Relative Calm for Now

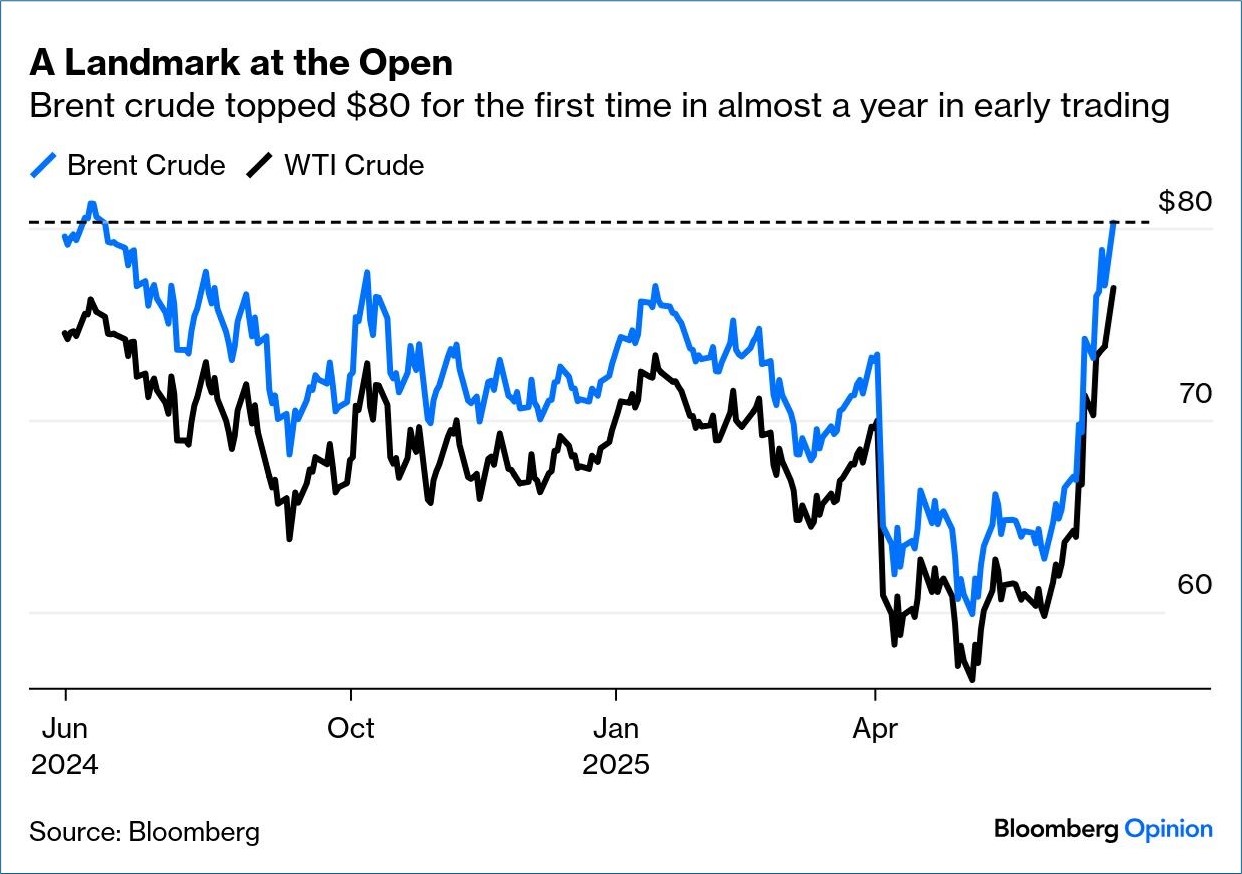

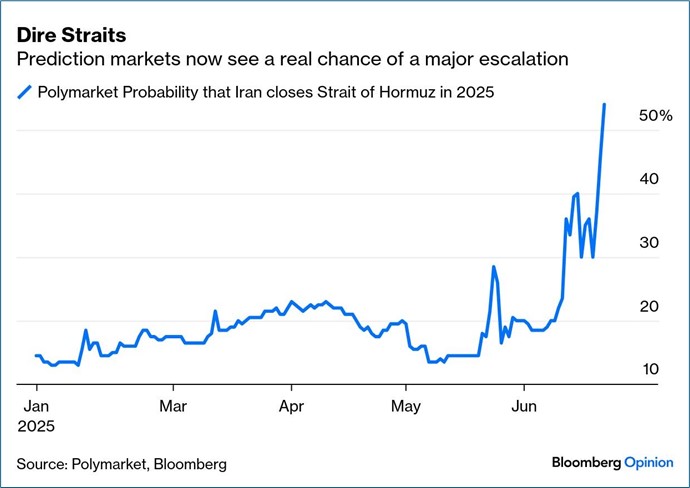

- The weekend bombing of several Iranian nuclear facilities by the US has opened another chapter in Middle East tensions with the West, and from an economic perspective the immediate question is if Iran will close the Strait of Hormuz where about 20% of global oil flows daily. So far, the Iranian Parliament has voted to allow closure but apparently that must be ratified by a security council before any action is implemented. From an economic and Fed perspective it adds another layer of uncertainty that the Fed’s cautious wait-and-see approach seems well-suited at the moment. That’s also how the market is currently playing it with a little risk-off tone but not what you would have expected upon first hearing the weekend news (Dow indicated down 50 points). Currently, the 10yr Treasury is yielding 4.34%, down 3bps on the day, while the 2yr is yielding 3.88%, also down 3bps on the day.

- From investors’ perspective, the Strait of Hormuz becomes the next flash point in this saga. If you’re old enough to remember the ‘70’s oil embargo that’s when most of us became acquainted with the strait. It is 21 miles wide at its narrowest point, with the shipping lane just 2 miles wide in either direction. About a fifth of the world’s total oil consumption passes through the strait. Between the start of 2022 and last month, somewhere between 17.8 million and 20.8 million barrels of crude, condensate and fuels flowed through the strait daily, data from analytics firm Vortexa showed.

- OPEC members Saudi Arabia, Iran, the United Arab Emirates, Kuwait, and Iraq export most of their crude via the strait, mainly to Asia. The UAE and Saudi Arabia have sought to find other routes to bypass the strait. Qatar, among the world’s biggest liquefied natural gas exporters, sends almost all of its LNG through the strait. The U.S. Fifth Fleet, based in Bahrain, is tasked with protecting commercial shipping in the area.

