Retail Sales Mixed as Fed Week Begins

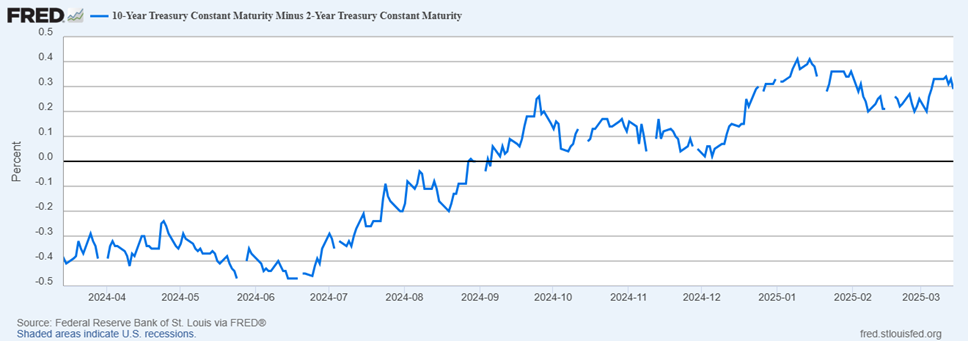

- Treasury yields are up a bit this morning with a Retail Sales report that noted a rebound in the Control Group. We characterize the report as more mixed so we suspect this upward bounce off of it may be short lived. In any event, it is the last major report before the mid-week Fed rate decision and while that will not bring a rate change it will bring updated economic and rate outlooks that will get plenty of attention. We talk more about meeting expectations below. Currently, the 10yr Treasury is yielding 4.32%, up 1bp on the day, while the 2yr is yielding 4.06%, up 4bps on the day.

- With the FOMC meeting and rate decision looming on Wednesday, a critical input into the monetary policy calculus was received today in the form of the February Retail Sales Report. Recall it was a weak January report that kicked off the Treasury market rally on the assumption that consumer spending was finally starting to flag after a strong 2024, and particularly the fourth quarter. The counter to that was that consumer spending often takes a breather in January following the holiday-selling season, but isn’t that what seasonal adjustments are for?

- In any event, retail sales for February were expected to rebound from January, and they did, but not as strongly as expected. Advance retail sales were up 0.2% vs. 0.6% expected and -1.2% the prior month. Sales ex the volatile auto and gas categories were up 0.5% vs. 0.5% expected and -0.8% in January. The direct feed into GDP, the so-called Control Group, rose 1.0% vs 0.4% expected and -1.0% the prior month. 7 of the 13 categories were down and that adds to the mixed view of the report. Our usual caveat here is that this report is heavy on the goods-side and not so much on services and it is not inflation adjusted. The month end personal spending numbers removes these shortfalls, but again, that’s not till month end.

- While the numbers represent something of a rebound from January’s bleak performance, the downward adjustments to January take a little of the shine off the modest rebound. The results still beg the question that while the consumer may still be spending, it may not match the pace of last year. That determination will be critical for the Fed that has relied on a strong economy to confidently express patience with getting inflation to 2%. With two-thirds of our economy tied to the consumer, any signs of that consumer stepping back, even modestly, will force some downgrading of expected economic performance and perhaps eat at some of the Fed’s confidence in waiting out inflation.

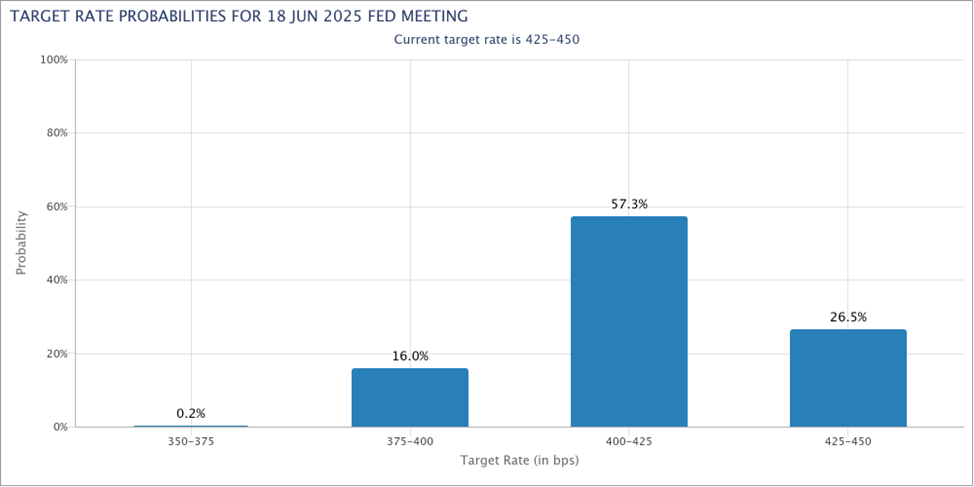

- The retail sales numbers will be the last big input to the Fed’s monetary policy decisions on Wednesday, but while no one expects a change in the policy rate at this meeting, the Committee will still provide a slew of information with updated dot plots and economic projections. We suspect that Powell will still hold his options close to his vest and not provide any specificity that the market is looking for. Indeed, with a decent jobs report and jobless claims still moribund, Powell can rightly claim that the economy continues to operate solidly. While soft survey data may tell a different story, the hard data has yet to confirm it to any great extent and that will be what Powell leans on in the press conference.

