Retail Sales and Fed Speak This Week

Retail Sales and Plenty of Fed Speak Highlight This Week

- Treasuries are opening the week with higher yields as a bounty of corporate supply is providing some hedging pressure. There is also some consolidation happening after the rally that has been the story for most of June. Recall, the 10yr Treasury was yielding 4.61% back on May 29. It dipped as low as 4.19% intra-day last Friday. Currently, the 10yr note is yielding 4.28%, up 6bp in yield, and the 2yr is yielding 4.74%, up 5bp in yield.

- After a week full of cool inflation reports, the market will have to content itself with a smattering of data in this holiday-shortened trading week. The most consequential will be tomorrow’s Retail Sales report for May. Recall, the April report was on the weak side, but a rebound in May is the expectation, albeit modestly. Overall sales are expected to increase 0.3% vs. unchanged in April, while sales ex-autos and gas are expected up 0.4% vs. -0.1% the prior month. Control Group sales are expected to rebound nicely up 0.4% vs. -0.3% in April. That last metric, being a direct feed into GDP, should boost some of the current projections for second quarter GDP. Currently, the Atlanta Fed’s GDPNow estimate is sitting at 3.1%.

- After retail sales, the preliminary S&P Global PMI series for June will be released on Friday. Expectations have the manufacturing sector at 51.0 vs. 51.3 in May and the Services PMI ticking lower to 53.4 vs. 54.8 in May. So, some very slight declines, but decent expansion in both segments of the economy is the expectation. That will play well with the Fed’s ongoing patience on rates.

- There will be nearly a dozen Fed speakers this week, but we’ve already heard from Kashkari and Mester after the FOMC meeting and the message seems to be the same. Mester wants a few more months of good inflation data before considering a rate cut while Kashkari has a single cut in December as his likely scenario. Willams and Harker will be speaking on their economic outlook this afternoon, so look for some headlines there. However, the muscle memory of “higher-for-longer” and ”needing more good inflation reports” is strong with this group, and as long as the economy doesn’t look like it’s falling out of bed the patient approach will most likely hold sway.

- One aside we can add on all this is the curious comment from Powell last week that most members didn’t update their forecasts after the cool May CPI Report was released. For a Fed whose mantra is data dependency it struck us as odd to ignore what has to be considered a consequential piece of data. We suppose they can always fall back on the “one report does not make a trend” line, but April’s report was better than March so there is that.

- The week will provide some housing data as well with May starts and permits and existing sales on Friday. Starts are expected to increase 1.1% after a 5.7% increase in April while permits are expected to increase 0.7% vs. -3.0% the prior month. Existing sales are expected to slip -1.2% after falling -1.9% in April. Modest inventories, high prices, and 7+% mortgage rates are all providing solid headwinds for the summer selling season. Existing sales are based on closings which means most were negotiated in March and April. Inventory levels have increased some recently, and mortgage rates are some 25bp lower from April, so we’ll see if that provides any spark before the summer selling season concludes.

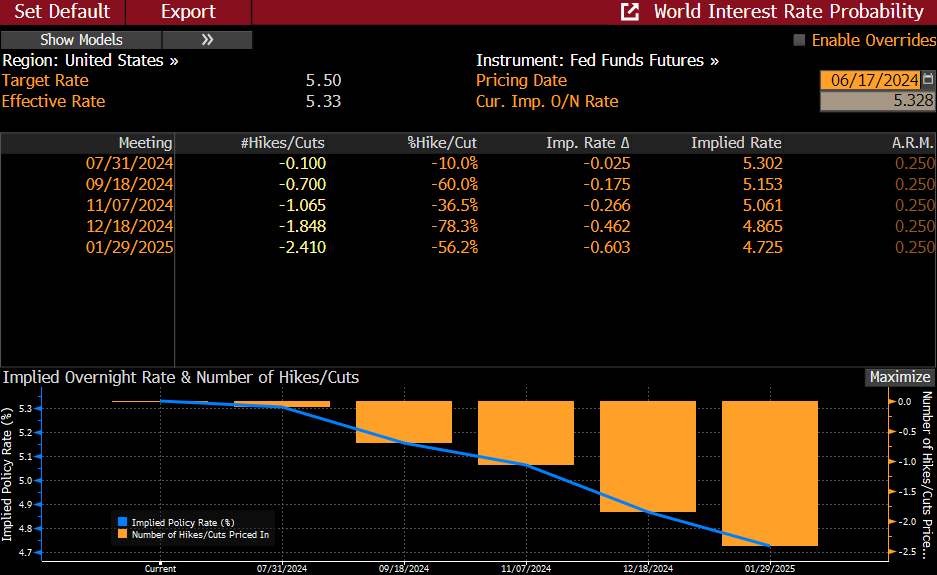

Despite the Fed’s Forecast, Futures Still See Good Odds of 2 Rate Cuts This Year

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.