- While US oil production is in much better shape than the 70’s when we were squeezed by outright oil shortages, this time it would be the impact on global oil prices and the consumption tax that higher gas and fuel costs would levy on US consumers. It adds to the uncertainty faced by the Fed regarding future prices. Last week, the concern was centered on the expected tariff impact. Today, it’s that plus possibly higher oil prices.

- Away from the geo-political events, we do get some pieces of economic news that will fill in the dull periods between geo-political developments. First up is the S&P Global Preliminary PMI series for June. Expectations are for both the manufacturing and services sector to show minimal slippage during the month with the manufacturing sector ticking lower from 52.0 to 51.2. The services sector is expected to slip a bit as well, from 53.7 to 53.0. As astute readers will quickly ascertain despite the expected slowing, both sectors are expected to remain solidly above the 50-level that divides an expanding and contracting sector. The S&P series has been a bit more optimistic in its reporting vs. the older and more popular ISM series with both sectors in that series closer to the 50-level with manufacturing dipping just below for several months now. In any event, decent numbers here will provide another indicator that the economy continues to motor along, albeit moving from the fast lane to something less speedy.

- Some home sales data, existing home sales for May and S&P CoreLogic 20-City Home Price Appreciation for April will fill the middle of the week with continued slight softening expected in both. You can throw in the Conference Board’s Consumer Confidence Report tomorrow as another release that will garner a few eyeballs. While soft survey data has been a feature lately it has only sporadically appeared in the hard numbers. Also, this confidence report does not include any post-Iran bombing reaction so it will be treated as a bit stale. That being said, expectations are for confidence to bump up a bit from May.