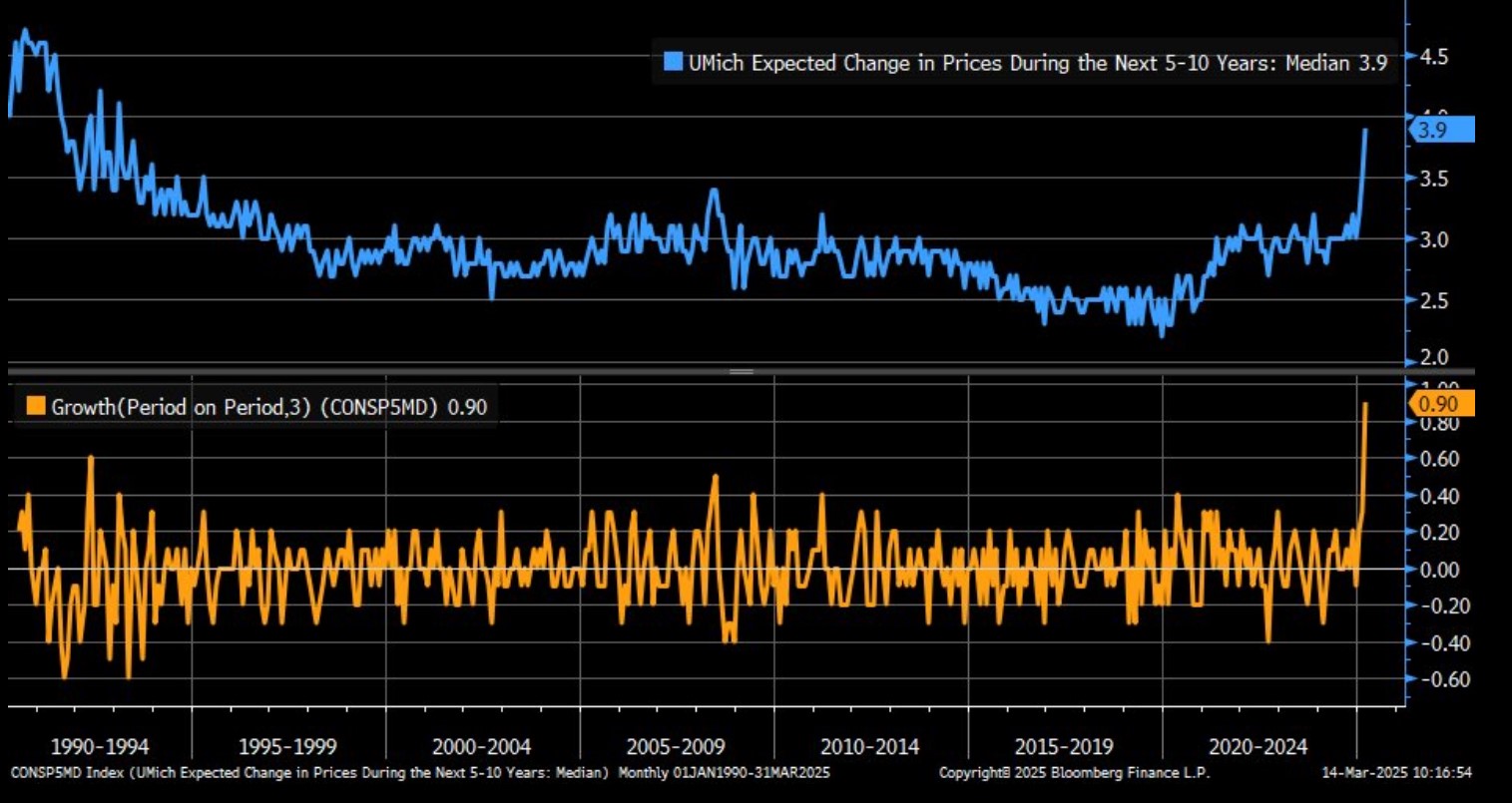

- One of the interesting questions that is sure to come up at the post-meeting press conference will be the material drop in consumer confidence in recent surveys, not to mention the long-term inflation expectation from Friday’ Univ. of Michigan Sentiment Survey reaching a 32-year high of 3.9%, well above the 3.4% expectation. The Fed is very intent on keeping those long-term expectations “well anchored” and that lift to a multi-decade high has to be troubling at a certain level, but we wonder if the tariff talk will be used as an excuse to diminish its importance, at least for this meeting.

Futures Odds of a June Rate Cut Continue to Increase but Three Cut Odds in 2025 Diminish

Source: Bloomberg

10Yr -2 Yr Spread Holding Around 30bps as Treasury Rally Stalls

Univ. of Michigan Sentiment Survey: 5-10yr Inflation Expectations Hit 32-Year High

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.