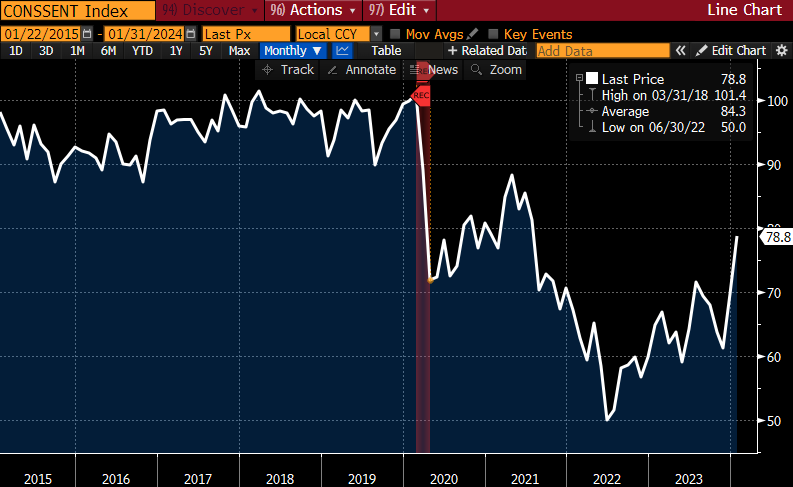

- For example, Friday’s University of Michigan Sentiment Survey came in better than expected with improved sentiment while inflation expectations edged lower. The headline sentiment index rose from 69.7 to 78.8, easily beating the 70.1 expected, and the highest since July 2021. Meanwhile, the 1yr inflation expectation dipped from 3.1% to 2.9% and the 5 – 10yr inflation expectation dipped to 2.8% from 2.9% and better than the 3.1% expected. The improved sentiment combined with the lower inflation expectations is exactly what the Fed needs to see to continue with its patient pause approach, and it certainly doesn’t paint a picture that the consumer needs rate cuts soon.

- The first estimate of fourth quarter GDP comes Thursday with the Bloomberg consensus at 2.0% which is off the 4.9% third quarter pace, but certainly in keeping with the modest slowing that the Fed is looking for. The Atlanta Fed’s GDPNow model is projecting growth of 2.38%. Recall that in the third quarter, besides the impressive growth, the dip in core PCE to 2.0% annualized helped boost the year-end bond rally. The expectation for the fourth quarter is another 2.0% core inflation print which would be another sign that inflation is indeed trending to the Fed’s 2% benchmark and that could reignite some March rate cutting odds. Those odds have taken a hit with the Fed’s verbal pushbacks and the basket of better-than-expected economic releases of late. Just a week ago, those odds were nearly 70% and now the enthusiasm has dipped with odds at 45%.

- The biggest bit of data this week will be Friday’s December Personal Income and Spending numbers and the PCE inflation series, the Fed’s favorite. Investors will get something of a preview with Thursday’s GDP release, but the quarterly data will give way to how inflation was trending at year-end. Bloomberg consensus has core PCE increasing 0.2% for the month and 3.0% YoY which would be down from November’s 3.2% pace and the lowest since March 2021. With the cooler PPI numbers, and with some PCE measurements using PPI data, some analysts have calculated core PCE around 0.1% MoM which would put the six-month annualized rate solidly below 2%. That too might reignite odds for a March rate cut but the Fed would probably have to see a real slowing in the labor market to move off their current patient pause stance.

University of Michigan Consumer Sentiment – Highest Since July 2021

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.