- The big reports will come later in the week with Thursday’s Initial Jobless Claims and then Friday’s last of the inflation reports for May in the Personal Income and Spending Report. Jobless claims last week didn’t climb further but they did, for the most part, hold to the higher ground that they have traveled over the last couple months. We’ll see if that trend continues.

- On the income and spending report, incomes are expected to moderate from April’s outsized 0.8% increase to a more normal 0.2% while real spending (net of inflation) is expected to be near flat, similar to April’s 0.1% result. On inflation, overall PCE is expected to repeat April’s 0.1% print while the all-important core PCE is expected to print 0.1% MoM, same as April, with the YoY rate at 2.6% vs. 2.5% the prior month as base effects work against the YoY this month. A trio of 0.2% prints will roll off this summer so some slight improvement may be had but it’s likely to be marginal.

- Fed speak will be back in full force this week headlined by Chair Powell at his semi-annual Congressional testimony on Tuesday and Wednesday. We don’t suspect he’ll stray too far from what we heard last week, but with the added element of Iran he could still make some news. Before that we have four speakers today, headlined by Fed Governor Christopher Waller, who made waves last week that a cut as early as July is still not off the table. He gives the opening address to a Covid Response gathering so his remarks are not likely to be relevant to current events.

- On the supply front, we have the final round of coupon supply for June. Auctions kick off tomorrow with $69 billion 2-year notes, Wednesday it’s $70 billion 5-year notes, and Thursday finishes the auctions with $44 billion in 7-year notes. The same trio of auctions were well-received in May, stopping-through by an average of 1.2 bp. While the story is a compelling one, until there is convincing evidence otherwise, the risk of overseas investors walking away from Treasury auctions has been overstated. In fact, of the 18 post-Liberation Day (April 2) coupon auctions, 11 have stopped-through (average of 1.3 bp), with one on the screws, and six tails. Tomorrow brings investor class allotments for June’s 3-, 10-, and 30-year auctions for further evidence of broad-based investor demand for US debt. The longer durations will get particular scrutiny as the ongoing deficit situation provides an easy excuse for foreign investors to step aside if they are so inclined. So far, that hasn’t been the case.

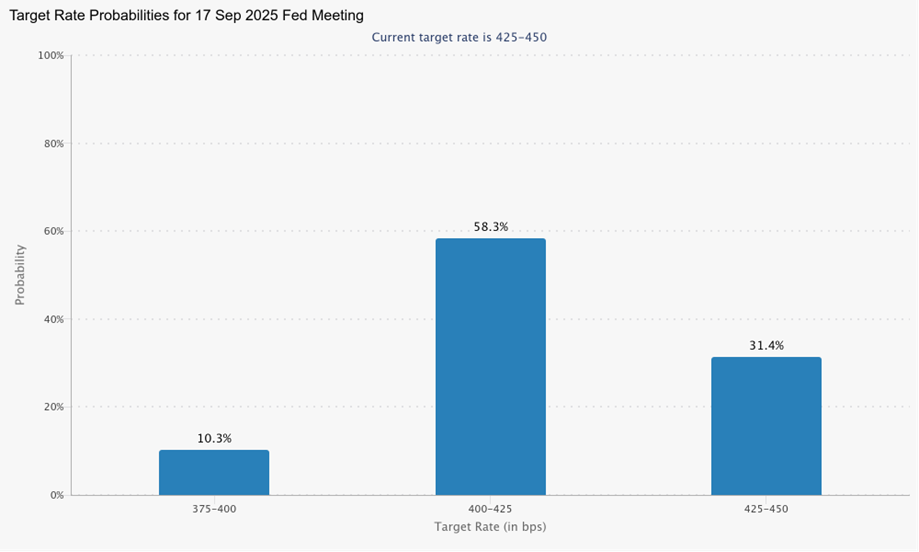

Fed Funds Futures Still Solidly in the September Rate Cut Camp

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.