Risk-On Tone Opens Fed Week

Risk-On Tone Opens Fed Week

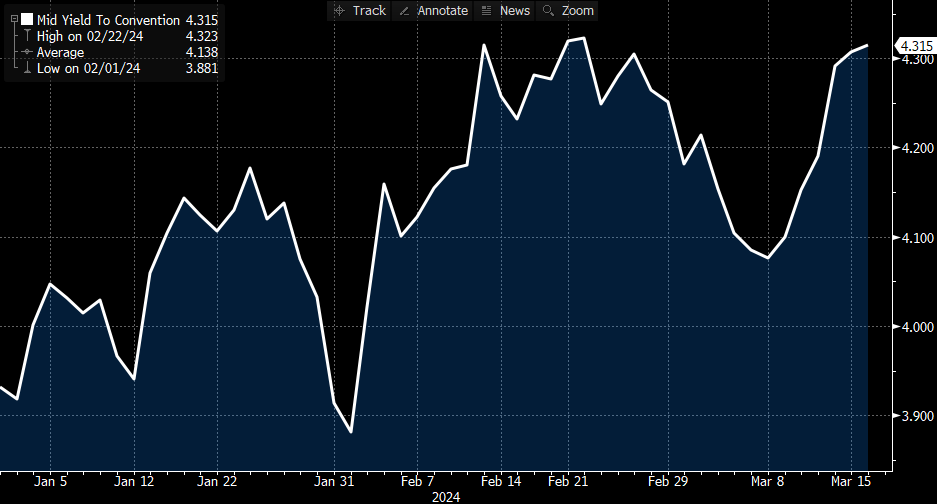

- After a short period of consolidation, tech stocks are getting a second wind this morning and that risk-on tone has Treasuries on the defensive as Fed Week begins. So far, yields remain below year-to-date highs, but they are within shooting distance (see graph below). The FOMC meeting will go a long way in resolving whether those yield highs hold. Presently, the 10yr Treasury is yielding 4.32%, down 2/32nds in price, while the 2yr Treasury is yielding 4.73%, unchanged on the day.

- The FOMC meeting on Wednesday is obviously the key event of the week, and while the FOMC is expected to hold rates steady, the key question will be whether the updated dot plot and economic forecast differs from the December forecast in any material respect.

- Recall, the December forecast had three rate cuts penciled in for this year, with most assuming they would begin the rate-cutting by mid-year, either at the June or July meeting. With the hotter-than-expected inflation numbers we’ve received this year the market is anxious to see if those three cuts are dialed back to two. With the press conference, Powell will have a chance to offer his view on the recent inflation news, and whether he still stands by his “not far” from being confident inflation is cooling at pace that warrants rate cuts that he offered up in his recent Capitol Hill testimony.

- The FOMC is also expected to offer its thoughts on the future of the quantitative tightening (QT) program. Currently, QT is running off $60 billion/month in Treasuries and up to $35 billion/month in MBS. The balance sheet peaked at nearly $9 trillion in 2022 and is currently at $7.5 trillion. Projections from Wall Street have centered on tapering beginning in June or July with Treasury run-off cut to $30 billion/month with a goal of reducing the balance sheet to $6 trillion, or close to it.

- Also, the Fed is not the only game in town this week as the Bank of Japan could hike their overnight rate this evening which has been at -0.10% since 2016. The Bank of England meets on Thursday and is expected to keep rates unchanged, but like in the US, futures pricing has a rate cut expected in June. We’ll see if Thursday’s meeting offers any changes to that forecast.

- Away from central bank news, this week will offer up new data on the housing market. Tomorrow, February housing starts and permits will be released with expectations of improved activity after disappointing results from a weather-plagued January. On Thursday, existing home sales for February are expected to be slightly below January’s activity (3.94 million annualized vs. 4.00 million in January). Since sales are tabulated at closing most of the February activity is likely to have gone to contract in late 2023 when mortgage rates approached 8%. With rates now in the 7% range, and the spring selling season fast approaching, activity should start to improve in the next few months.

10 Year Treasury Yield in 2024 – Approaching YTD High Yield

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.